Key Takeaways

- Strong HVAC cooling demand and capital investments may drive sustained revenue growth and boost net margins in key sectors.

- Anticipated leverage improvements and solid backlog position could support strategic acquisitions and sustained organic revenue growth into 2025.

- Reliance on cooling demand and project delivery uncertainties pose risks to revenue stability and growth, while low leverage limits capital deployment strategies.

Catalysts

About SPX Technologies- Supplies infrastructure equipment serving the heating, ventilation, and cooling (HVAC); and detection and measurement markets worldwide.

- Strong demand in HVAC cooling across key markets such as data centers, healthcare, and institutional offerings, facilitating sustained revenue growth through potential continued expansion in these sectors.

- The implementation of significant capital investments aimed at enhancing production capacity and throughput, which is expected to drive incremental margin gains, thereby potentially boosting net margins in future periods.

- Anticipated leverage improvement and robust free cash flow generation may enable strategic acquisitions, supporting revenue and earnings growth through portfolio expansion.

- Margin improvement initiatives within the Detection & Measurement segment, including project mix optimization and operational efficiency enhancements, are likely to support future earnings growth.

- The anticipation of a solid backlog position by year-end sets a foundation for sustained organic revenue growth into 2025, with potential impacts on overall topline financial performance.

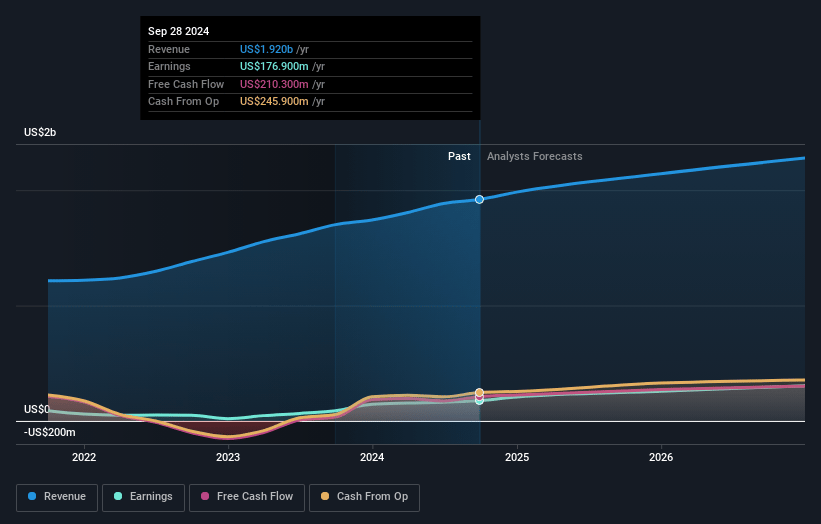

SPX Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SPX Technologies's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.2% today to 14.9% in 3 years time.

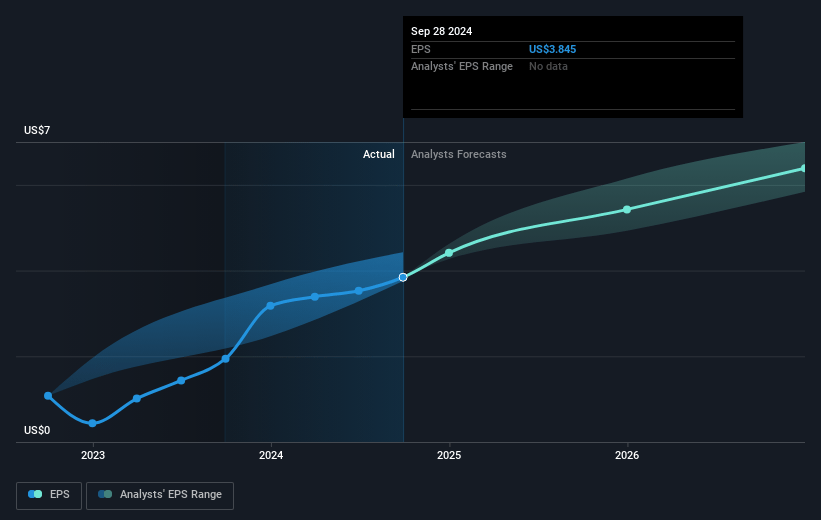

- Analysts expect earnings to reach $359.2 million (and earnings per share of $7.48) by about January 2028, up from $176.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.1x on those 2028 earnings, down from 38.1x today. This future PE is greater than the current PE for the US Machinery industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

SPX Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Detection & Measurement segment experienced a 7% decrease in revenue due to lower contract sales, which could negatively affect future revenue and earnings if the trend continues.

- The HVAC segment's growth is heavily reliant on cooling demand, with heating revenues being flat year-on-year; this dependency could impact future revenues if cooling demand weakens, especially without a significant heating season boost.

- The leverage ratio is anticipated to decline to 1.2x or lower, which, while indicative of low debt levels, could limit aggressive capital deployment or acquisitions needed for significant revenue growth and margin expansion.

- The HVAC heating platform is highly dependent on winter temperatures as a key driver for year-end demand; atypically warm winters could result in revenue shortfalls in this segment.

- While the company is well-positioned for growth, particularly in HVAC, uncertainties around large project deliveries could result in revenue timing mismatches within the Detection & Measurement segment, impacting earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $171.4 for SPX Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $359.2 million, and it would be trading on a PE ratio of 28.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $145.45, the analyst's price target of $171.4 is 15.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives