Narratives are currently in beta

Key Takeaways

- Snap-on's focus on short-term products may hinder long-term growth, as technicians are cautious about large investments.

- Macroeconomic and geopolitical uncertainties pose risks, potentially impacting future earnings and revenue projections if current conditions shift.

- Snap-on's resilience, market diversification, and strategic alignment with consumer demand bolster its financial stability and growth prospects amid a robust automotive repair market.

Catalysts

About Snap-on- Manufactures and markets tools, equipment, diagnostics, and repair information and systems solutions for professional users worldwide.

- Snap-on's strategy to pivot towards quicker payback products indicates that they are focusing on short-term market demand rather than long-term innovation, which could limit future revenue growth as technicians hesitate on big-ticket investments.

- The company faces ongoing macroeconomic uncertainties and geopolitical tensions that could stifle investment in their critical industries segment, potentially impacting future earnings growth despite current resilience.

- Snap-on has observed a decrease in organic sales and appears to depend heavily on maintaining high gross margins through cost control; however, if market conditions shift or cost-saving measures falter, this could impact net margins adversely in future periods.

- Uncertain interest rates and potential tax changes could continue to weigh on investment decisions by repair shops, affecting equipment sales within the RS&I division and in turn impacting revenue projections.

- The current environment of technician confidence being tempered by economic instability introduces significant risks to Snap-on's Tools Group, potentially affecting earnings as the market's demand dynamics fluctuate.

Snap-on Future Earnings and Revenue Growth

Assumptions

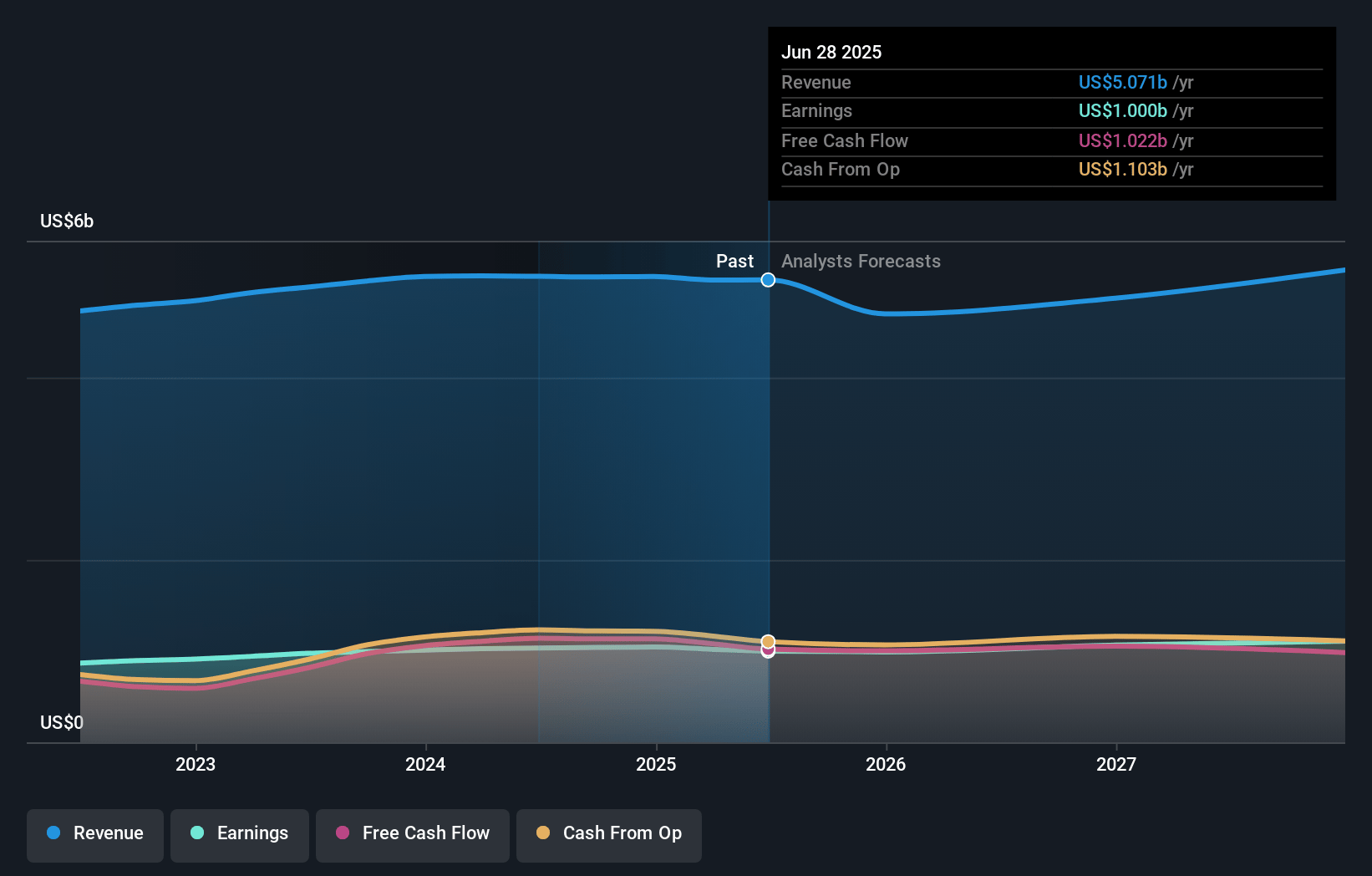

How have these above catalysts been quantified?- Analysts are assuming Snap-on's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.4% today to 19.7% in 3 years time.

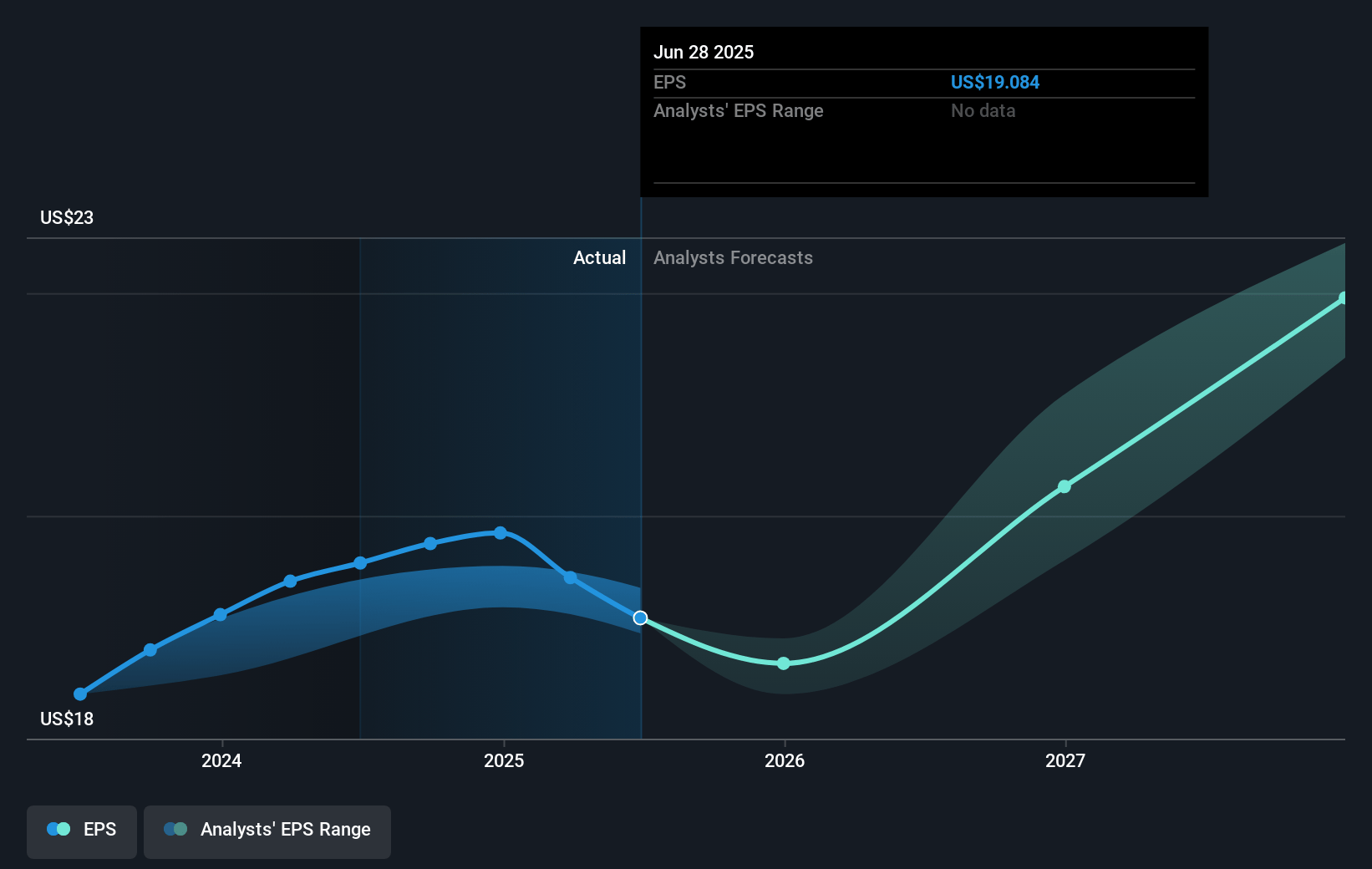

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $21.8) by about November 2027, up from $1.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2027 earnings, down from 18.2x today. This future PE is lower than the current PE for the US Machinery industry at 24.6x.

- Analysts expect the number of shares outstanding to decline by 2.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

Snap-on Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite challenges, Snap-on demonstrated resilience and adaptability, evidenced by strong profitability and margin improvements, indicating potential for sustained financial health, particularly in earnings and net margins.

- Automotive repair market remains robust with increasing vehicle complexity, providing long-term growth opportunities for Snap-on's tools and diagnostics, positively impacting future revenue streams.

- Snap-on's pivot to shorter payback products in their Tools Group aligns with current market demand and consumer sentiment, potentially stabilizing or improving revenue and earnings.

- Growth in Snap-on's specialty torque products and expansion in critical industries like aviation and defense highlight diversification and reduced reliance on one market, potentially bolstering overall revenue and profitability.

- Snap-on's financial services segment shows a stable yield and expanding loan portfolio, supporting consistent earnings growth and reinforcing the company's financial stability and resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $324.5 for Snap-on based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $385.0, and the most bearish reporting a price target of just $237.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.3 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $361.26, the analyst's price target of $324.5 is 11.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives