Key Takeaways

- Advanced proprietary technology and manufacturing strength enable Snap-on to outpace competitors, maintain premium pricing, and drive growing high-margin subscription revenue.

- Rising vehicle complexity, industry labor shortages, and an aging global car fleet underpin strong, consistent demand for Snap-on’s specialized tools and diagnostic solutions.

- Shifting industry trends, market saturation, structural franchise challenges, and technology disruption threaten Snap-on’s traditional business model, constraining growth and compressing margins.

Catalysts

About Snap-on- Manufactures and markets tools, equipment, diagnostics, and repair information and systems solutions for professional users worldwide.

- Ongoing increases in vehicle complexity, including the rise of hybrid and electric vehicles, are fueling persistent and growing demand for Snap-on's advanced diagnostic and repair products, particularly in the RS&I segment where proprietary software and databases provide repair shops with capabilities many competitors cannot match. This dynamic is likely to drive higher recurring revenue streams and support durable, above-average gross margins.

- The global automotive fleet continues to age, with the average U.S. car now 12.6 years old and getting older, directly underpinning repair and maintenance activity for both shops and independent technicians. As long as cars remain on the road longer, steady demand for premium tools, equipment, and retrofit solutions positions Snap-on for consistent, long-term revenue growth.

- Continued skilled labor shortages in the U.S. manufacturing and automotive service industries are driving demand for productivity-enhancing, specialized tools—areas where Snap-on has expanded through proprietary product innovation and American-based manufacturing. This not only supports volume but enables Snap-on to sustain premium pricing and higher net margins.

- Investment in proprietary diagnostic technology and software platforms, such as those embedded in the RS&I business, increases high-margin, recurring subscription revenue and creates competitive moats that help maintain industry leadership. As AI and repair database integration progress, these offerings are expected to drive higher earnings quality and incremental margin expansion.

- Snap-on’s broad U.S. manufacturing footprint and flexible global sourcing—recently expanded with multiple new facilities—enable the company to deliver faster product innovation, bypass major tariff risks, and quickly respond to regional demand surges. This operational flexibility is poised to safeguard and expand profitability even if trade barriers increase, supporting the most optimistic projections for sustainable long-term earnings growth.

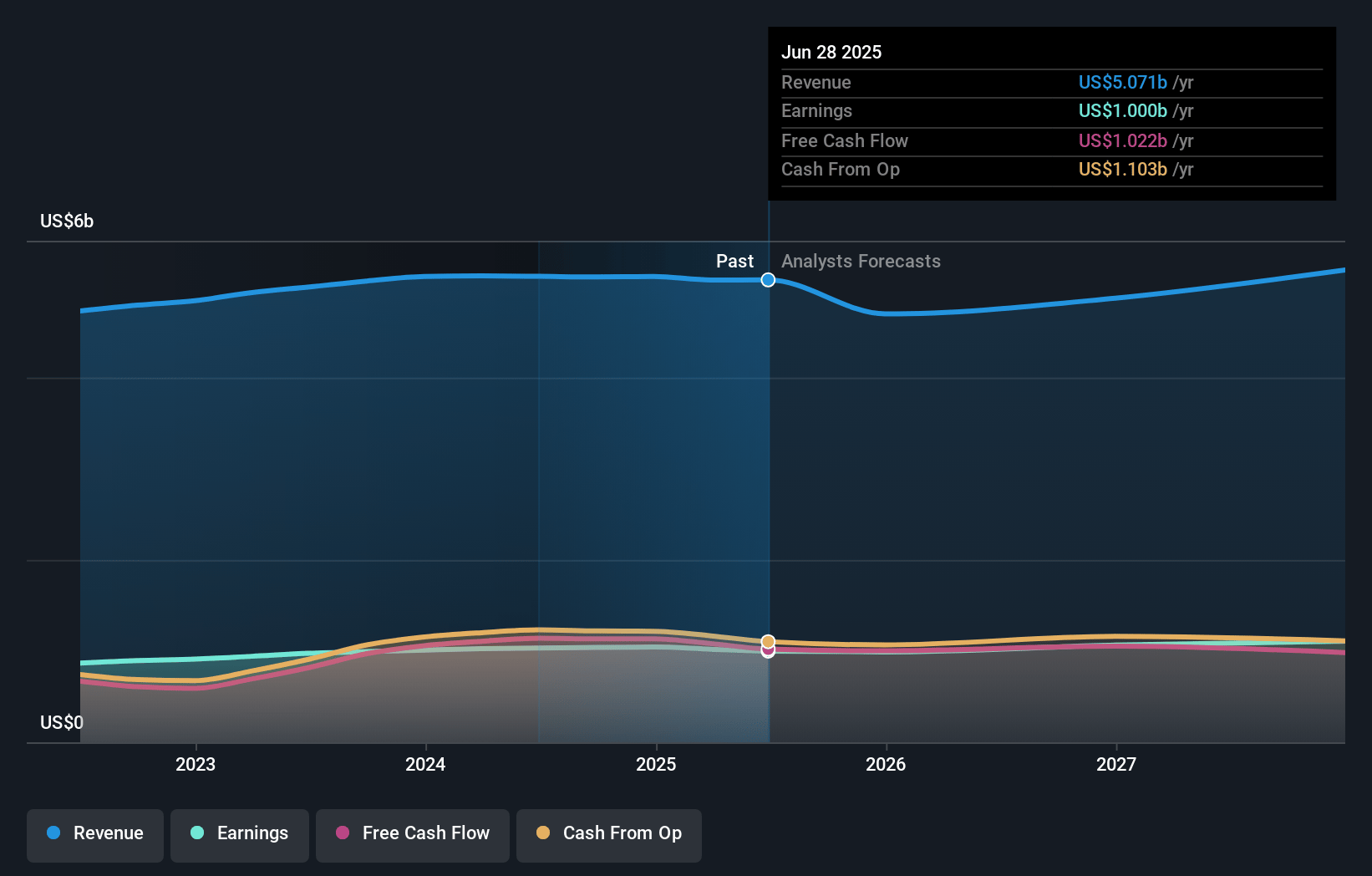

Snap-on Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Snap-on compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Snap-on's revenue will grow by 1.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 20.1% today to 21.6% in 3 years time.

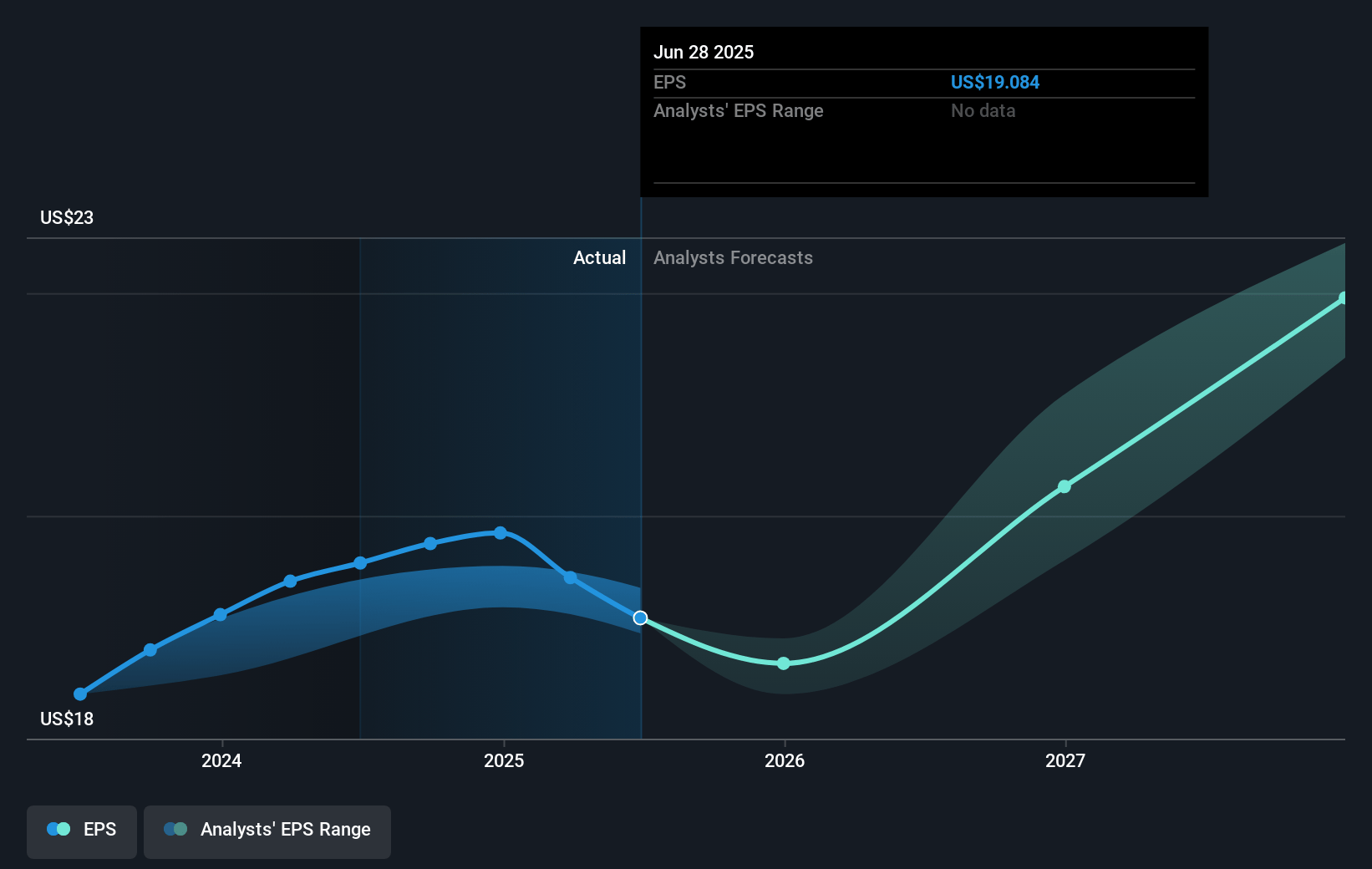

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $22.48) by about April 2028, up from $1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, up from 15.4x today. This future PE is greater than the current PE for the US Machinery industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.2%, as per the Simply Wall St company report.

Snap-on Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing adoption of electric vehicles and increased vehicle electrification may lead to a secular decline in demand for Snap-on’s core mechanic tools, potentially shrinking the long-term customer base and putting downward pressure on revenues.

- The company’s persistent reliance on its mature North American markets, coupled with limited international expansion, could constrain revenue growth as the U.S. and Canada approach market saturation over time.

- Snap-on’s franchise distribution model is facing structural challenges such as increased attrition, higher entry costs for new franchisees, and an aging dealer population, all of which could hinder tool sales growth and compress net margins due to higher support costs and lower overall system expansion.

- The rise of automation, autonomous vehicles, and digital diagnostics threatens Snap-on’s traditional tool categories; if insufficient innovation occurs, this technology shift could erode revenue and reduce earnings growth.

- Ongoing skilled labor shortages in the automotive repair industry, combined with industry consolidation by large repair chains and OEMs, limits the pool of end customers while also increasing pricing pressure, both of which could negatively impact long-term earnings and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Snap-on is $400.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Snap-on's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $400.0, and the most bearish reporting a price target of just $236.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.3 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 7.2%.

- Given the current share price of $301.33, the bullish analyst price target of $400.0 is 24.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:SNA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.