Key Takeaways

- Water scarcity, changing consumer landscaping preferences, and stricter regulations threaten demand for traditional products, challenging revenue growth and inventory management.

- Heavy reliance on acquisitions, cyclical markets, and rising competition risks margin pressure, integration difficulties, and diminished pricing power, undermining sustained profitability.

- Urbanization, industry consolidation, digital initiatives, and a shift to higher-margin offerings position SiteOne for sustained growth and margin expansion despite economic uncertainties.

Catalysts

About SiteOne Landscape Supply- Engages in the wholesale distribution of landscape supplies in the United States and Canada.

- SiteOne faces significant long-term risks from increasing water scarcity and the likelihood of stricter environmental regulations, which could sharply reduce demand for water-intensive landscaping products and services, ultimately constraining revenue growth for the company.

- There is a rising threat from the spread of artificial turf and low-maintenance landscaping preferences among consumers, eroding SiteOne’s core product demand and potentially leading to sustained weakness in organic sales growth and prolonged challenges with inventory turnover.

- Despite its aggressive acquisition strategy, SiteOne’s dependency on integrating smaller distributors in a fragmented industry raises the risk of operational missteps and future write-downs, threatening both margin expansion and earnings stability as acquisition-driven synergies become harder to capture over time.

- The company remains highly exposed to cyclical end markets, such as residential and commercial construction, which are expected to be flat or slightly down. This exposure creates an ongoing risk of earnings volatility and net margin compression during any broader economic downturn or prolonged weakness in construction activity.

- Intensifying competition from e-commerce entrants, coupled with potential consolidation and strengthened bargaining power among major suppliers or exclusive retailer partnerships, is likely to drive margin pressures and diminish SiteOne’s pricing power, putting long-term profitability at risk.

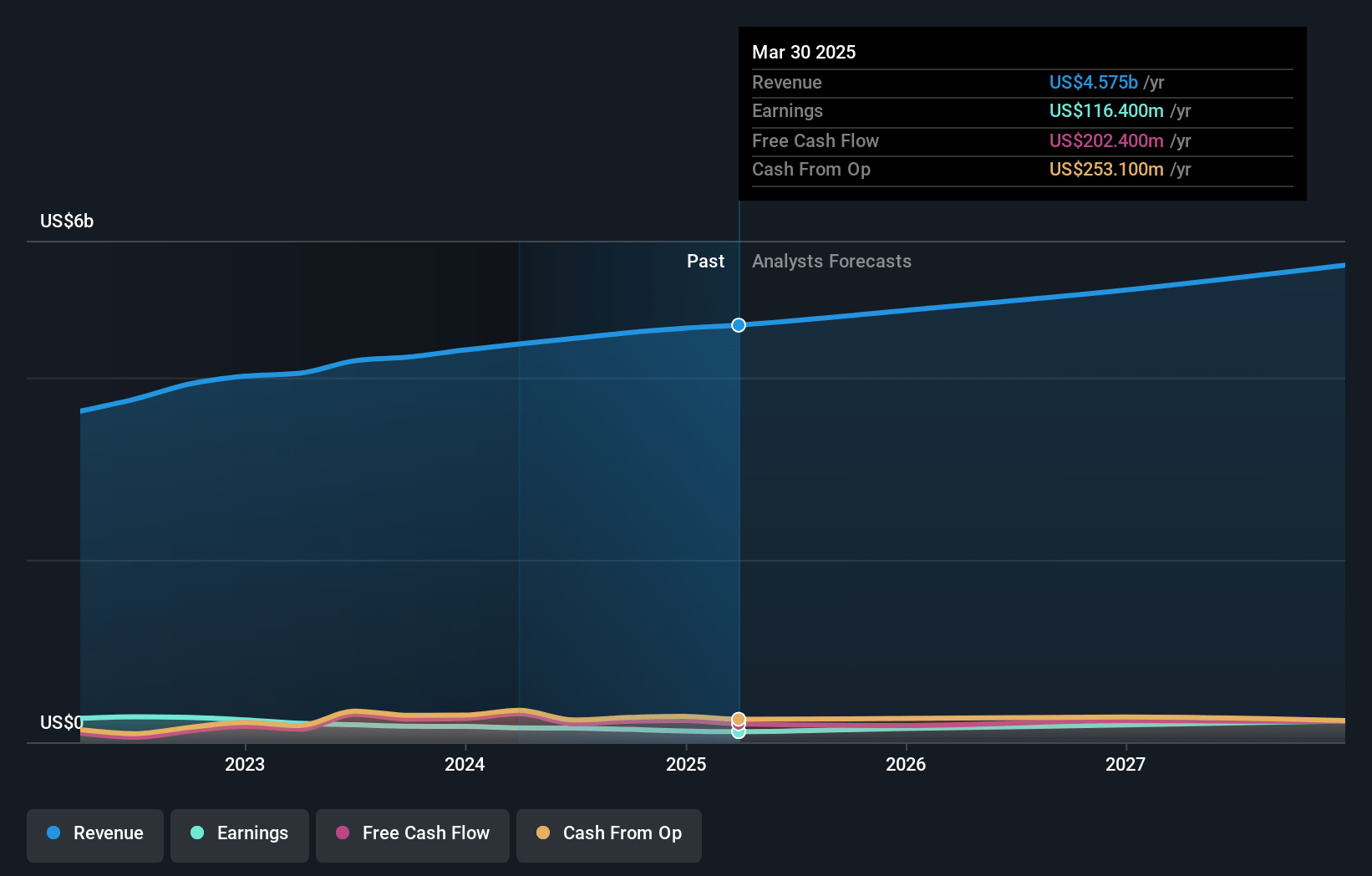

SiteOne Landscape Supply Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SiteOne Landscape Supply compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SiteOne Landscape Supply's revenue will grow by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.5% today to 3.9% in 3 years time.

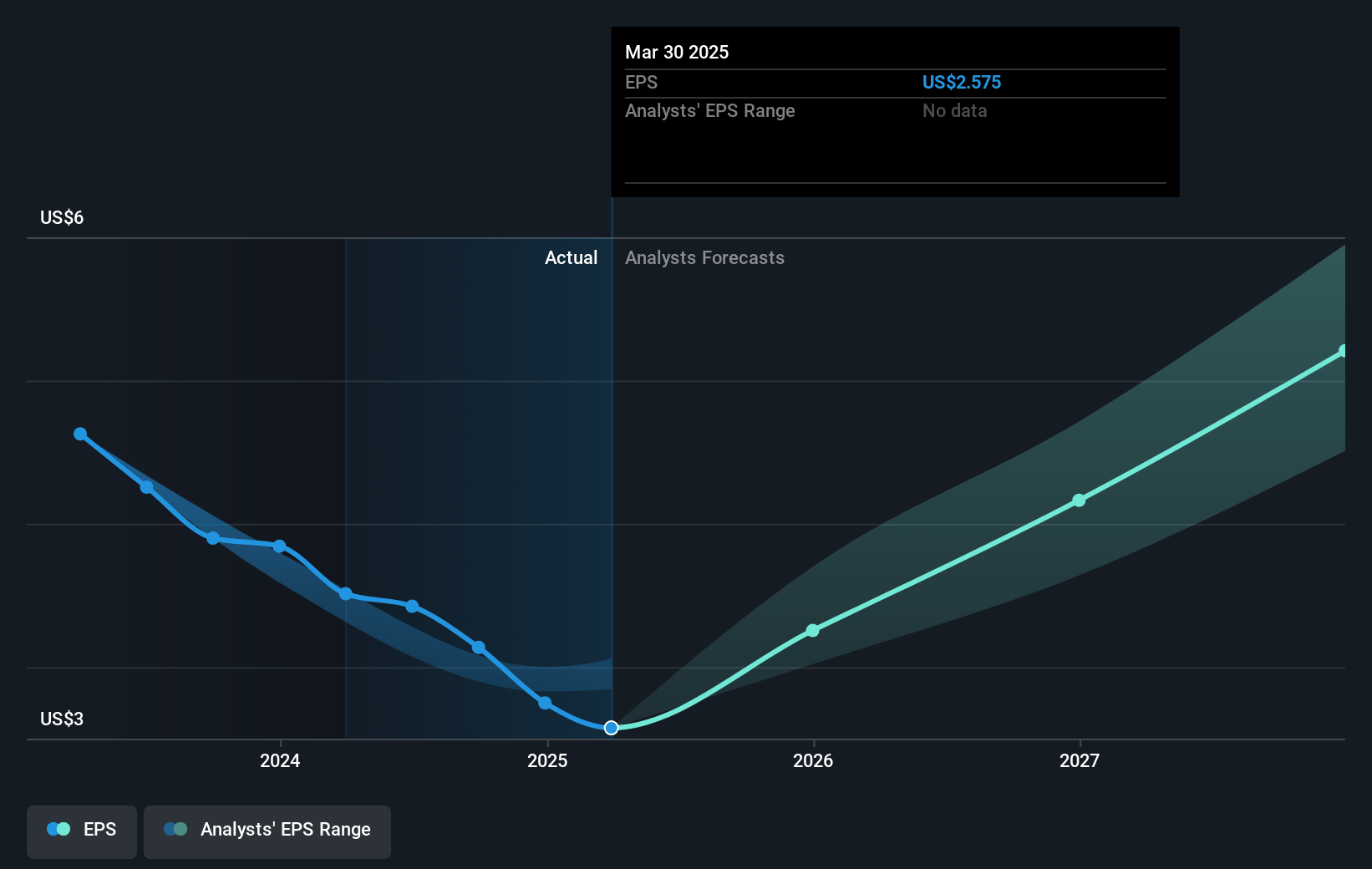

- The bearish analysts expect earnings to reach $194.0 million (and earnings per share of $4.51) by about May 2028, up from $116.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.3x on those 2028 earnings, down from 45.6x today. This future PE is greater than the current PE for the US Trade Distributors industry at 19.7x.

- Analysts expect the number of shares outstanding to decline by 0.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

SiteOne Landscape Supply Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term trend of urbanization and suburban growth is likely to persist, with SiteOne’s focus on residential and commercial market expansion, giving them a significant runway to grow revenues as these population shifts continue to support landscaping demand.

- SiteOne’s continued consolidation of a fragmented $25 billion industry, with only 18% current share and a robust acquisition pipeline, provides the potential for sustained revenue growth and operating margin improvement through scale and synergies over many years.

- Initiatives in digital sales, customer retention, and operating efficiency—such as rapid adoption of e-commerce platforms and delivery tracking—are driving productivity, allowing for higher organic growth and operating leverage that could improve both topline growth and earnings over time.

- Ongoing efforts to shift the sales mix toward higher-margin private label and value-added offerings, such as proprietary product lines and technical services, are already resulting in meaningful margin expansion, which should benefit future gross and net margins.

- Despite near-term headwinds, SiteOne’s strong balance sheet, disciplined cost controls, and the flexibility to adjust labor and expenses position the company to remain resilient across economic cycles, supporting stable cash flows and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SiteOne Landscape Supply is $106.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SiteOne Landscape Supply's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $182.0, and the most bearish reporting a price target of just $106.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.0 billion, earnings will come to $194.0 million, and it would be trading on a PE ratio of 29.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of $118.37, the bearish analyst price target of $106.0 is 11.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives