Last Update01 May 25Fair value Increased 0.047%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Strategic partnerships and industrial solutions development are fueling revenue growth and market share expansion in challenging environments.

- Focus on cost efficiencies, debt reduction, and improved margins are enhancing earnings potential and driving positive financial outlooks.

- Weaker demand in key markets, foreign exchange issues, and tariffs threaten Regal Rexnord's revenue stability and long-term financial outlook.

Catalysts

About Regal Rexnord- Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

- Regal Rexnord’s strategic partnership with Honeywell Aerospace to provide electromechanical actuator solutions for the advanced air mobility market is expected to drive future revenue growth by moving up the value chain with differentiated customer solutions.

- The company's pipeline of industrial powertrain systems and integrated solutions, especially within IPS and AMC segments, is contributing to outgrowth despite current market challenges, indicating potential revenue growth as they capture more share.

- Efforts to ramp capacity in the residential HVAC segment and anticipated recovery in general commercial markets are expected to support an improved revenue trajectory for the PES segment, particularly as ISM conditions strengthen.

- The realization of $54 million in synergies, primarily from cost efficiencies, is expected to drive margin expansion and positively impact earnings, targeting an EBITDA margin improvement to approximately 23% for 2025.

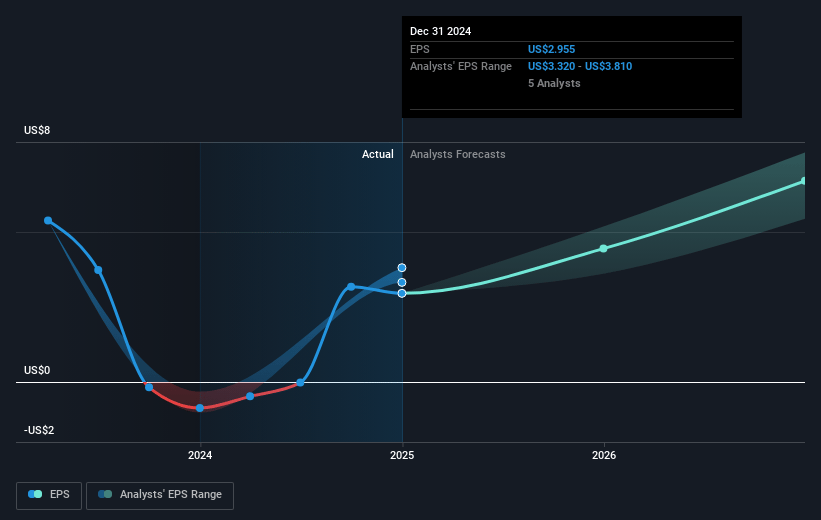

- Commitments to significantly reduce debt by deploying free cash flow for debt retirement and anticipated lower interest expenses enhance the potential for EPS growth, with expected EPS to rise by approximately 10% in 2025.

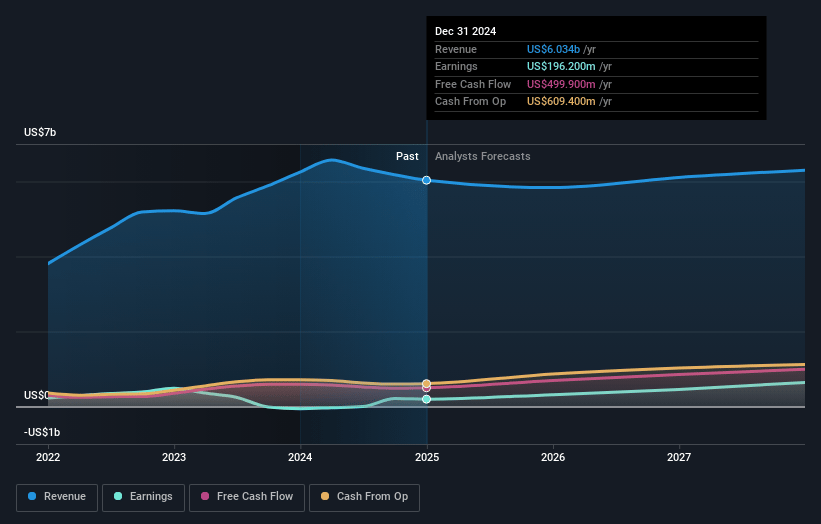

Regal Rexnord Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Regal Rexnord's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 10.2% in 3 years time.

- Analysts expect earnings to reach $641.4 million (and earnings per share of $10.74) by about May 2028, up from $196.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, down from 36.1x today. This future PE is lower than the current PE for the US Electrical industry at 22.8x.

- Analysts expect the number of shares outstanding to decline by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

Regal Rexnord Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained or incrementally weaker demand in key markets, including machinery and off-highway, poses a risk to revenue stability for Regal Rexnord's sales in some segments.

- Significant incremental pressure noted in the Chinese market could impact the company’s revenue growth given the size of the market and global interconnectedness.

- Notable fourth-quarter customer pushouts in markets could be indicative of underlying weakness or cautious customer spending, affecting future earnings visibility.

- Foreign exchange pressures, particularly on AMC EBITDA margins, may pose risks to net margins if adverse currency movements continue.

- The impact of potential tariffs, notably from Mexico or Canada, could affect cost structures and profitability, thereby impacting net earnings and long-term financial outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $156.093 for Regal Rexnord based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $190.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.3 billion, earnings will come to $641.4 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 9.7%.

- Given the current share price of $106.91, the analyst price target of $156.09 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.