Narratives are currently in beta

Key Takeaways

- Strong defense segment and multiyear backlog drive potential sustained revenue growth and long-term cash flow stability.

- Margin expansion and debt reduction efforts improve financial flexibility, enhancing earnings potential and facilitating strategic acquisitions.

- Dependence on Boeing, challenges in the Industrial segment, reliance on defense orders, cash flow constraints, and competitive M&A pressures threaten revenue stability and growth.

Catalysts

About RBC Bearings- Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

- Continued strong demand in the Defense segment, led by substantial growth in Marine products and guided munitions, indicates potential for sustained revenue growth well into the future, driven by geopolitical tensions and defense spending increases.

- The multiyear backlog and increasing demand in the Marine business, along with fixed wing and missile categories, suggest a strong revenue pipeline that could bolster long-term revenue visibility and cash flow stability.

- Margin expansion due to increased absorption of aerospace and defense capacity, enhanced synergies from the Dodge acquisition, and plant-level efficiency improvements are expected to drive higher net margins.

- Ongoing investment in personnel and sales resources for international expansion aims to bolster revenue through geographic diversification and accessing untapped markets.

- Planned significant debt reduction of $275 million to $300 million by the end of the year is expected to decrease interest expenses, increase financial flexibility, and potentially enhance earnings via further acquisitions.

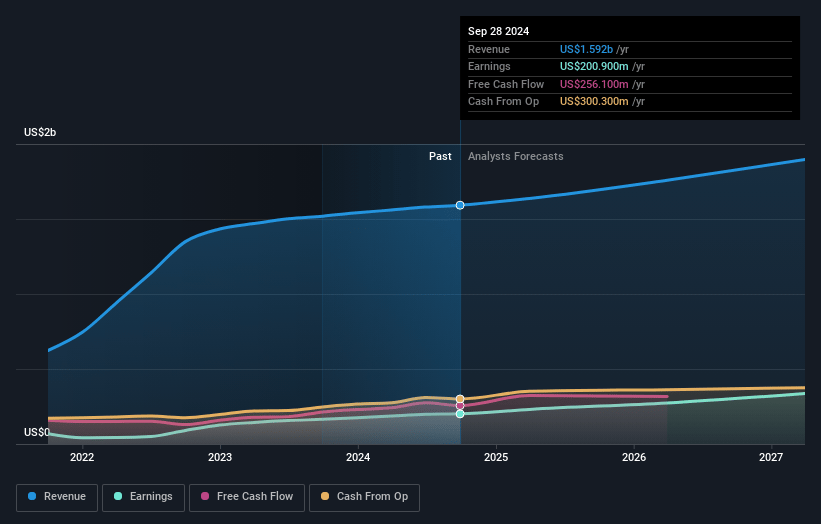

RBC Bearings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RBC Bearings's revenue will grow by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.6% today to 18.6% in 3 years time.

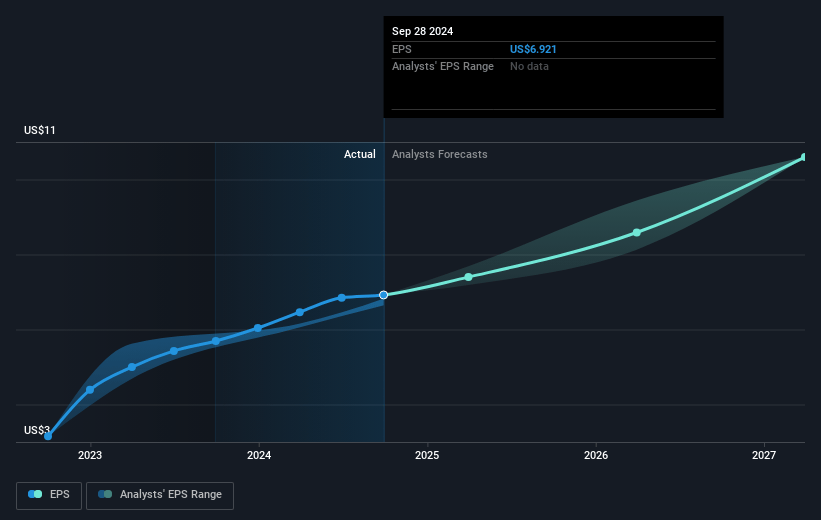

- Analysts expect earnings to reach $364.2 million (and earnings per share of $10.58) by about November 2027, up from $200.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.5x on those 2027 earnings, down from 52.9x today. This future PE is greater than the current PE for the US Machinery industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 3.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

RBC Bearings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's dependence on Boeing, which is decreasing in revenue contribution, poses a risk due to ongoing uncertainties with production rates and the recent strike, potentially affecting future revenues from this customer.

- The Industrial segment saw a decline of 1.4% year-over-year, with OEM sales down 2.5%, and there is concern regarding the ongoing challenges in this sector related to inventory corrections in oil and gas, which may continue to affect overall revenue growth.

- The expectation of future demand hinges significantly on defense orders, which, although currently robust, are susceptible to changes in government spending and geopolitical factors, potentially impacting future revenue stability.

- The company's free cash flow was affected by timing and scope of cash tax payments, and the overall leverage is being actively managed, indicating financial strategy constraints that might affect earnings growth.

- Competitive pressures on the M&A side from private equity, coupled with the need for a big toolbox to address issues in potential acquisitions, could limit successful inorganic growth opportunities, impacting long-term revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $328.6 for RBC Bearings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.0 billion, earnings will come to $364.2 million, and it would be trading on a PE ratio of 37.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $339.97, the analyst's price target of $328.6 is 3.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives