Narratives are currently in beta

Key Takeaways

- Strategic realignment and facility closures are expected to enhance operational efficiency, boosting margins and long-term earnings growth.

- Focus on higher-value orders and increasing customer usage of combined offerings signals future revenue growth and improved profitability.

- Operational restructuring and industry challenges may hinder growth and profitability despite beneficial short-term margin improvements.

Catalysts

About Proto Labs- Operates as a digital manufacturer of custom parts in the United States and Europe.

- Proto Labs is focusing on increasing the number of customers using its combined offerings across Factory and Network, which presents a significant growth opportunity for future revenue as the company continues to expose this comprehensive offer to its customers.

- The company has made strides in increasing revenue per customer contact, which is up 5% year-to-date, reflecting a shift towards higher-value production orders. This focus is expected to positively impact future earnings.

- The realignment of regional go-to-market teams with a new global fulfillment organization aims to drive growth and improve operational efficiencies. This strategic move is expected to enhance net margins by optimizing consolidated gross margin.

- Proto Labs is actively using its global operations and network partners to better fulfill customer orders, specifically in Europe. By streamlining operational efficiency and bringing a full range of capabilities, the company is positioned to improve profitability and cash flows.

- The company's strategic decision to close underperforming facilities in Europe and reshape its portfolio aligns with its global fulfillment strategy. This is anticipated to enhance operational efficiency and bolster gross margins, contributing positively to long-term earnings growth.

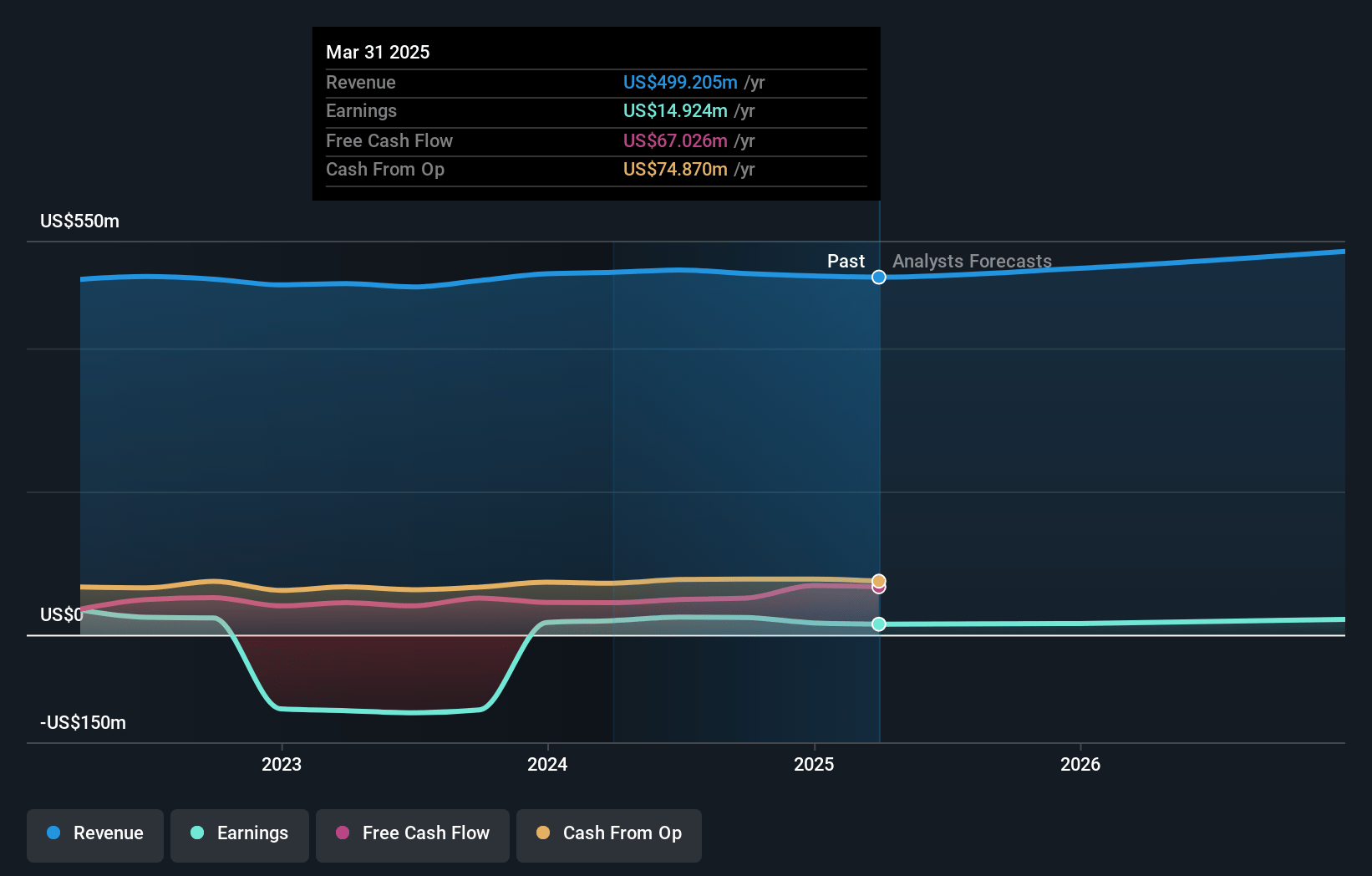

Proto Labs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Proto Labs's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.8% today to 2.8% in 3 years time.

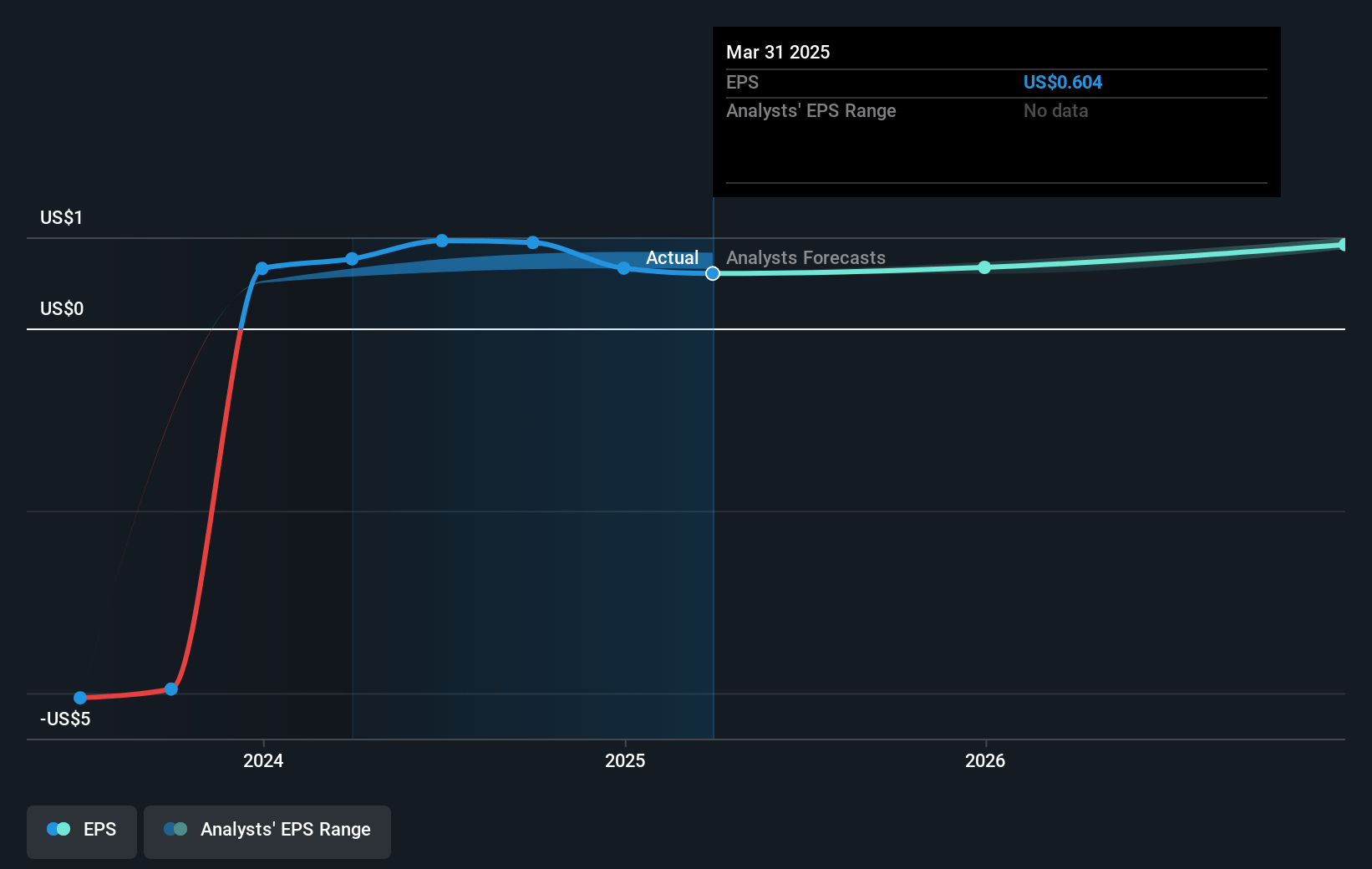

- Analysts expect earnings to reach $15.4 million (and earnings per share of $0.83) by about November 2027, down from $24.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.2x on those 2027 earnings, up from 36.8x today. This future PE is greater than the current PE for the US Machinery industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 9.65% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.6%, as per the Simply Wall St company report.

Proto Labs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Flat revenue growth year-to-date indicates challenges in expanding market share or product demand, which could impact future revenue growth expectations.

- The 4% year-over-year revenue decline in the third quarter, especially in key services like Injection Molding and Sheet Metal, reflects weaknesses in industrial and consumer electronics verticals, potentially affecting overall earnings.

- Closing the German prototype injection molding facility and discontinuing certain metal manufacturing services in Europe could disrupt operations and result in near-term income instability, impacting net margins.

- Excess capacity in the manufacturing sector, while beneficial for current margin improvements, could signal broader industry challenges affecting long-term profitability.

- Seasonal fluctuations and inefficient labor management during the holiday season typically lead to a decline in gross margins, indicating potential volatility in earnings due to external and operational factors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.33 for Proto Labs based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $556.8 million, earnings will come to $15.4 million, and it would be trading on a PE ratio of 57.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of $35.14, the analyst's price target of $40.33 is 12.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives