Narratives are currently in beta

Key Takeaways

- Record backlog in solar and industrial bookings could boost revenue but carries risks of overvaluation if execution lags.

- Challenges in renewables and divestment efforts may affect margin and earnings predictions, raising investor concerns.

- Primoris Services' record performance, strong cash flow, and strategic capital allocation promote financial stability, supporting growth in renewables and effective cost management in utilities.

Catalysts

About Primoris Services- A specialty contractor company, provides a range of specialty construction, fabrication, maintenance, replacement, and engineering services in the United States and Canada.

- Primoris Services' record backlog driven by new solar and industrial bookings may create expectations for continued high revenue growth. However, any perceived execution risks or delays in converting backlog into actual projects could lead to stock overvaluation concerns. (Revenue)

- The company is experiencing lower margins in its renewables business due to fewer project closeouts and weather-related productivity issues. If these challenges persist, they might negatively impact future earnings growth expectations. (Earnings)

- Primoris anticipates increased spending by California utility clients following regulatory approvals, which could boost their gas operations. However, any delays or changes in these plans could affect anticipated revenue growth. (Revenue)

- Although storm response has helped improve margins in the Utilities segment, ongoing reliance on such events for margin improvement can be risky if not consistently reproducible, potentially leading investors to question long-term margin sustainability. (Net Margins)

- The company's move to streamline industrial services by divesting low-margin businesses might encounter integration or transition challenges, which could temporarily impact earnings and raise questions about the timing of projected financial improvements. (Earnings)

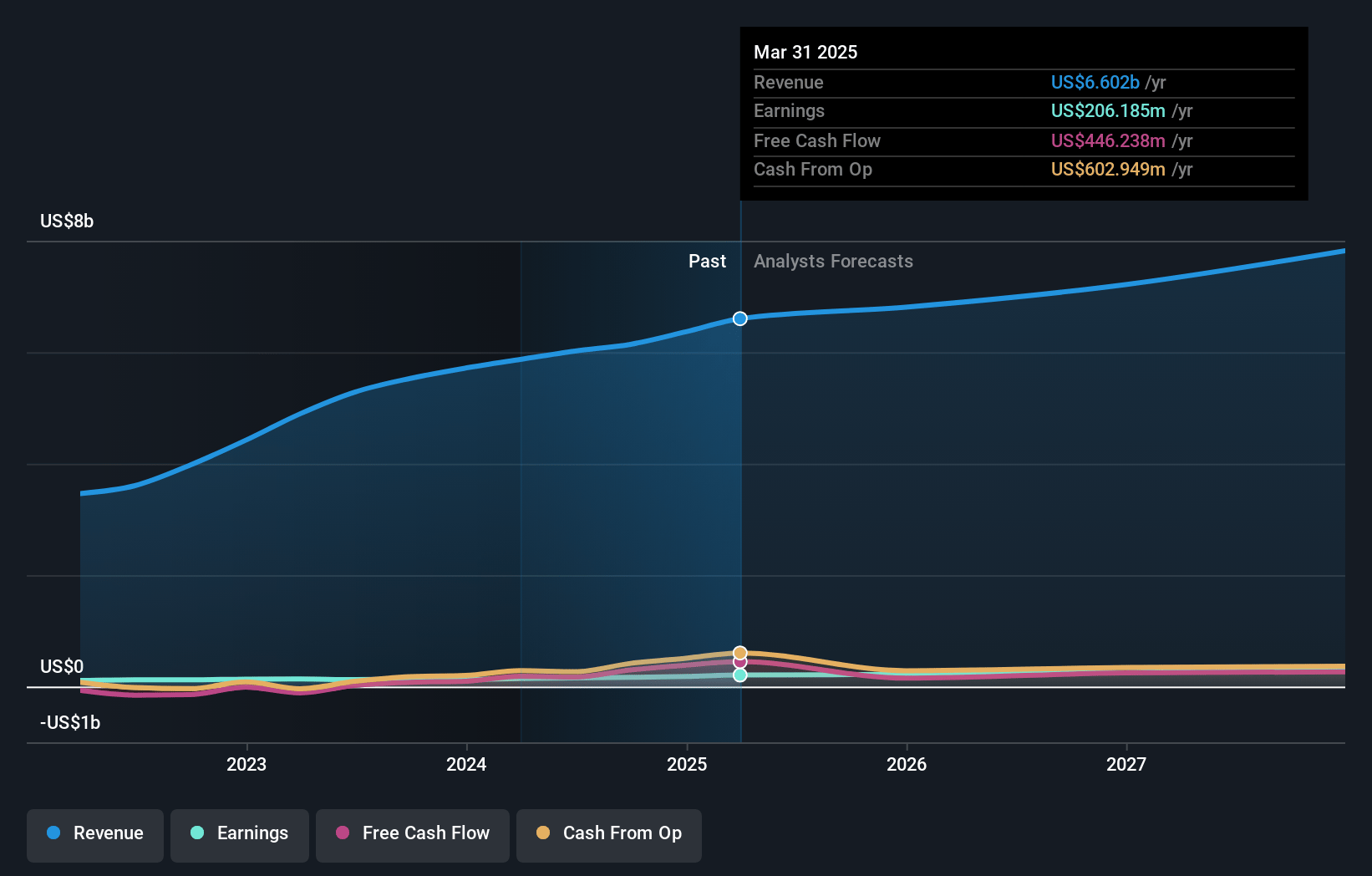

Primoris Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Primoris Services's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 3.5% in 3 years time.

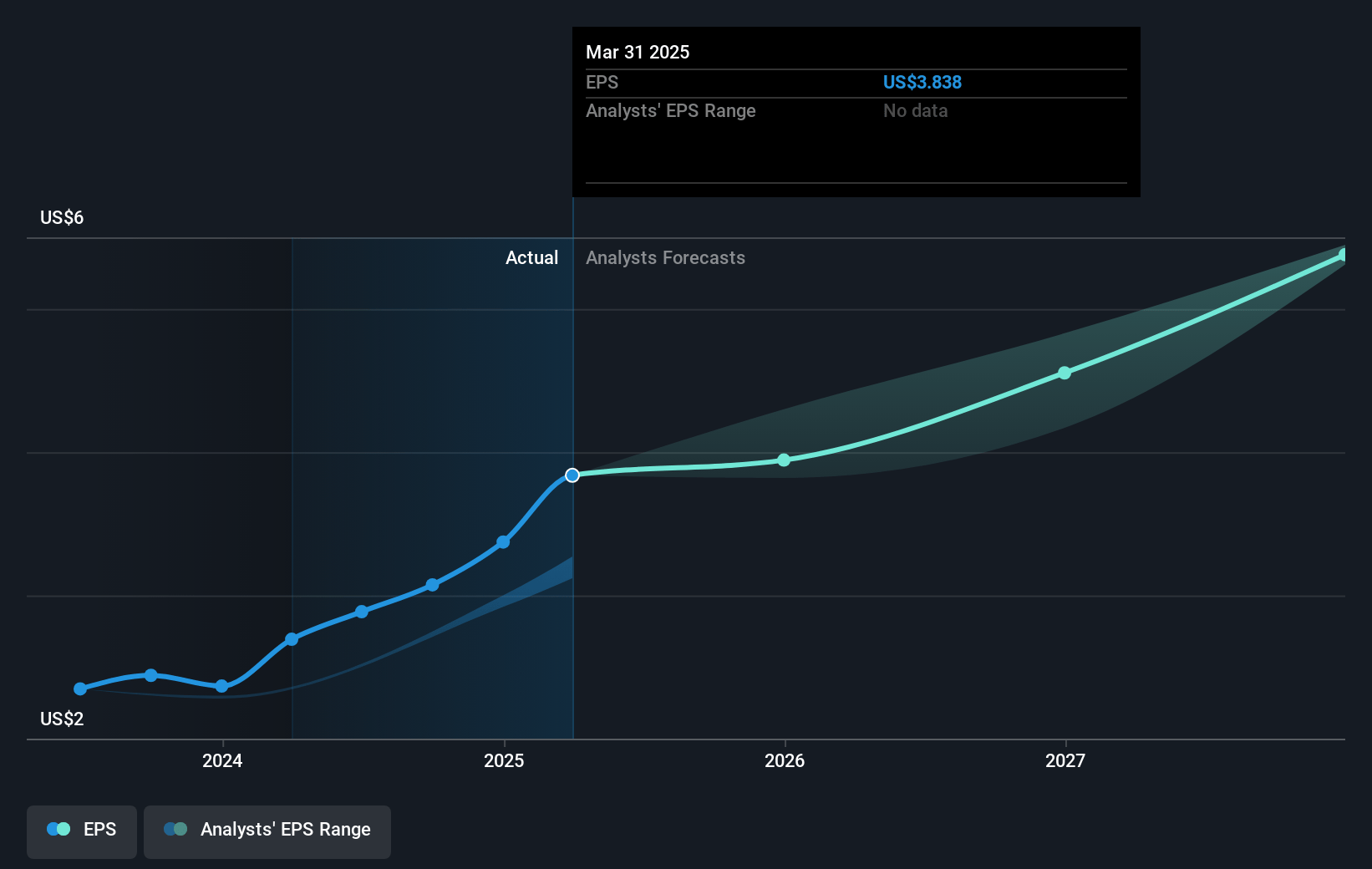

- Analysts expect earnings to reach $251.4 million (and earnings per share of $4.48) by about November 2027, up from $164.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2027 earnings, down from 24.1x today. This future PE is lower than the current PE for the US Construction industry at 32.6x.

- Analysts expect the number of shares outstanding to grow by 1.5% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

Primoris Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Primoris Services demonstrated record financial performance in Q3 2024, highlighting strong revenue, earnings, backlog, and cash flow, which could support future financial stability and limit the likelihood of a share price decrease. (Revenue, Earnings)

- The company is experiencing high demand in its renewables business, particularly in solar EPC services, which contributes significantly to revenue with a growing backlog, indicating potential for continued revenue growth. (Revenue)

- Improved gross margins in the Utilities segment, driven by higher margins in communications and gas operations, suggest the company is effectively managing costs and maintaining profitability despite sector variability. (Net Margins)

- Primoris' strong cash flow performance, with Q3 2024 being the best quarter historically, enhances liquidity, reduces debt levels, and positions the company well for future investments or downturns. (Cash Flow, Debt Management)

- Strategic focus on capital allocation, including reducing debt and maintaining organic growth, indicates proactive financial management that could buffer the organization against financial volatility. (Debt Management, Earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $65.83 for Primoris Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $7.1 billion, earnings will come to $251.4 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $73.85, the analyst's price target of $65.83 is 12.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives