Last Update07 Aug 25Fair value Increased 7.78%

The upward revision in NPK International's consensus price target primarily reflects significantly improved revenue growth forecasts, partially offset by a higher discount rate, resulting in the fair value rising from $11.25 to $12.12.

What's in the News

- Repurchased 1,217,606 shares for $9.53 million, completing buyback of 3,037,206 shares for $20.3 million under the February 2024 program.

- Raised full-year 2025 earnings guidance; now expects revenues between $250 million and $260 million based on strong first half and continued momentum.

Valuation Changes

Summary of Valuation Changes for NPK International

- The Consensus Analyst Price Target has risen from $11.25 to $12.12.

- The Consensus Revenue Growth forecasts for NPK International has significantly risen from 8.2% per annum to 11.0% per annum.

- The Discount Rate for NPK International has risen from 7.53% to 7.94%.

Key Takeaways

- Expanding infrastructure spending and longer rental contracts are driving sustained revenue growth, improved asset utilization, and enhanced earnings consistency.

- Innovation in high-margin products and a strong balance sheet enable ongoing investment, market share gains, and improved shareholder returns.

- Dependence on large infrastructure projects, unpredictable product sales, slow market diversification, and rising cost pressures create significant risks to NPK International's revenue and profitability stability.

Catalysts

About NPK International- A temporary worksite access solutions company, manufactures, sells, and rents recyclable composite matting products.

- NPK International is benefiting from robust, sustained demand for utility transmission and pipeline infrastructure, supported by increasing global investment in critical infrastructure modernization and energy transition projects; with the company reasonably early in this wave of spending and utilities reaffirming or upping their CapEx commitments, there is a visible multi-year revenue growth runway from these long-term infrastructure trends.

- The ongoing shift by utility and infrastructure customers toward longer-duration rental contracts is increasing asset utilization rates (currently trending at the high end of historical ranges), providing greater revenue visibility and operational leverage-which should support improved earnings consistency and operating margins.

- Continued expansion of NPK International's rental fleet and geographic footprint-especially in high-growth regions such as the Midwest, Gulf Coast, and markets tied to infrastructure spending-positions the company to capture more share from secular increases in food, energy, and infrastructure demand, driving sustainable top-line and EBITDA growth over the long term.

- Industry adoption of advanced, longer-life composite mats (versus traditional timber) for access solutions is accelerating, with NPK's product innovation and strong customer relationships with utilities and fleet operators driving a secular transition to higher-margin, value-added products-enhancing overall net margins.

- Strong and flexible balance sheet with ample liquidity allows continued investment in fleet expansion, operational efficiency, and share repurchases, while also enabling potential strategic acquisitions; this supports both revenue growth and shareholder returns (EPS uplift from buybacks), and underpins the company's undervaluation relative to forward growth prospects.

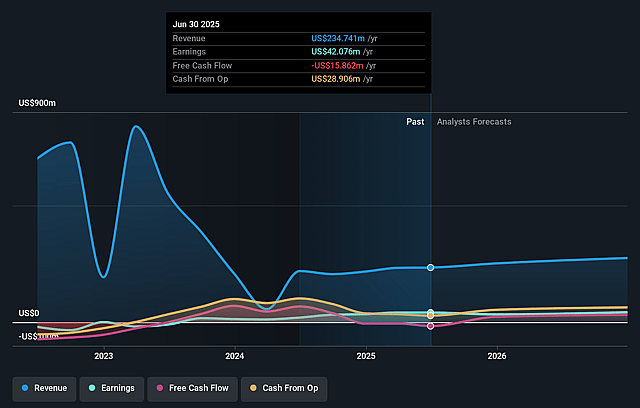

NPK International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NPK International's revenue will grow by 11.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.9% today to 13.3% in 3 years time.

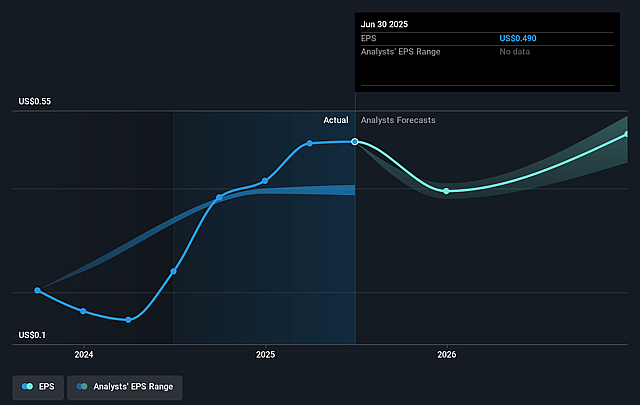

- Analysts expect earnings to reach $42.8 million (and earnings per share of $0.49) by about August 2028, up from $42.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.1x on those 2028 earnings, up from 18.1x today. This future PE is greater than the current PE for the US Trade Distributors industry at 22.0x.

- Analysts expect the number of shares outstanding to decline by 2.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.93%, as per the Simply Wall St company report.

NPK International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NPK International's significant increase in rental revenues has been driven by a concentrated surge in large-scale infrastructure projects; however, this exposes the company's future revenues to project timing risks and sector cyclicality-potentially leading to revenue volatility if such projects decline or are delayed.

- The company's product sales, while currently robust, are described as more difficult to predict and are down year-over-year from record levels, suggesting a risk of declining or inconsistent revenue streams as industry transitions or customer preferences shift-negatively impacting both revenue stability and net margins.

- While NPK International is expanding geographically, its historical concentration in oil and gas basins and slower expansion into new markets could limit long-term growth and expose the company to competitive pressure and regional market downturns-putting both revenue growth and earnings at risk.

- The elevated SG&A expenses tied to performance-based incentives and rightsizing efforts, along with management's ongoing focus on streamlining overhead, indicate operating cost pressures and execution risk; if not managed effectively, these could compress operating margins and lower overall profitability.

- Increasing reliance on large utility and infrastructure customers, and the heavy investment in rental fleet scale, may create vulnerability if regulatory or policy changes (e.g., delayed utility CapEx, shifting infrastructure priorities, or increased compliance demands) result in reduced project pipelines or higher operational costs-adversely impacting revenue growth, EBITDA, and net earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.125 for NPK International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $321.7 million, earnings will come to $42.8 million, and it would be trading on a PE ratio of 28.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of $8.99, the analyst price target of $12.12 is 25.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.