Narratives are currently in beta

Key Takeaways

- Operational efficiencies and strategic investments are expected to improve profitability and enhance gross and net margins.

- Strategic initiatives and acquisitions could boost revenue growth through infrastructure projects and market expansion.

- Operational challenges from geopolitical tensions and rising costs may constrain growth and profitability, while minimal infrastructure funding exacerbates future revenue risks.

Catalysts

About Mueller Water Products- Manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally.

- The closure of Mueller's legacy brass foundry and elimination of duplicative costs are expected to improve consolidated gross margins by 80 to 100 basis points annually starting in the second half of fiscal 2025. This operational efficiency is poised to positively impact net margins and earnings.

- Continued investments in commercial and operational capabilities, with a focus on improving supply chain efficiencies and developing advanced manufacturing capabilities, are anticipated to drive further performance improvements and margin gains. This could positively influence net margins and overall profitability.

- Mueller's strategic initiatives include providing solutions for aging infrastructure and lead service line replacements in response to federal infrastructure spending, potentially resulting in increased revenue as these projects gain momentum.

- Mueller's customer experience investments aim to deepen relationships and enhance engagement, which may lead to increased revenue through higher sales volumes and expanded market share.

- The company's strong balance sheet and liquidity position, with the ability to support strategic acquisitions, could lead to additional revenue streams and enhanced earnings through acquisition-driven growth.

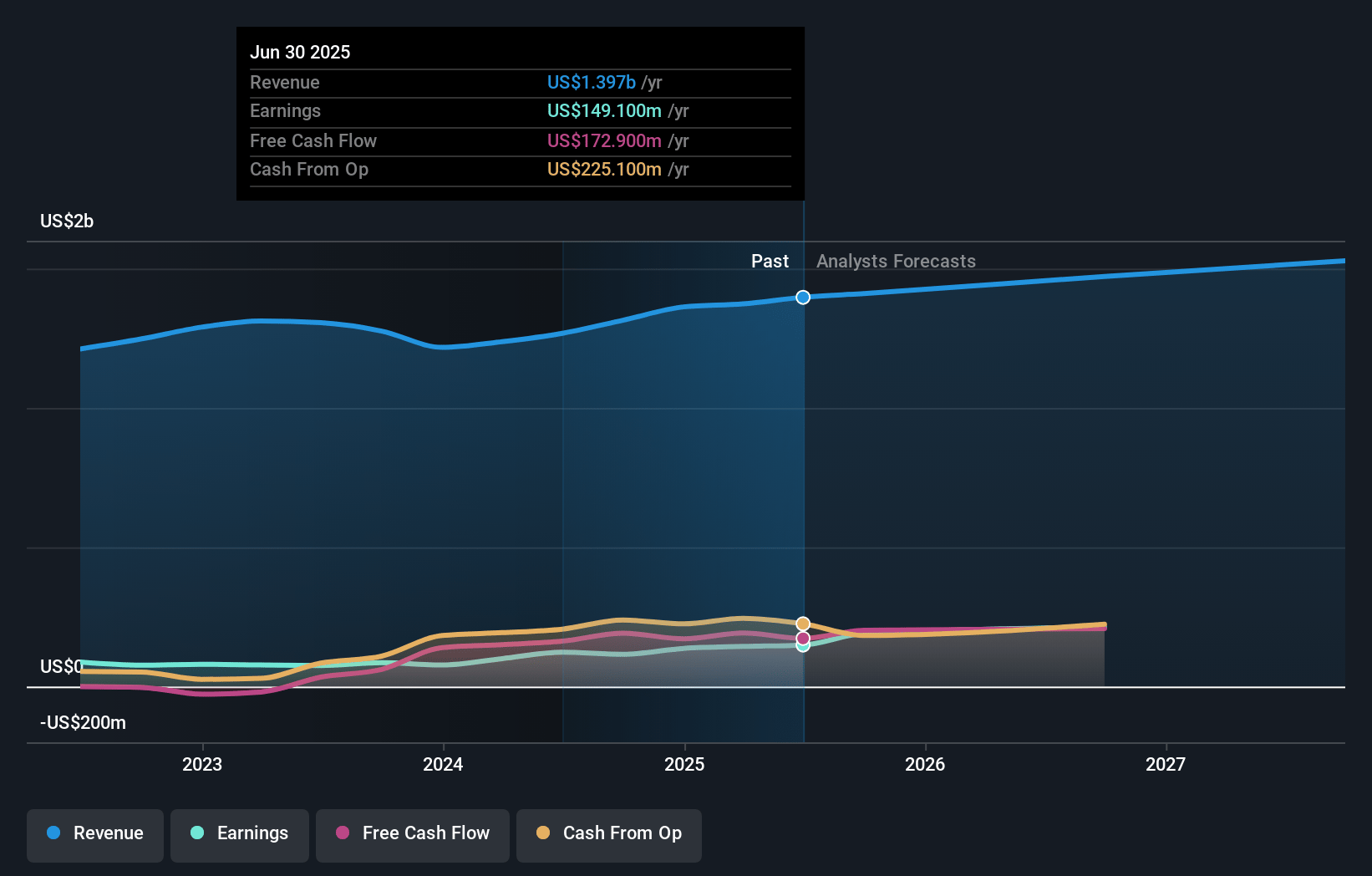

Mueller Water Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mueller Water Products's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.8% today to 17.1% in 3 years time.

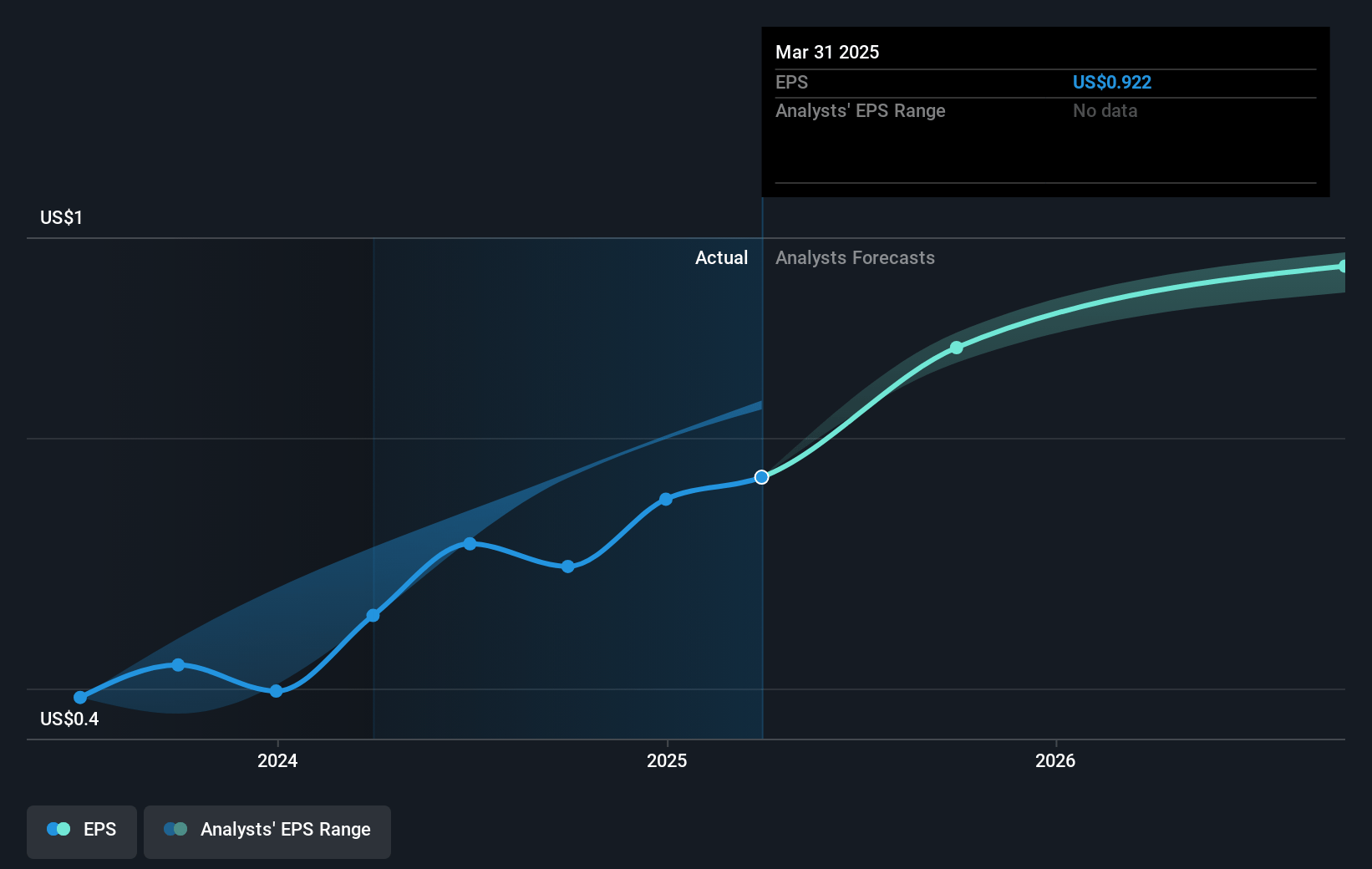

- Analysts expect earnings to reach $244.5 million (and earnings per share of $1.6) by about November 2027, up from $115.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2027 earnings, down from 33.9x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.98%, as per the Simply Wall St company report.

Mueller Water Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impacts of the Israel-Hamas war are expected to continue creating operational challenges and headwinds, particularly affecting the Water Management Solutions segment, which could impact revenue and margins.

- The guidance assumes minimal contribution from the Infrastructure Investment and Jobs Act (IIJA) spending, implying potential risk if infrastructure funding delays persist, which could negatively affect future revenue and growth.

- The company's revenue growth forecast of only 1.9% to 3.4% in fiscal 2025 suggests limited volume growth in a resilient municipal and residential construction market, which may impact the company's ability to capitalize on favorable market conditions and affect earnings.

- The non-cash goodwill impairment charge indicates lower forecasted revenues and profitability within certain product lines, reflecting potential ongoing challenges in these areas that could affect overall profit margins.

- Increasing inflationary pressures and higher SG&A expenses, resulting from higher incentive costs, could erode net margin improvements and impact profit levels if not offset by strong revenue performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $25.83 for Mueller Water Products based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.4 billion, earnings will come to $244.5 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $25.13, the analyst's price target of $25.83 is 2.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives