Narratives are currently in beta

Key Takeaways

- Record backlog and strong growth in communications and power delivery segments signal potential for significant revenue and margin enhancements in 2025.

- Diversified model and strategic investments position MasTec to improve operational efficiencies and capitalize on higher-margin projects.

- Delayed project starts, material delivery issues, and regulatory revenue recognition rules may hinder MasTec's revenue growth and margin sustainability across multiple segments.

Catalysts

About MasTec- An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

- MasTec's record backlog of $13.9 billion, with a $520 million sequential increase, provides strong momentum and confidence for revenue growth entering 2025. This signals expected future revenue enhancement.

- The Communications segment demonstrated significant improvements, achieving record quarterly revenues with a 12% year-over-year and sequential revenue growth. Continued expansion in market share and upcoming projects like the Lumen Technologies fiber program are set to elevate future revenues and support earnings growth.

- In the Power Delivery segment, improving trends in distribution spending and a significant 700-mile transmission project that is set to fully mobilize in early 2025 indicate a positive outlook for substantial revenue growth and margin enhancement.

- The Clean Energy and Infrastructure segment showcased a sequential revenue increase of over 20% and EBITDA growing 80%, with record backlog levels. Continued progress in project execution and backlog growth point toward improved margins and robust revenue growth in 2025.

- The company's diversified model and strategic investments in labor and scale position it to capture more market opportunities, potentially improving net margins through operational efficiencies and increased volume of higher-margin projects.

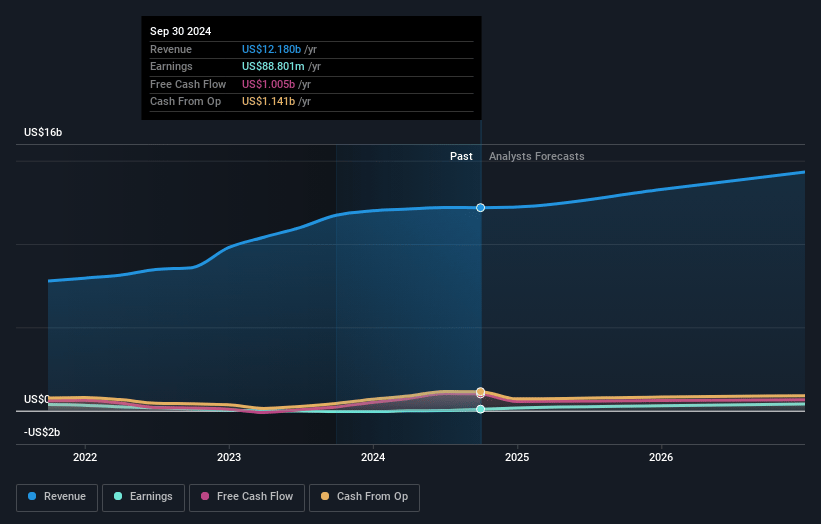

MasTec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MasTec's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 3.2% in 3 years time.

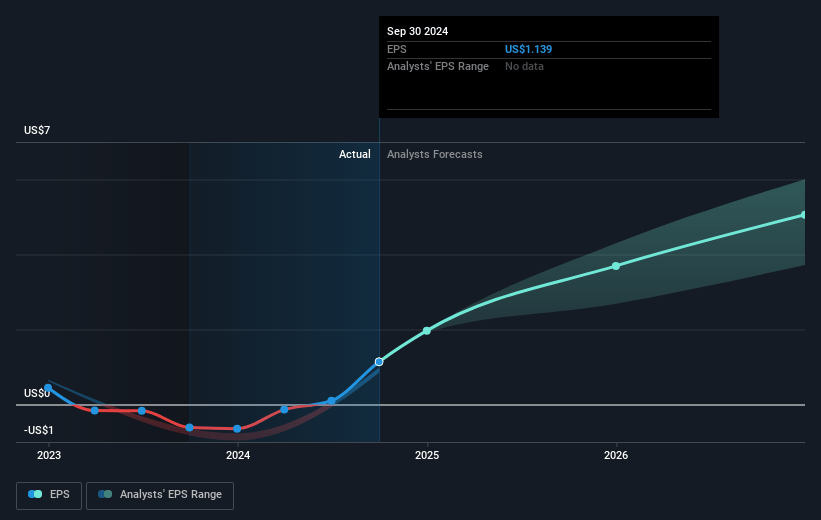

- Analysts expect earnings to reach $482.7 million (and earnings per share of $6.08) by about November 2027, up from $88.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $292 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.0x on those 2027 earnings, down from 122.3x today. This future PE is lower than the current PE for the US Construction industry at 33.8x.

- Analysts expect the number of shares outstanding to grow by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

MasTec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenues were slightly below expectations due to delayed construction starts and slower project burn in several segments, which could impact overall revenue growth and financial performance.

- Certain project activity in the Clean Energy and Infrastructure segment faced delays driven by material delivery timing and adverse weather, risking future project execution and potentially affecting revenue and earnings timing.

- The Oil and Gas Pipeline segment experienced a decline in revenues and a backlog reduction; despite optimism about future demand, near-term visibility on actual conversions might impact revenue and net margins negatively if projects are delayed or canceled.

- While backlog growth was a highlight, many of the awarded projects, especially in large-scale transmission, are only partially booked due to 18-month revenue recognition rules, which might delay revenue realization and impact earnings forecasts.

- Compressed margins in other segments due to timing and mix might also pose a challenge, especially if historical projects underperform, reducing the ability of the company to sustain net margin improvements across all operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $148.21 for MasTec based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $173.0, and the most bearish reporting a price target of just $108.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $15.2 billion, earnings will come to $482.7 million, and it would be trading on a PE ratio of 30.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of $139.32, the analyst's price target of $148.21 is 6.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives