Narratives are currently in beta

Key Takeaways

- Significant projects in the MENA region and anticipated U.S. infrastructure spending could drive revenue growth despite margin compression from large sales.

- Investment in new technologies and innovations, including Nebraska facility enhancements, aims to improve margins and capitalize on emerging markets.

- Global revenue and profitability suffer due to market softness, currency fluctuations, and low profitability in key regions, impacting the irrigation segment significantly.

Catalysts

About Lindsay- Provides water management and road infrastructure products and services in the United States and internationally.

- Significant infrastructure projects in the MENA region, expected to continue shipping through fiscal year 2025, could drive international revenue growth despite margin compression from large project sales.

- Anticipated increase in U.S. infrastructure spending, supported by federal funding from the Infrastructure Investments and Jobs Act, is likely to boost revenues and margins in the infrastructure segment, particularly due to project sales and Road Zipper leases.

- Continued growth in FieldNet and field-wise irrigation management platforms, alongside a 28% growth rate in annual recurring revenue from device subscriptions, is expected to support revenue growth and enhance overall margins through higher-margin technology offerings.

- Investment in technology and innovation, including development of new products like the TAU XR crash cushion and Impact Alert product, aims to differentiate Lindsay's offerings and improve operating margins by capitalizing on new market opportunities.

- A $50 million investment in the Nebraska facility is set to improve production efficiencies, better manage variable costs, and provide margin stability, potentially boosting net earnings as the market returns to growth.

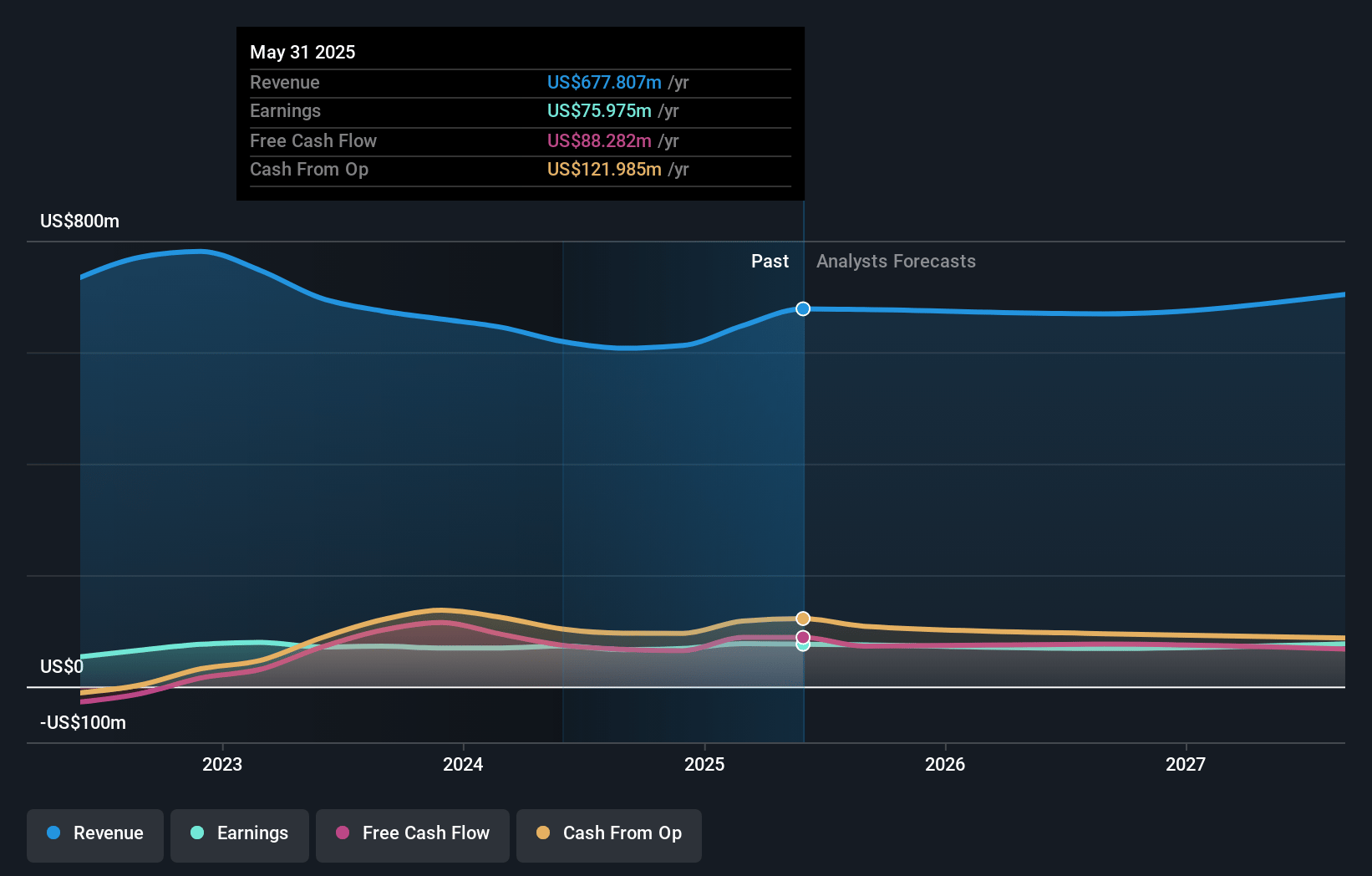

Lindsay Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lindsay's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.9% today to 11.1% in 3 years time.

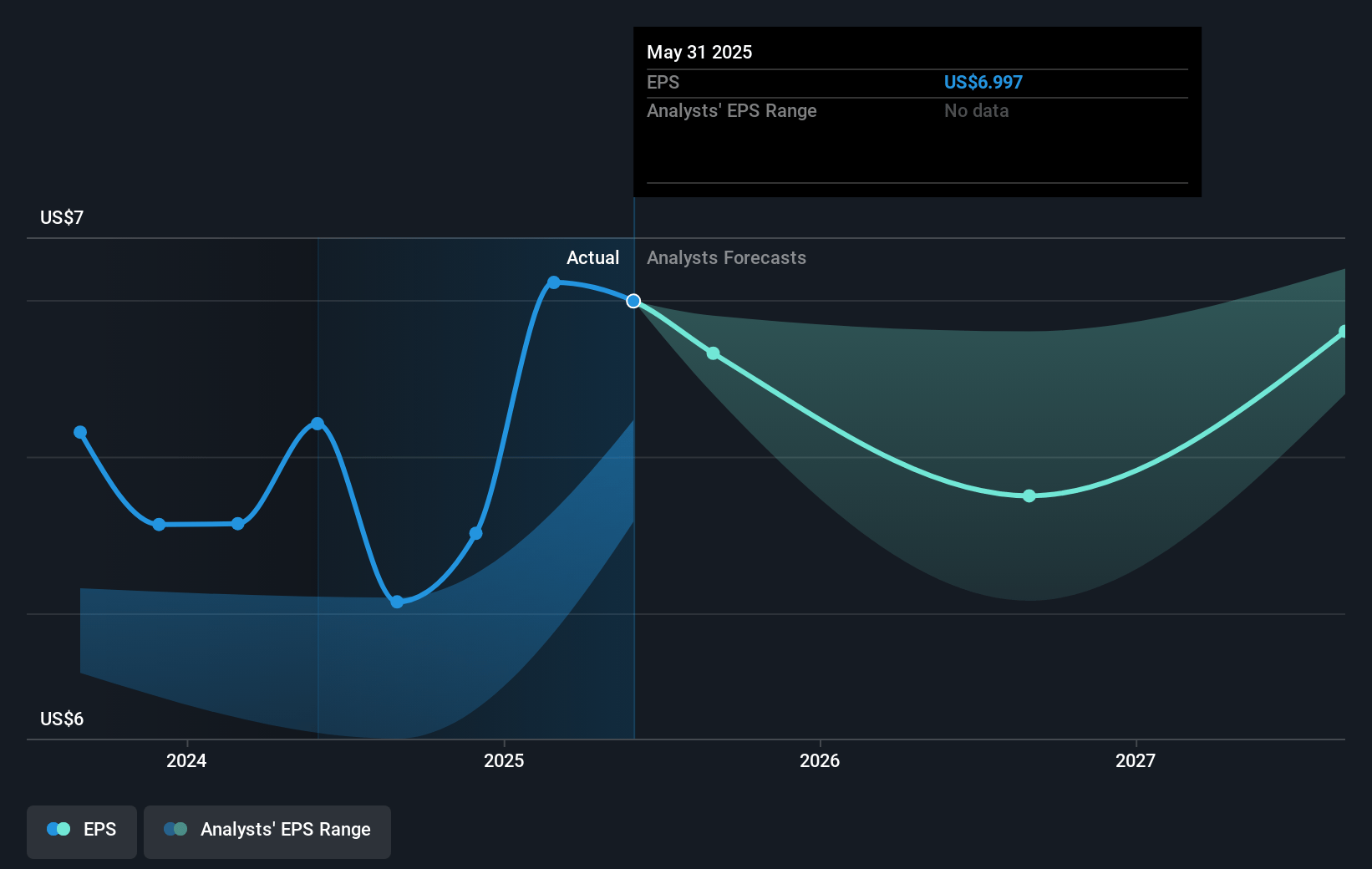

- Analysts expect earnings to reach $77.0 million (and earnings per share of $7.06) by about November 2027, up from $66.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2027 earnings, down from 21.5x today. This future PE is lower than the current PE for the US Machinery industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

Lindsay Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Market softness in Brazil due to lower grower profitability and poor customer sentiment persists, impacting international irrigation revenues and potentially reducing earnings from this segment.

- Headwinds in the cropping segment in North America due to low net farm income and poor customer sentiment may result in a down market, negatively affecting revenue projections for the irrigation business.

- The profitability of large projects like those in the MENA region is generally lower, which can dilute overall operating margins and impact net earnings despite increased revenues from these projects.

- Currency fluctuations resulted in unfavorable effects of foreign currency translation, leading to reduced revenues in international irrigation markets and impacting net earnings.

- Continued low profitability and credit availability in Brazil and Latin America, coupled with potential delays in planting due to historic droughts, can cause sustained demand weakness, impacting revenues and margins from these crucial regions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $132.0 for Lindsay based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $695.1 million, earnings will come to $77.0 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of $131.08, the analyst's price target of $132.0 is 0.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives