Key Takeaways

- Lockheed Martin's integration of AI, 5G, and cloud technologies into existing platforms could boost revenue through contracts and operational enhancements.

- Expedited defense acquisition processes and aligned defense priorities significantly position Lockheed Martin for revenue growth and efficient market expansion.

- Dependency on advanced missile and space system development poses risks of execution challenges and cost overruns, affecting profitability and operating margins.

Catalysts

About Lockheed Martin- An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

- Lockheed Martin's strategic pivot to its 21st Century Security strategy, which integrates advanced AI, 5G, and distributed cloud technologies into existing platforms like the F-35, F-22, and NGAD, is expected to enhance operational capabilities and drive future growth. This innovation should positively impact revenue and earnings through new contracts and upgrades.

- The substantial opportunities from the Golden Dome project, leveraging Lockheed's established products in weapons systems, radar, and missile defense, could increase revenue significantly as these solutions align well with U.S. defense priorities and international interest.

- Lockheed Martin's missile systems, such as PrSM, JASSM/LRASM, and THAAD, continue to win large contracts that impact future backlog, setting the stage for sustained high single-digit growth and contributing to revenue and cash flow stability.

- The implementation of high-impact measures from new executive orders to cut through bureaucratic red tape in defense acquisitions and foreign military sales (FMS) is expected to speed up deal processing times and potentially boost revenues by making it easier for Lockheed to expand market share.

- Lockheed's continued investment in digital transformation initiatives through the 1LMX business process is enhancing production efficiencies and client satisfaction through advanced, scalable solutions, expected to improve net margins over time.

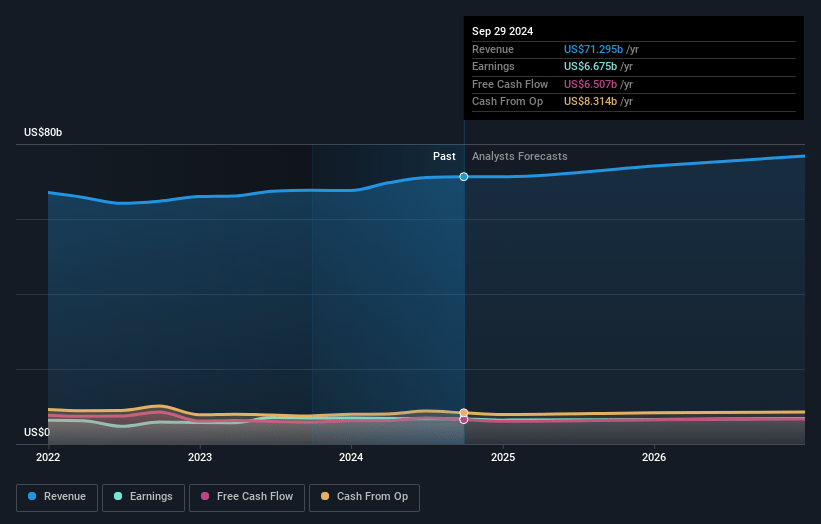

Lockheed Martin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lockheed Martin's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 8.9% in 3 years time.

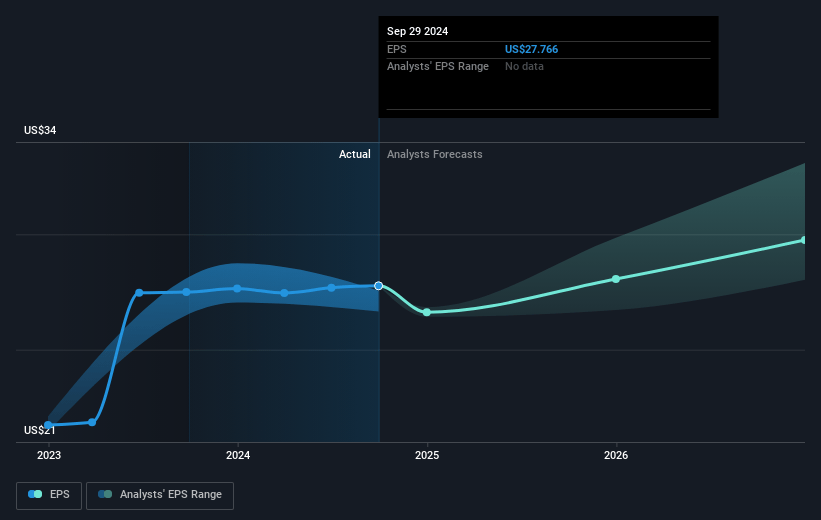

- Analysts expect earnings to reach $7.1 billion (and earnings per share of $31.82) by about April 2028, up from $5.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, down from 19.7x today. This future PE is lower than the current PE for the US Aerospace & Defense industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 2.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Lockheed Martin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continuation of operating under a full-year continuing resolution for the U.S. defense budget may delay new contract awards and limit Lockheed Martin's ability to increase future revenue streams.

- The company's focus on development and integration of advanced missile and space systems, characterized by high-end technology, inherently carries execution challenges and cost overruns which could impact margins and profitability.

- External economic factors such as future changes in U.S. foreign policy, export controls, or military spending priorities could adversely affect Lockheed Martin's international sales and overall revenue growth.

- The competitive risk associated with the loss of the Next Generation Air Dominance (NGAD) program may limit growth in the Aeronautics sector and potentially impact future order backlogs and earnings.

- Supply chain disruptions, including issues with critical components like rare earth metals, could affect Lockheed Martin's production capabilities, leading to increased costs and impacting operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $523.124 for Lockheed Martin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $670.0, and the most bearish reporting a price target of just $424.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $80.0 billion, earnings will come to $7.1 billion, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $462.08, the analyst price target of $523.12 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.