Key Takeaways

- Increased federal infrastructure funding and resilient construction demand are expected to drive sustained revenue growth and help stabilize cash flows.

- Strategic acquisitions and planned facility modernization support improved operational efficiency, margin expansion, and provide flexibility to pursue long-term growth opportunities.

- Reliance on costly imports, unstable end markets, tariff uncertainties, operational disruptions, and narrow focus expose Insteel to ongoing margin pressures and long-term revenue vulnerability.

Catalysts

About Insteel Industries- Manufactures and markets steel wire reinforcing products for concrete construction applications.

- Ongoing and increasing federal infrastructure funding (such as IIJA) is beginning to flow through to real demand for steel reinforcement products, suggesting a multi-year pipeline of public works and civil projects that should drive sustained shipment volume growth and steadily higher revenues.

- Despite macroeconomic uncertainty, robust quoting activity, growing backlogs, and project momentum in data center and infrastructure construction point to continued demand resilience, which is likely to help mitigate cyclicality and support more stable cash flows, aiding both revenue and earnings predictability.

- Strategic acquisitions (like Engineered Wire Products and O'Brien Wire Products) and ongoing integration efforts are expanding the company's operational footprint, improving logistics capabilities and potentially unlocking synergies in freight and manufacturing, which should help boost operating margins and overall profitability.

- Investment plans aimed at facility modernization and expanding the product portfolio-though temporarily delayed by acquisition integration-are expected to resume, paving the way for lower production costs, entry into higher-margin product segments, and improved net margins over the long term.

- The company's conservative balance sheet, strong liquidity, and low debt position provide flexibility to withstand raw material cost volatility, invest in growth opportunities, and weather industry headwinds, which supports earnings resilience and positions Insteel to capitalize on broader industry secular trends.

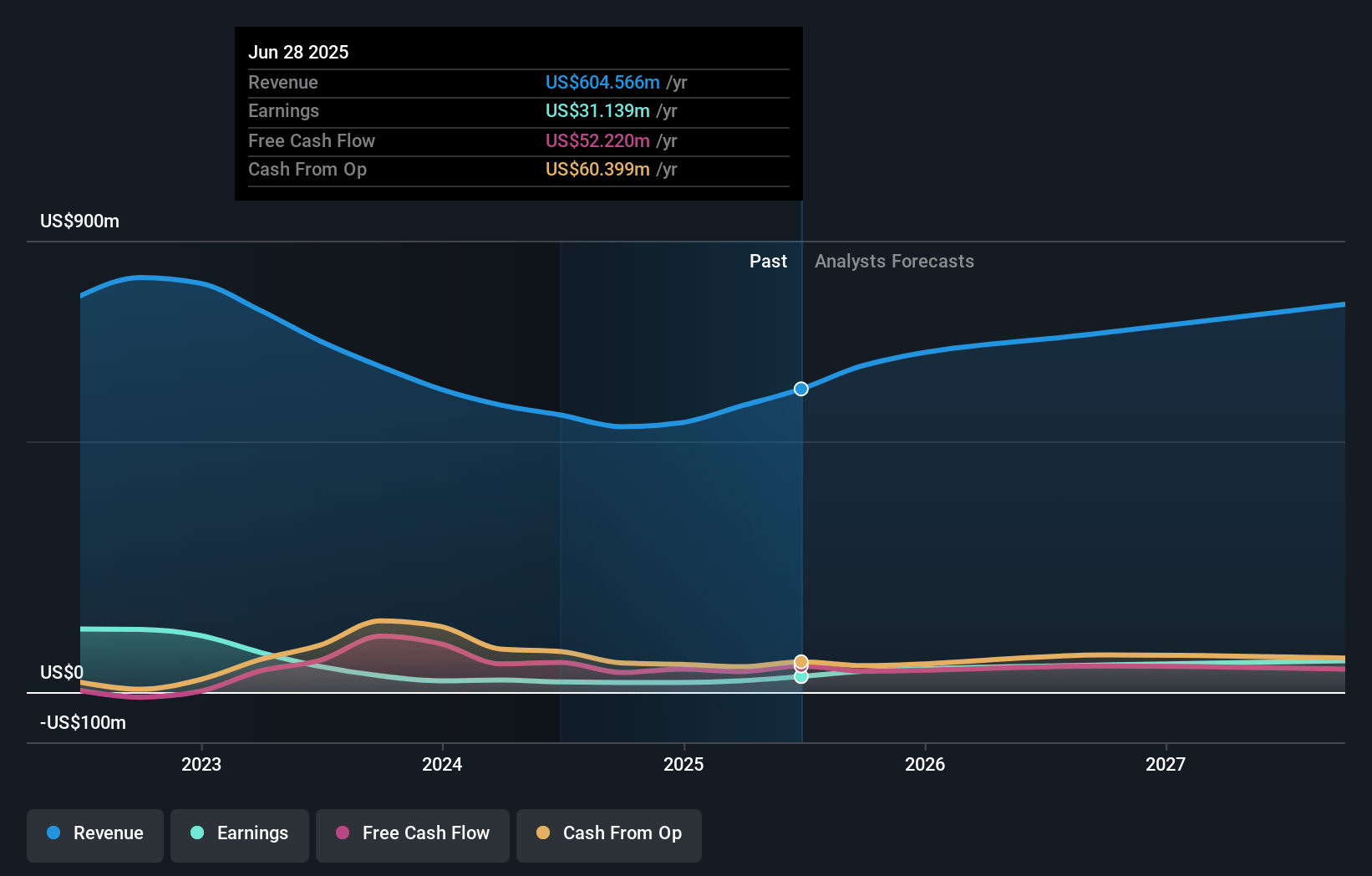

Insteel Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Insteel Industries's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 9.2% in 3 years time.

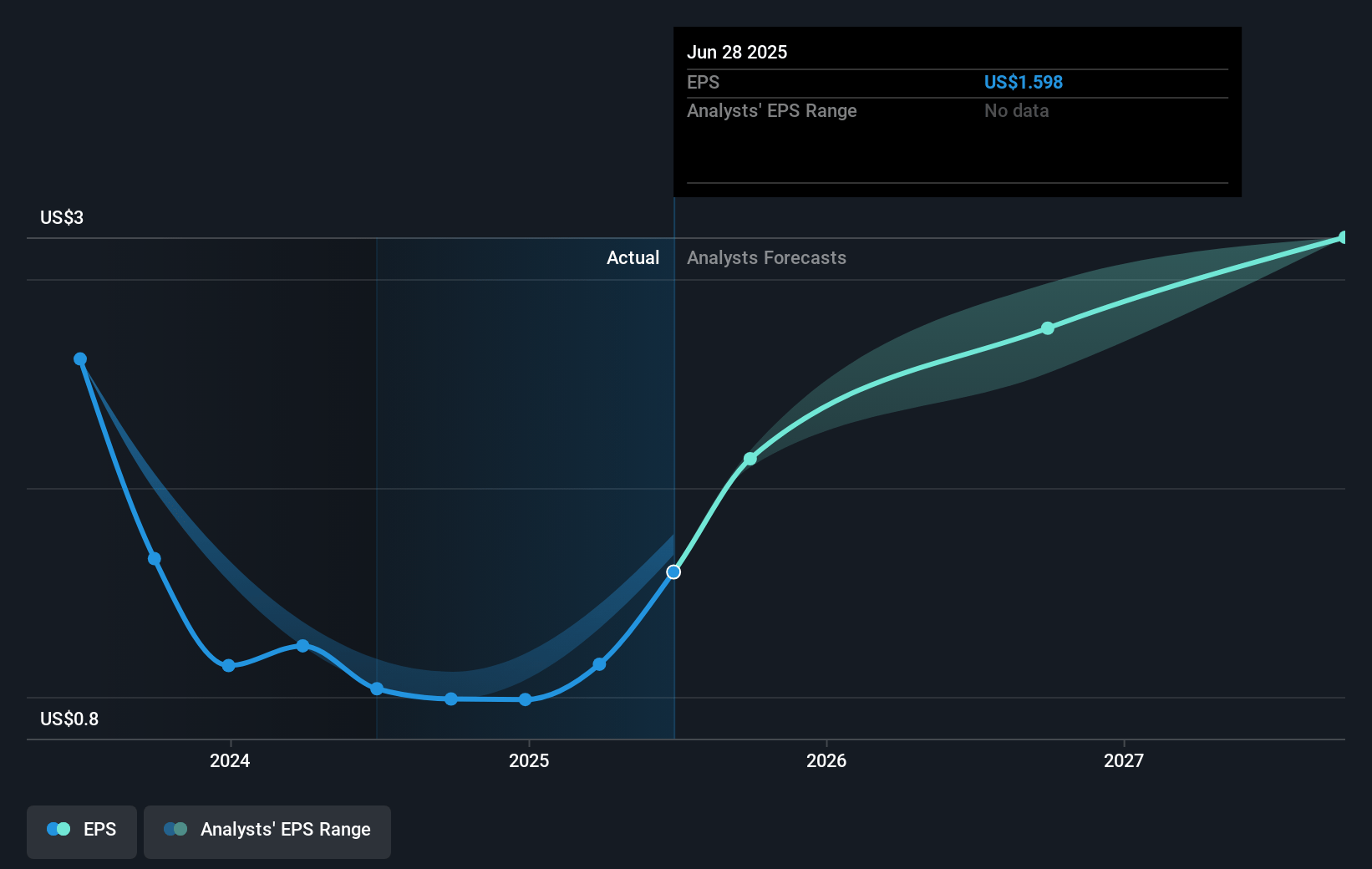

- Analysts expect earnings to reach $77.4 million (and earnings per share of $3.97) by about July 2028, up from $31.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, down from 23.0x today. This future PE is lower than the current PE for the US Building industry at 21.1x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

Insteel Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing supply constraints in domestic wire rod production are causing Insteel to rely heavily on more expensive offshore imports, exposing the company to volatile input costs, unpredictable tariffs, and longer lead times; this threatens gross margins and could limit earnings growth if material availability does not improve.

- The company's end markets-primarily nonresidential, commercial, and infrastructure construction-are experiencing mixed signals, with soft construction spending, a downward trend in cement shipments, and weak residential demand; sustained softness or further declines in these sectors could pressure shipment volumes and revenue growth over the long term.

- Ambiguity and frequent changes in U.S. trade and tariff policy, especially around Section 232 tariffs, create regulatory and execution risks for Insteel; uncertainty around tariff application and the potential for retroactive penalties may increase costs, reduce operational flexibility, and negatively impact net margins.

- Persistent challenges in staffing and plant scheduling due to raw material disruptions are resulting in lost shipments and higher operating costs; ongoing labor shortages and production inefficiencies could squeeze net margins and dampen earnings resilience.

- Heavy dependence on U.S. domestic markets and a limited product portfolio centered on wire reinforcing products leave Insteel vulnerable to structural shifts, such as the adoption of alternative construction materials (e.g., advanced composites) or demographic headwinds, which could reduce the addressable market and impact long-term revenue and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $39.0 for Insteel Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $839.0 million, earnings will come to $77.4 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $36.93, the analyst price target of $39.0 is 5.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.