Key Takeaways

- Strong demand for naval expansion and defense services, alongside multiyear contracts, ensures revenue stability and positions the company as vital to national security priorities.

- Diversification into technology-driven services and operational efficiency initiatives are set to boost margins, recurring revenue, and long-term profitability.

- Dependence on large Navy contracts, persistent cost and workforce challenges, and uncertain defense budgets threaten profitability, efficiency, and long-term revenue growth.

Catalysts

About Huntington Ingalls Industries- Designs, builds, overhauls, and repairs military ships in the United States.

- The rapidly escalating geopolitical tensions and great power competition are resulting in strong, sustained bipartisan support for significant U.S. defense budgets and naval expansion, as evidenced by multi-billion dollar, multi-ship block contract awards and continued Congressional endorsement of major shipbuilding programs. This structural demand is expected to maintain a robust order backlog and drive consistent revenue growth through the decade.

- The strategic shift by governments toward greater investment in maritime security, supply chain resilience, and advanced naval deterrence—driven in part by persistent threats to global trade routes—ensures that Huntington Ingalls remains essential to U.S. and allied defense planning. This importance manifests through multiyear contracts and ongoing new program funding, dramatically reducing revenue cyclicality and enhancing long-term visibility.

- The company’s unique position as the sole builder of U.S. nuclear-powered aircraft carriers and a key supplier of nuclear submarines secures recurring, large-scale, repeat business on long-cycle contracts. As older, less profitable pre-COVID deals roll off, the increasing share of recently negotiated contracts—structured with more balanced risk-sharing and economic adjustments—will support a steady expansion in operating margins and stabilize earnings growth.

- Expansion into high-margin, technology-driven defense services such as cyber, autonomous systems, and mission technologies is rapidly diversifying Huntington Ingalls’ revenue base. This growth in services not only boosts overall company margins but also provides additional resilient, recurring revenue streams that smooth out shipbuilding volatility and underpin robust earnings projections.

- Significant ongoing investments in automation, digital shipbuilding, and operational throughput—as well as targeted cost reduction initiatives—are expected to drive step-changes in efficiency, enabling stronger margin recovery to historical highs. With the majority of financially-challenged pre-COVID contracts set to expire by 2027, forward profitability should accelerate, with management targeting $15 billion in annual revenue and substantial free cash flow growth by 2030.

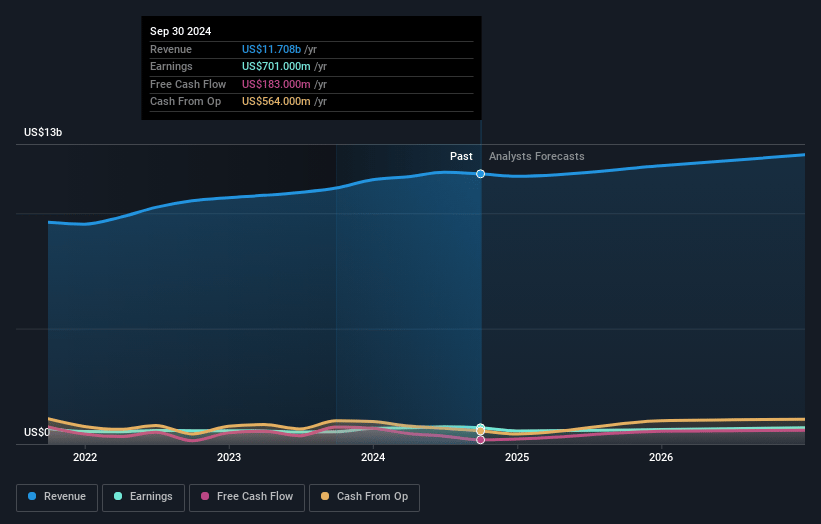

Huntington Ingalls Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Huntington Ingalls Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Huntington Ingalls Industries's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.8% today to 5.7% in 3 years time.

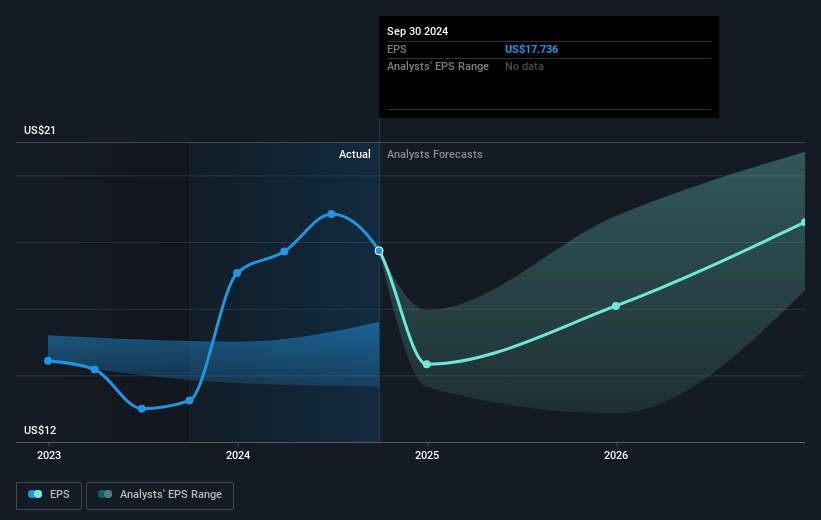

- The bullish analysts expect earnings to reach $792.9 million (and earnings per share of $20.81) by about April 2028, up from $550.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from 15.5x today. This future PE is lower than the current PE for the US Aerospace & Defense industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.75%, as per the Simply Wall St company report.

Huntington Ingalls Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company remains heavily reliant on a handful of large, long-cycle contracts with the U.S. Navy, exposing it to considerable risk from potential program delays, cancellations, or contract renegotiations, which could result in unpredictable revenue streams and volatile earnings in future periods.

- Persistent cost overruns and delays on major legacy shipbuilding programs, such as pre-COVID Virginia-class submarines and aircraft carriers, have led to negative cumulative adjustments totaling over one hundred million dollars in 2024, compressing segment operating margins and reducing profitability—pointing to ongoing execution challenges that may persist or recur in future programs.

- Workforce challenges remain acute, as stubbornly high attrition and the need to attract experienced shipbuilders are driving up labor costs and threatening productivity improvements, which could limit operational efficiency and depress operating margins and long-term earnings growth if not effectively resolved.

- Increasing use of outsourcing and acquisition of new fabrication facilities—though intended to support throughput—bring quality control and execution risks, and may only partially address underlying labor shortages, potentially leading to cost escalations or setbacks that impair near-term and future net margins.

- Future U.S. defense budgets are at risk from rising federal deficits and possible shifts in spending priorities away from military programs, which could materially reduce order flow, slow backlog growth, and cap the long-term revenue outlook for Huntington Ingalls Industries.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Huntington Ingalls Industries is $312.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Huntington Ingalls Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $312.0, and the most bearish reporting a price target of just $165.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.8 billion, earnings will come to $792.9 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $217.22, the bullish analyst price target of $312.0 is 30.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:HII. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.