Key Takeaways

- Accelerated innovation and strategic spin-offs are set to drive revenue growth and unlock operational efficiencies, boosting market share and margins.

- Strategic use of capital for acquisitions and innovation aligns with secular trends, projecting enhanced long-term revenue and earnings growth.

- Potential FX headwinds, tax rates, and Chinese tariffs could negatively impact Fortive's revenue growth, earnings per share, and net margins.

Catalysts

About Fortive- Designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally.

- Fortive's accelerated pace of innovation, including launching a record number of new products, particularly in high-growth areas like solar, energy storage, and AI-based solutions, is expected to sustain top-line revenue growth and expand market share.

- The company's strategic separation and spin-off of the Precision Technologies segment into the newly named Ralliant Corporation is anticipated to unlock value and streamline operations, potentially boosting net margins through more focused business strategies.

- The record free cash flow generated in 2024, which is being utilized for aggressive share repurchases, suggests a commitment to enhancing earnings per share and returning capital to shareholders, thus driving shareholder value.

- Investments in software, data analytics, and AI capabilities, especially in recurring revenues and SaaS businesses, are projected to drive higher margin revenue streams, positively impacting long-term earnings growth.

- Fortive's disciplined deployment of capital into strategic acquisitions and innovation initiatives positions the company to benefit from favorable secular trends such as next-gen power applications, thereby supporting robust future revenue and earnings growth.

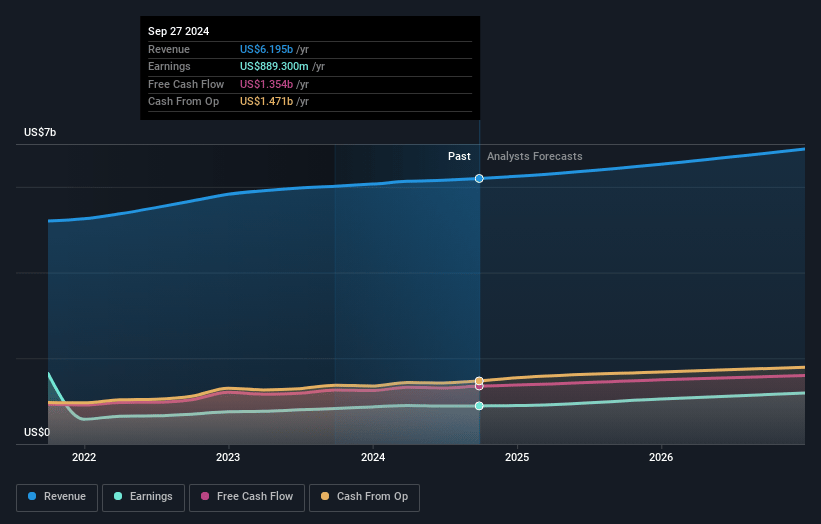

Fortive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fortive compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fortive's revenue will grow by 5.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.4% today to 19.5% in 3 years time.

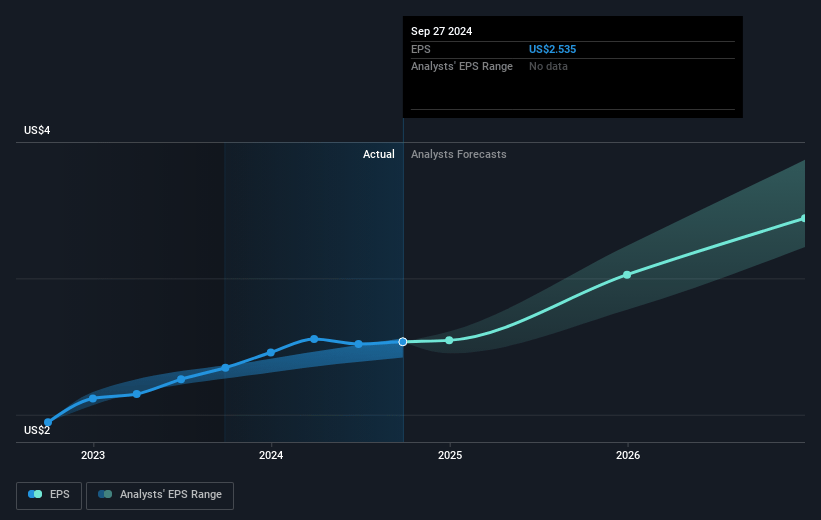

- The bullish analysts expect earnings to reach $1.4 billion (and earnings per share of $4.13) by about April 2028, up from $832.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.5x on those 2028 earnings, up from 27.0x today. This future PE is greater than the current PE for the US Machinery industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 3.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Fortive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential FX headwinds, due to unfavorable currency translation, could negatively impact Fortive's revenue growth and reduce adjusted operating margins.

- Slowdown in China, driven by GDP and industrial production declines, could adversely affect Fortive's core revenue growth, particularly impacting the Fluke segment, associated with reduced demand.

- Higher effective tax rates and adverse currency fluctuations could lead to a decrease in Fortive's adjusted earnings per share, affecting overall earnings.

- Commodity and tariff-related pressures, especially concerning Chinese tariffs, may impose additional costs on Fortive, potentially squeezing net margins if offsetting cost measures fall short.

- Execution risks associated with the separation of Precision Technologies into Ralliant could lead to additional operational costs and complexity, potentially impacting free cash flow and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fortive is $107.63, which represents two standard deviations above the consensus price target of $83.27. This valuation is based on what can be assumed as the expectations of Fortive's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $121.0, and the most bearish reporting a price target of just $67.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.4 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 28.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of $65.99, the bullish analyst price target of $107.63 is 38.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:FTV. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.