Key Takeaways

- Expanding focus on infrastructure, energy transition, and data center projects positions the company for strong, sustainable revenue and margin growth.

- Shifting portfolio toward higher-margin contracts and operational discipline enhances earnings stability, free cash flow, and capacity for shareholder returns and strategic acquisitions.

- Ongoing legacy risks, declining traditional backlogs, and slow diversification threaten margins and growth amid rising ESG, compliance, and digital transformation pressures.

Catalysts

About Fluor- Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

- Fluor is poised to benefit significantly from a surge in global infrastructure investment, evidenced by a 20% growth in Urban Solutions backlog and a robust pipeline of large projects, including data centers, mining, and ports. This sustained infrastructure push, aligned with government and private sector priorities, is likely to drive double-digit revenue growth and contribute to a strong book-to-bill ratio well above one in the coming years.

- Rising demand for energy transition and decarbonization projects, such as carbon capture, hydrogen, and nuclear initiatives, positions Fluor as a leader in large-scale energy projects. The company’s ramped-up focus on these complex projects, along with front-end engineering awards for major international facilities, supports the case for higher future earnings as global clients accelerate their low-carbon investments.

- The explosive growth in data center construction and associated power infrastructure in North America, propelled by AI and cloud adoption, is rapidly expanding Fluor’s addressable markets. The company’s newly signed master agreements with top data center developers and growing engagements on power projects will translate into substantial multi-year revenue streams and margin expansion as these opportunities mature.

- Fluor’s ongoing portfolio shift towards higher-margin segments such as life sciences, advanced technologies, and reimbursable contracts—now comprising 80% of its backlog—provides a foundation for improving net margins and more stable, less volatile earnings as the legacy fixed-price project risk continues to decline.

- Continued progress in operational efficiency through digital transformation, disciplined project selection, and risk management—demonstrated by reduced corporate G&A and a commitment to reimbursable, well-structured contracts—will enhance free cash flow generation. This enables shareholder returns through growing share repurchases and positions Fluor for potential bolt-on acquisitions to further accelerate future growth.

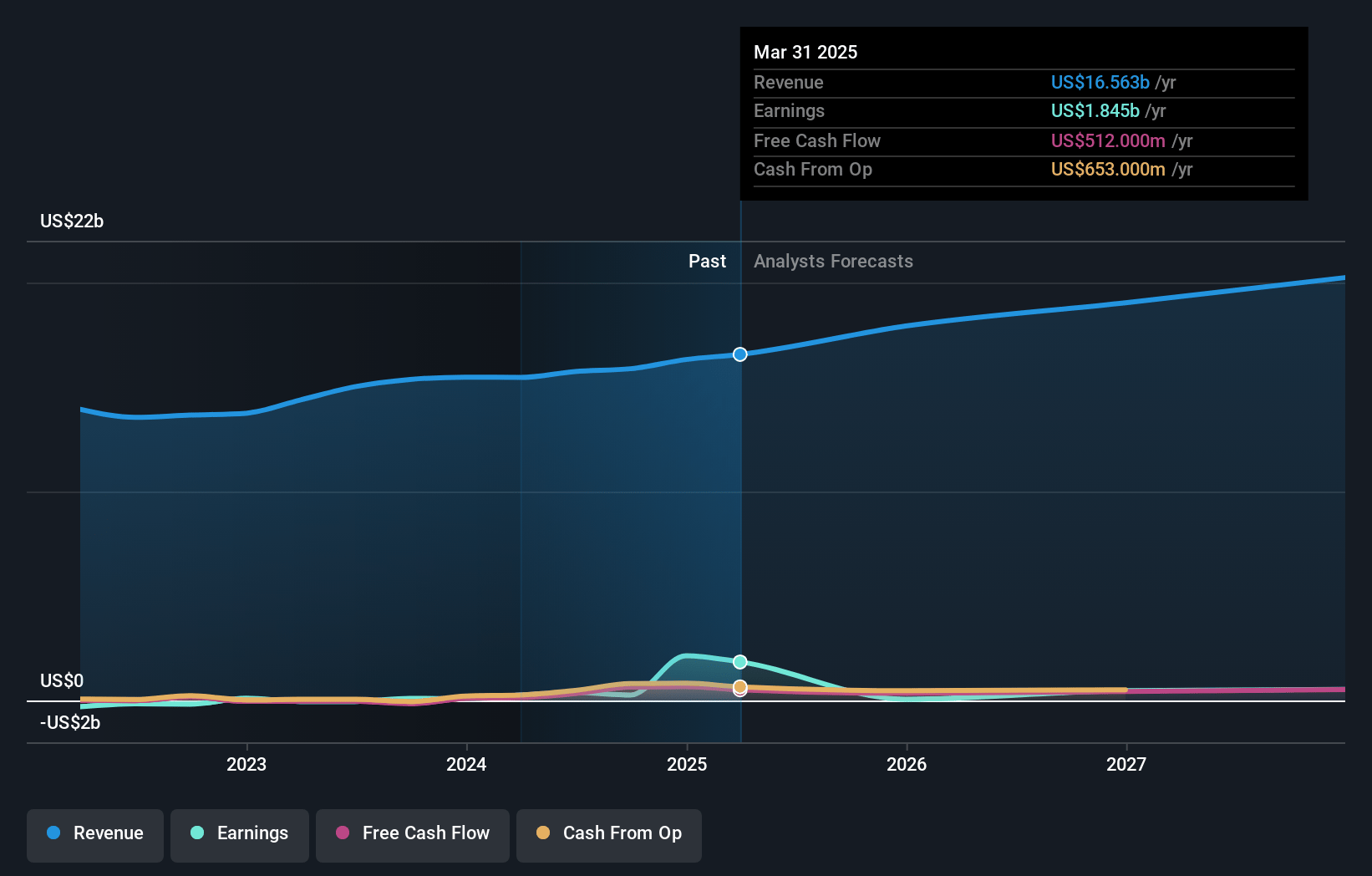

Fluor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fluor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fluor's revenue will grow by 9.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 13.1% today to 2.9% in 3 years time.

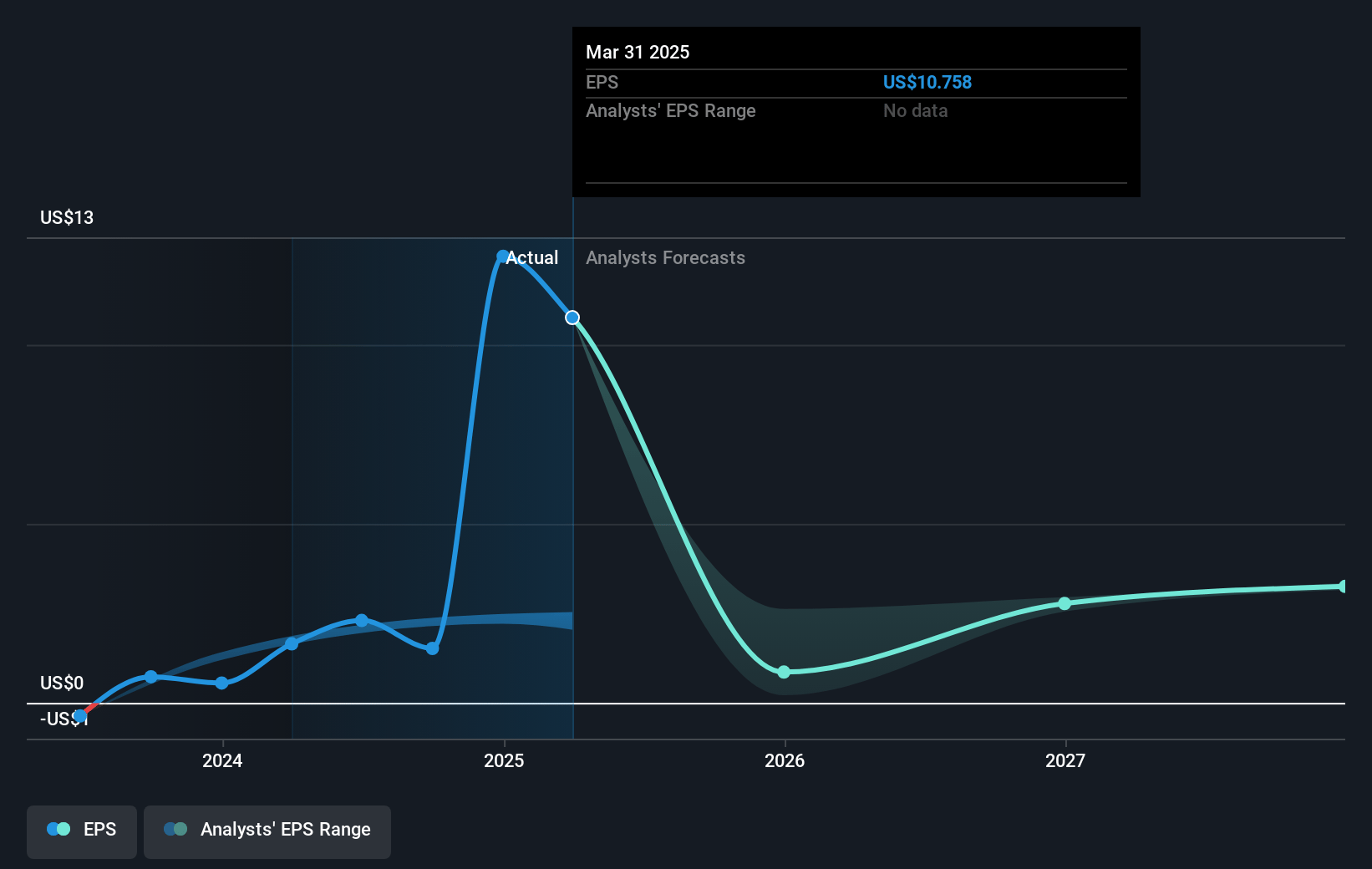

- The bullish analysts expect earnings to reach $618.0 million (and earnings per share of $3.66) by about April 2028, down from $2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, up from 2.7x today. This future PE is lower than the current PE for the US Construction industry at 21.3x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Fluor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persisting legacy legal and cost overrun issues, such as the recent $116 million provision related to a jury verdict for an old infrastructure project, indicate that past fixed-price contract risks remain unresolved, which could continue to depress net margins and earnings.

- The Energy Solutions segment is experiencing a declining backlog, from $9.7 billion to $7.6 billion over the past year, while the timing of major new project awards is uncertain and likely dependent on client investment decisions, creating long-term volatility and limiting predictable revenue growth.

- As the global transition accelerates away from fossil fuels, traditional oil and gas EPC work—a historic revenue driver for Fluor—faces structural decline, threatening future revenues unless the company can quickly and effectively diversify into renewable, nuclear, and infrastructure markets.

- Increased industry focus on ESG and tightening regulatory requirements will likely drive up compliance and pre-construction costs, introduce more project delays, and reduce accessible project opportunities, thereby negatively impacting both revenue and segment margins over the long term.

- The rise of digitalization, automation, and AI in engineering and project management presents competitive risks; if Fluor fails to keep pace with more technologically advanced peers, it may experience margin pressure, lose bid competitiveness, and see its profitability erode over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fluor is $60.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fluor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $36.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $21.3 billion, earnings will come to $618.0 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 7.5%.

- Given the current share price of $33.88, the bullish analyst price target of $60.0 is 43.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:FLR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives