Narratives are currently in beta

Key Takeaways

- Strong market presence and government investment in India and the Middle East boost revenue growth prospects.

- R&D investments and product innovation in India support increased market share and revenue expansion.

- Heavy reliance on high-growth markets and pricing discipline may put revenue and earnings at risk amid potential market instability and pricing dynamics.

Catalysts

About ESAB- Engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment.

- ESAB's strong presence and leadership in high-growth markets like India and the Middle East, alongside significant government infrastructure investments in these regions, are expected to drive substantial revenue growth in the coming years.

- The company's continued focus on commercial excellence initiatives is enhancing customer experiences and accelerating equipment sales, likely contributing to both top-line revenue growth and improved net margins through better pricing strategies.

- Strategic investments in R&D facilities in India and the emphasis on new product development, such as battery-driven products and advanced robotics, are expected to bolster revenue through innovative offerings and increased market share.

- The robust acquisition pipeline, particularly in faster-growing sectors like gas control, is expected to augment revenue streams and provide opportunities for margin expansion, leveraging synergies and scaling operations.

- Expansion of training programs to address the shortage of skilled labor, particularly in regions like India, aims to build a dedicated workforce familiar with ESAB's products, likely resulting in increased brand equity and sustained revenue growth.

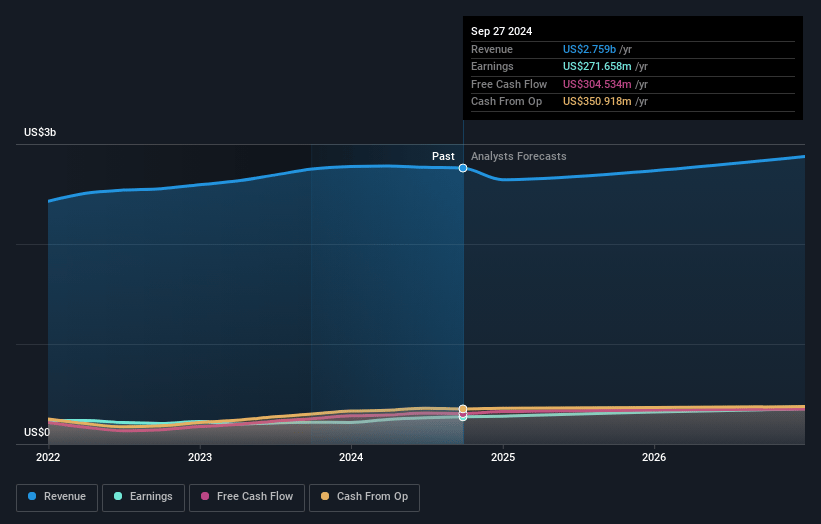

ESAB Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ESAB's revenue will decrease by 0.9% annually over the next 3 years.

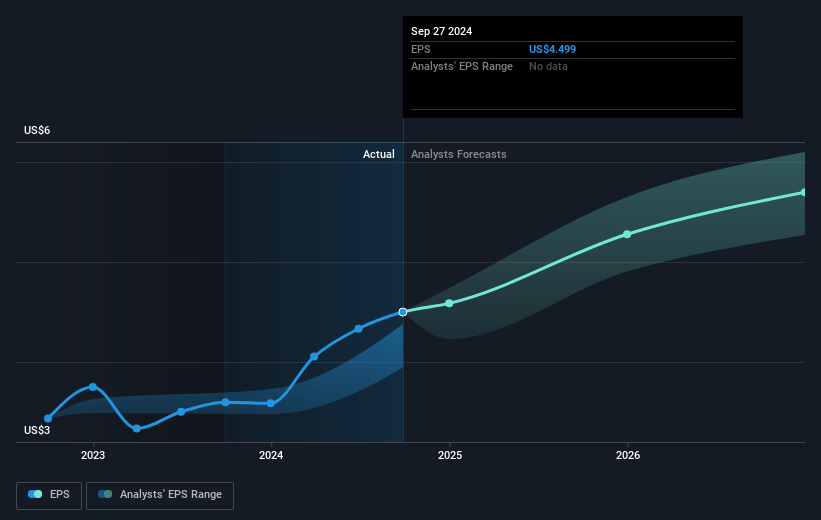

- Analysts assume that profit margins will increase from 9.8% today to 13.1% in 3 years time.

- Analysts expect earnings to reach $372.6 million (and earnings per share of $6.26) by about October 2027, up from $271.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.1x on those 2027 earnings, down from 27.9x today. This future PE is greater than the current PE for the US Machinery industry at 21.3x.

- Analysts expect the number of shares outstanding to decline by 0.48% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

ESAB Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ESAB's growth strategy heavily depends on high-growth markets such as India and the Middle East, where future economic or political instability could impact revenue projections and backlog fulfillment.

- The European market remains subdued, with sectors like automotive and yellow goods down, which could continue to exert pressure on revenue if these markets don't recover or if ESAB fails to gain further market share.

- In North America, equipment volume growth faces challenges due to sluggish channel uptake and broader macroeconomic conditions, which might affect revenue stability and market share.

- Despite advancements in automation and digital marketing, ESAB faces increasing competition and the need to continually innovate, which could strain R&D expenditures and affect net margins if not managed effectively.

- ESAB's dependency on achieving significant price discipline and net pricing improvements amidst fluctuating costs could put earnings at risk if global pricing dynamics shift unfavorably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $119.44 for ESAB based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $102.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.8 billion, earnings will come to $372.6 million, and it would be trading on a PE ratio of 23.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $125.53, the analyst's price target of $119.44 is 5.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives