Key Takeaways

- Alignment with global nuclear investment and defense modernization trends positions Curtiss-Wright for accelerated, recurring growth through major infrastructure projects and expanding military sales.

- Technology advancement, strategic acquisitions, and robust order backlog underpin margin expansion, new program wins, and sustained growth in earnings and free cash flow.

- Heavy reliance on defense and fossil fuel sectors, slow adaptation to new technologies, and global policy shifts threaten Curtiss-Wright’s long-term growth and operating margins.

Catalysts

About Curtiss-Wright- Provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide.

- Major policy shifts toward energy security and decarbonization worldwide, including pro-nuclear stances in the U.S. and Europe, are expected to drive an unprecedented wave of investment in nuclear power infrastructure. Curtiss-Wright’s alignment with leading reactor and SMR projects positions the company to grow its nuclear business fivefold by the middle of the next decade, which would transform recurring revenues and accelerate long-term sales and earnings growth.

- Escalating global defense budgets and sustained modernization programs across NATO and allied nations are boosting foreign military sales, particularly in ground and air defense platforms. Curtiss-Wright’s unique systems capabilities and entrenched relationships with major suppliers and governments position it for continued double-digit growth in foreign military sales, expanding top-line revenue and providing multi-year earnings visibility.

- Curtiss-Wright’s commitment to advancing mission-critical electronics, embedded computing, and actuation technologies is driving competitive differentiation, enabling sustained growth in high-margin defense electronics. This technology leadership is expected to produce new program wins, higher-value content per platform, and ongoing net margin expansion, reinforcing strong operating income growth relative to revenue.

- Strategic acquisitions such as Ultra Energy expand Curtiss-Wright’s global manufacturing footprint, deepen its portfolio in nuclear and defense electronics, and open doors to high-growth regions and new customer sets. Synergies from these acquisitions are expected to drive both immediate revenue contribution and future margin accretion, accelerating long-term EPS and free cash flow growth.

- Record backlog and order growth—underpinned by robust demand across defense and commercial nuclear markets—offer clear multi-year visibility, creating a solid foundation for the company’s pivot to growth strategy. Strong order momentum, ongoing operational excellence, and incremental R&D investments are expected to drive sustained double-digit EPS growth and operating margin expansion beyond 18 percent, supporting bullish projections for free cash flow and shareholder returns.

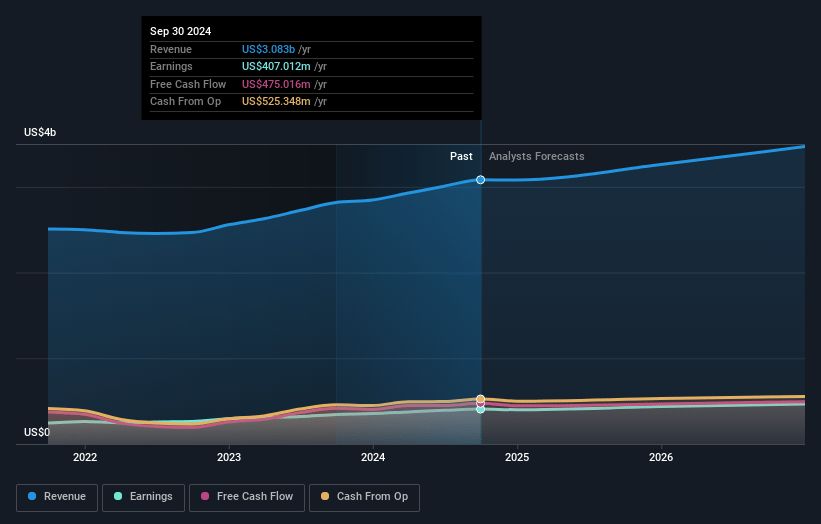

Curtiss-Wright Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Curtiss-Wright compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Curtiss-Wright's revenue will grow by 8.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.0% today to 13.8% in 3 years time.

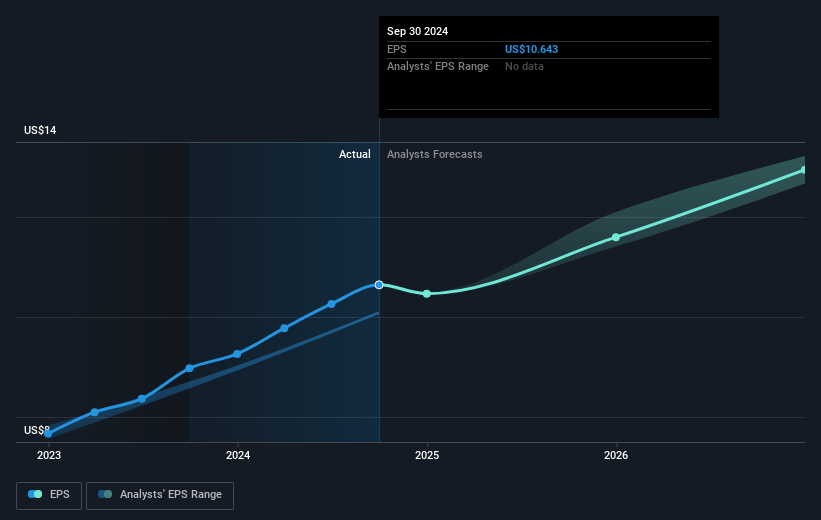

- The bullish analysts expect earnings to reach $556.7 million (and earnings per share of $14.85) by about April 2028, up from $405.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.6x on those 2028 earnings, up from 29.6x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 31.1x.

- Analysts expect the number of shares outstanding to decline by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

Curtiss-Wright Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Curtiss-Wright’s heavy reliance on large, multi-year defense and nuclear contracts exposes the company to volatility from shifting government spending priorities, anti-war sentiment, and potential caps or cuts to defense budgets, which could significantly impact future revenue and order growth.

- The company’s continued expansion and investments in traditional nuclear and fossil fuel-related businesses may put it at odds with accelerating global energy transition policies, potentially resulting in shifting R&D funding, market share loss, or stricter regulations, ultimately constraining long-term growth and compressing net margins.

- Curtiss-Wright’s longstanding business model, focused on manufacturing for select defense and commercial nuclear customers, faces long-term risks from increased automation, digitalization, and the rise of advanced competitors utilizing new technologies, potentially necessitating heavy and costly investments to avoid operational obsolescence and future earnings decline.

- Supply chain security concerns, reshoring pressures, and rising tariffs introduce new uncertainties and compliance costs to Curtiss-Wright’s defense and industrial operations, creating risks for profitability, particularly through increased operating costs and margin pressures.

- Structural declines in legacy sectors, such as commercial nuclear power, and the risk of delayed innovation or inability to adapt to advances in areas like unmanned systems, AI, and SMR (small modular reactor) technology could erode the company’s market share, reduce backlog quality, and weigh on company-wide revenue growth and earnings over the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Curtiss-Wright is $432.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Curtiss-Wright's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $432.0, and the most bearish reporting a price target of just $308.11.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $556.7 million, and it would be trading on a PE ratio of 32.6x, assuming you use a discount rate of 6.3%.

- Given the current share price of $318.48, the bullish analyst price target of $432.0 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:CW. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.