Last Update06 Aug 25

With no changes in the discount rate (8.10%) or net profit margin (15.15%), the consensus analyst price target for CSW Industrials remained steady at $294.67.

What's in the News

- CSW Industrials, Inc. has been removed from the Nasdaq Composite Index.

- The company completed a share repurchase of 20,045 shares (0.12% of shares outstanding) for $6.78 million under its 2025 buyback program.

- CSW Industrials, Inc. is expected to report Q1 2026 results on July 31, 2025.

Valuation Changes

Summary of Valuation Changes for CSW Industrials

- The Consensus Analyst Price Target remained effectively unchanged, at $294.67.

- The Discount Rate for CSW Industrials remained effectively unchanged, at 8.10%.

- The Net Profit Margin for CSW Industrials remained effectively unchanged, at 15.15%.

Key Takeaways

- Enhanced product offerings and strategic acquisitions position CSWI to benefit from regulatory trends and recurring demand in HVAC and infrastructure markets.

- Operational efficiencies and labor-saving innovations are driving margin improvement, pricing power, and long-term organic and inorganic growth.

- Heavy acquisition reliance, margin pressures, and end-market concentration expose the company to ongoing growth volatility, profit risks, and potential market share loss amid industry shifts.

Catalysts

About CSW Industrials- Provides various industrial products in the United States and internationally.

- Growing regulatory drivers around building efficiency, indoor air quality, and refrigerant standards (e.g., American Innovation and Manufacturing Act) are accelerating HVAC maintenance and compliance retrofits; CSWI's strengthened value-added product portfolio and recent acquisitions (like Aspen) directly position the company to capture increased demand, supporting higher revenue growth and potential share gains going forward.

- Sustained U.S. infrastructure upgrading and urbanization continues to expand the base of aging buildings needing renovation and maintenance, which underpins long-lived, recurring demand for CSWI's consumables and specialty construction products, creating a stable and expanding revenue base with visibility for long-term earnings growth.

- Strategic focus on M&A and integration of high-growth, innovative brands has driven robust inorganic growth (+17% revenue YoY) and expanded CSWI's addressable market; as acquired brands are fully integrated into CSWI's distribution channels, cross-selling and footprint optimization are expected to drive organic growth and lift EBITDA margins over the coming years.

- Investments in automation, operational efficiency, and domestic manufacturing (e.g., supply chain shifts out of China, consolidation of production facilities, U.S.-based Aspen acquisition) are expected to mitigate margin volatility from tariffs, reduce cost of goods sold, and enable better pricing power, supporting margin improvement and enhanced free cash flow longer term.

- Rising labor costs and skilled trade shortage trends are reinforcing market adoption of CSWI's innovative, labor-saving HVAC and building solutions; this secular shift strengthens pricing power and net margins, enabling CSWI to outperform as value-added product uptake increases across end-markets.

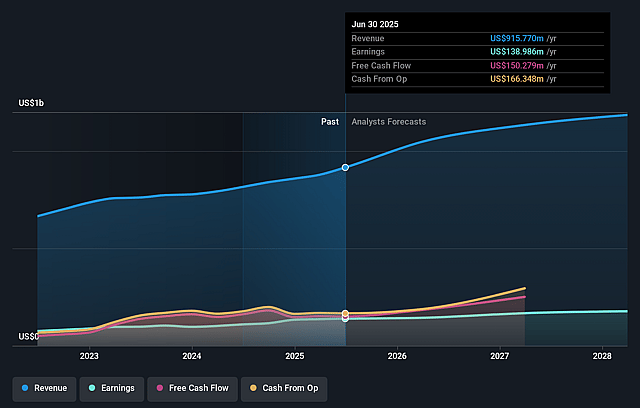

CSW Industrials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CSW Industrials's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.2% today to 14.6% in 3 years time.

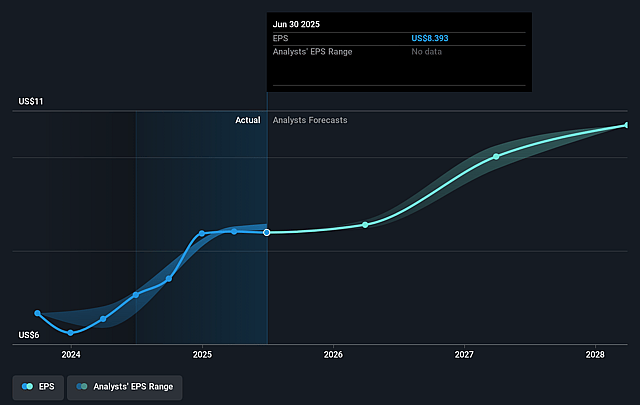

- Analysts expect earnings to reach $183.2 million (and earnings per share of $10.52) by about August 2028, up from $139.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.6x on those 2028 earnings, up from 32.1x today. This future PE is greater than the current PE for the US Building industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

CSW Industrials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on inorganic revenue growth through recent acquisitions masks a 2.8–4.6% organic revenue decline in the core Contractor Solutions business, indicating vulnerability in underlying end-market demand that could weigh on future topline growth if acquisition opportunities slow. (Impacts: revenue, earnings stability)

- EBITDA margin contraction of 280 basis points year-over-year, primarily due to input cost inflation (notably from tariffs and trade policy), margin-dilutive acquisitions (Aspen's lower margins), and unfavorable sales mix-if these pressures persist or intensify, long-term net margins could remain under pressure. (Impacts: net margins, EBITDA)

- CSWI's end-market exposure remains heavily concentrated in U.S. residential HVAC and construction; protracted weakness in new housing starts, existing home sales, and a consumer shift from replacement to repair may result in ongoing revenue volatility and constrain organic earnings growth. (Impacts: revenue, earnings)

- Supply chain complexities-including continued (albeit reduced) exposure to China and broader Asian sourcing, plus evolving tariff regimes-pose persistent risks of cost inflation, inventory build-up, and profit compression, especially in an environment of geopolitical uncertainty or further trade policy escalation. (Impacts: cost of goods sold, gross margins)

- Increased competition from alternative, eco-friendly building materials and tightening environmental regulations could disrupt demand for traditional CSWI products, requiring accelerated investment and adaptation or risking loss of market share over the long term. (Impacts: long-term sales, market share, R&D expenses)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $294.667 for CSW Industrials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $340.0, and the most bearish reporting a price target of just $269.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $183.2 million, and it would be trading on a PE ratio of 40.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $265.91, the analyst price target of $294.67 is 9.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.