Key Takeaways

- Investment in precision agriculture, automation, and sustainability positions CNH to capitalize on digitalization trends and secular demand in farming and construction.

- Cost reductions, supply chain optimization, and new product launches enable margin expansion, improved cash flow, and above-peer market share as industry volumes recover.

- Shifting industry trends, technological lag, rising costs, and evolving compliance demands threaten CNH Industrial’s traditional business model, market share, and profit stability.

Catalysts

About CNH Industrial- An equipment and services company, engages in the design, production, marketing, sale, and financing of agricultural and construction equipment in North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

- CNH’s heavy investment in precision agriculture and autonomous solutions, including expanding in-house precision components and leveraging the strengths from the Raven Industries acquisition, positions the company to capture a greater share of the rapidly growing market for digitally enabled equipment, supporting higher margins, better pricing power, and secular long-term revenue growth as global farming increasingly adopts data-driven solutions.

- Ongoing global food demand and population growth are set to drive sustained underlying demand for CNH’s advanced agriculture and construction machinery, regardless of short-term commodity cycles, supporting a robust topline recovery and long-term revenue expansion as industry volumes normalize.

- Structural cost reductions and supply chain optimization, including over $600 million in run-rate savings and a multi-phase procurement program just beginning to contribute, position CNH for significant margin expansion and improved cash flow conversion as volumes recover and warranty costs normalize in the coming upcycle.

- A strategy of disciplined inventory management and channel destocking, matched with upcoming launches of a fully renewed tractor lineup and enhanced quality initiatives, sets CNH up to gain market share when industry demand rebounds and increases the likelihood of above-peer margin strength and earnings growth as new products come to market.

- Heightened environmental regulations and the shift toward sustainable, lower-emission equipment globally create opportunities for CNH to expand its differentiated eco-friendly portfolio, driving higher value product mix, stronger aftermarket revenues, and net earnings growth as electrification and climate-driven investment in agriculture and construction accelerate worldwide.

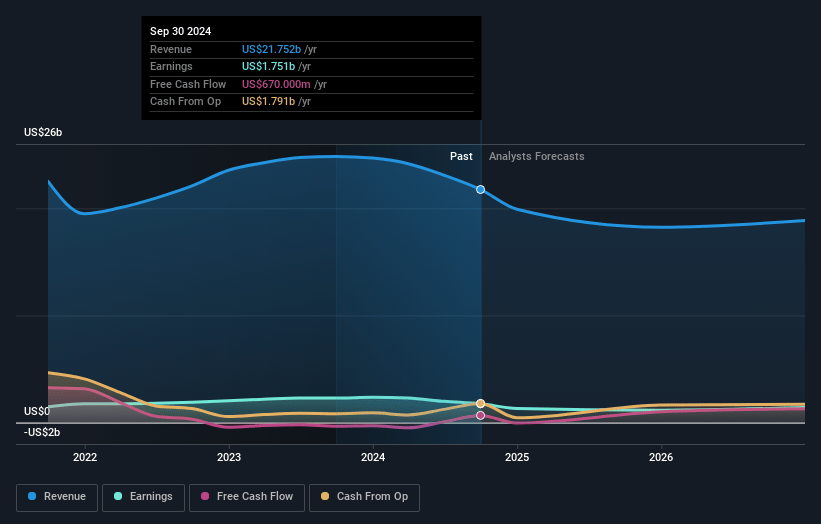

CNH Industrial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on CNH Industrial compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming CNH Industrial's revenue will decrease by 0.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.3% today to 8.5% in 3 years time.

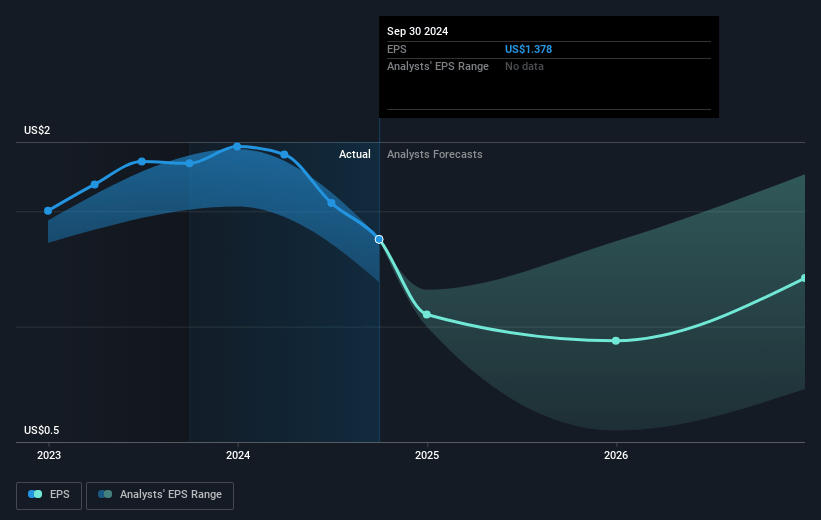

- The bullish analysts expect earnings to reach $1.7 billion (and earnings per share of $1.65) by about April 2028, up from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, up from 11.3x today. This future PE is lower than the current PE for the US Machinery industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.01%, as per the Simply Wall St company report.

CNH Industrial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift toward sustainable and regenerative agriculture, such as increased adoption of vertical farming or alternative proteins, may reduce the long-term demand for conventional large-scale machinery, negatively affecting CNH Industrial’s long-term revenue growth and addressable market.

- CNH Industrial's underinvestment or slower pace relative to competitors in areas like autonomous and precision agriculture technology could result in permanent loss of market share, constraining future revenue and EBIT margin expansion.

- Persistent global supply chain de-globalization, new tariffs, and regionalization trends may increase CNH Industrial’s operating costs and erode its manufacturing and distribution efficiency, putting pressure on net margins and cash flow.

- The company’s high reliance on cyclical agriculture and construction markets, combined with a continued high fixed cost structure, exposes CNH Industrial to pronounced earnings volatility and limits its ability to improve net margin stability during industry downturns.

- The rise of equipment-as-a-service models and stricter emissions standards could reduce traditional machinery sales volumes and increase compliance costs, challenging CNH Industrial’s existing sales strategies and placing sustained pressure on both revenue and net profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for CNH Industrial is $19.24, which represents two standard deviations above the consensus price target of $14.26. This valuation is based on what can be assumed as the expectations of CNH Industrial's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $20.3 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 13.0%.

- Given the current share price of $11.28, the bullish analyst price target of $19.24 is 41.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:CNH. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.