Narratives are currently in beta

Key Takeaways

- Cummins is poised for growth through sustainable product innovations and aligning with global trends toward environmentally friendly and zero-emissions technologies.

- Strong demand in power generation and medium-duty truck markets positions Cummins for sustained revenue growth and margin expansion.

- Weakening demand in multiple markets and reduced guidance signal potential revenue and earnings challenges for Cummins.

Catalysts

About Cummins- Designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide.

- Cummins has initiated full production of its X15N natural gas engine, which could drive future growth by meeting the demand for environmentally friendly alternatives. This is likely to impact Cummins' revenue positively as more fleets adopt this technology for decarbonization.

- The opening of the Accelera by Cummins electrolyzer manufacturing plant in Spain, with the potential to significantly scale production, indicates future revenue growth through increased production and sales of zero emissions technologies, aligning with global trends toward cleaner energy.

- Strength in the Power Systems segment, driven by robust demand in power generation markets, particularly for data centers, suggests potential for revenue and margin expansion, given Cummins' ongoing capacity enhancements and strategic pricing efforts.

- Cummins' medium-duty truck market strength, evidenced by increased sales despite broader market challenges, could lead to sustained revenue growth, supported by the high demand for medium-duty applications.

- The launch of the new 15-liter HELM engine platform, scheduled before 2027 emissions regulations, aims to capitalize on pre-buy behavior and early adoption. This strategic move could result in increased market share and revenue, along with improved net margins from higher efficiency engines.

Cummins Future Earnings and Revenue Growth

Assumptions

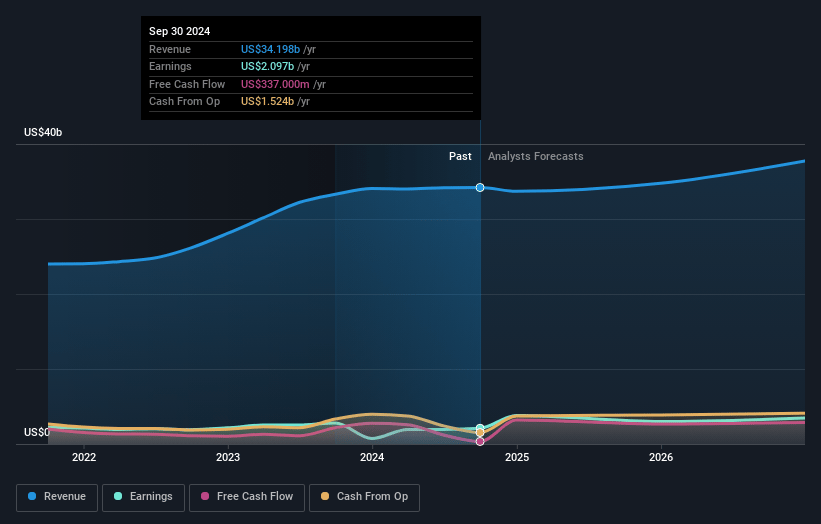

How have these above catalysts been quantified?- Analysts are assuming Cummins's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.1% today to 9.1% in 3 years time.

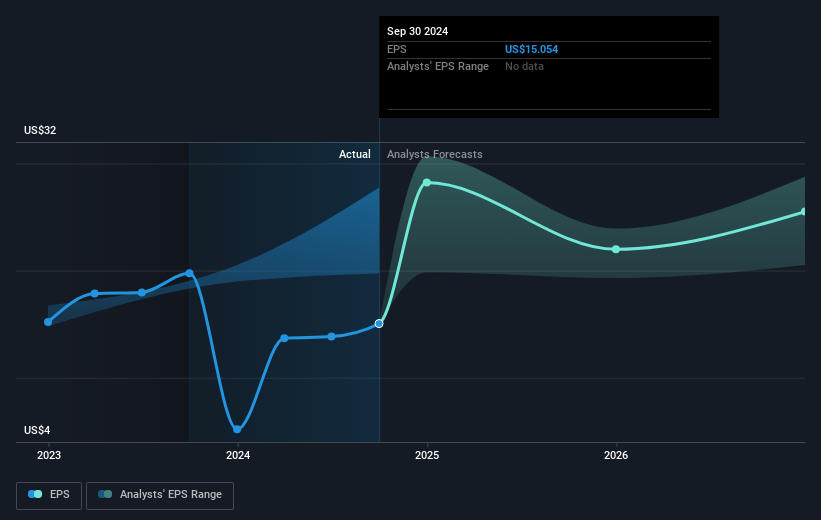

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $24.84) by about November 2027, up from $2.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.9 billion in earnings, and the most bearish expecting $2.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.5x on those 2027 earnings, down from 24.0x today. This future PE is lower than the current PE for the US Machinery industry at 24.6x.

- Analysts expect the number of shares outstanding to decline by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.1%, as per the Simply Wall St company report.

Cummins Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demand in the North American heavy-duty truck market is softening, with expected further declines in the fourth quarter, which could negatively impact future revenue.

- Sales in North America decreased 1% year-over-year, with a decline in heavy-duty and light-duty truck volumes, impacting both revenue and net margins.

- There is a reduction in guidance for Components, with a projected revenue decline of 12% to 15% for 2024, due in part to the separation of Atmus and hurricane disruptions, which could affect earnings.

- Weak demand in China’s truck market, especially for domestic diesel trucks, poses a risk and could lead to decreased revenue from this region.

- India’s revenue decreased 12% year-over-year, driven by a slowdown in manufacturing and government infrastructure spending, which could impact revenue and net earnings from this market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $355.28 for Cummins based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $436.0, and the most bearish reporting a price target of just $275.32.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $36.9 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 7.1%.

- Given the current share price of $366.34, the analyst's price target of $355.28 is 3.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives