Key Takeaways

- Carrier's innovation in sustainable energy and data center solutions is poised to capture growing demand, boosting future revenue and market share.

- Operational efficiencies and strategic acquisitions, like the Viessmann acquisition, are set to enhance margins, strengthen revenue streams, and improve profitability.

- Challenges in specific regions, tariff risks, and currency headwinds threaten Carrier Global's revenue and profitability, alongside underperformance in certain business segments.

Catalysts

About Carrier Global- Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

- Carrier's introduction of differentiated products, such as air-cooled commercial heat pumps and the integration of HEMS technology with Google Cloud's AI, positions them to capture the growing demand for sustainable and smart energy solutions, potentially driving future revenue growth.

- The company's strong performance in the aftermarket space, with double-digit growth and increased attachment rates on chillers, is expected to bolster net margins through high-margin service offerings and customer retention.

- Carrier's strategic expansion into the data center cooling market, including the development of integrated quantum leap cooling systems, sets the stage for substantial future earnings growth through an increase in market share and capitalizing on the high-demand sector.

- The company's efforts in operational efficiency, such as using Carrier Excellence to enhance productivity and mitigate tariff impacts through cost containment and supply chain adjustments, are likely to support margin expansion and improved earnings per share.

- Projected strong growth across residential and commercial HVAC segments in Europe, supported by favorable government climate goals and subsidies, alongside cost synergies from the Viessmann acquisition, are positioned to enhance Carrier's revenue streams and profitability.

Carrier Global Future Earnings and Revenue Growth

Assumptions

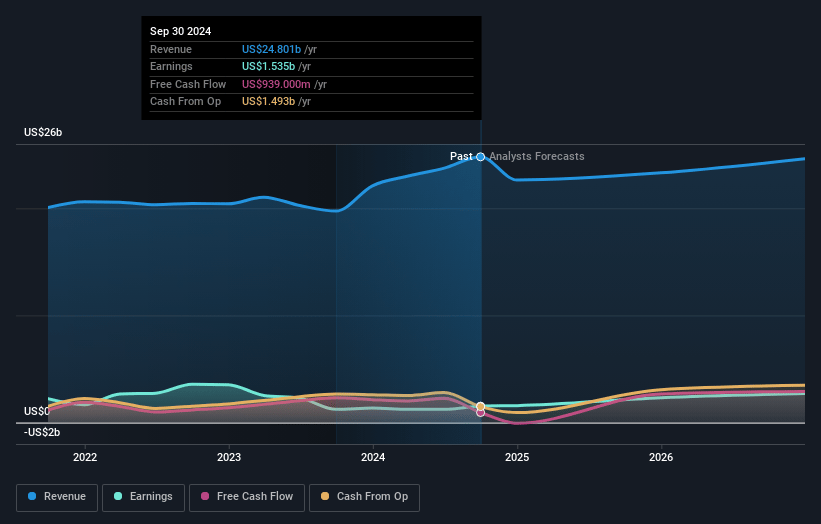

How have these above catalysts been quantified?- Analysts are assuming Carrier Global's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 10.4% in 3 years time.

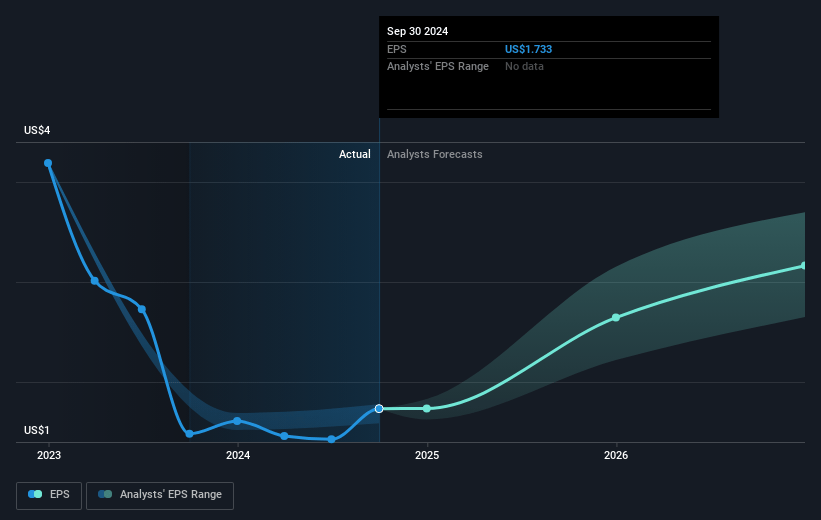

- Analysts expect earnings to reach $2.7 billion (and earnings per share of $3.34) by about May 2028, up from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, down from 44.8x today. This future PE is greater than the current PE for the US Building industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 4.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Carrier Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The CSA segment's organic sales were partially offset by weaker performance in Climate Solutions Asia, Middle East, and Africa, indicating potential challenges in these regions which could undermine revenue growth.

- The light commercial business experienced a sharper decline than expected, primarily due to softer demand in small and medium businesses and delayed K-12 funding, potentially affecting total revenues.

- The exposure to tariffs, especially the remaining $300 million unmitigated, poses a risk that could impact net margins if pricing strategies fail to compensate fully.

- Despite overall positive results, foreign currency headwinds negatively impacted growth by approximately 1%, suggesting that exchange rate fluctuations could affect earnings.

- The European segment's low operating margin of 9% and legacy RLC business performance challenges pose risks to achieving planned margin improvements, potentially affecting overall profitability and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $77.398 for Carrier Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.12, and the most bearish reporting a price target of just $56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $26.0 billion, earnings will come to $2.7 billion, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of $70.19, the analyst price target of $77.4 is 9.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.