Narratives are currently in beta

Key Takeaways

- Growth in the Architectural Specialties segment and transportation projects is driving strong revenue and earnings growth, supported by federal funding.

- Focus on energy efficiency and sustainability, alongside manufacturing efficiency and strategic reinvestment, is enhancing margins and long-term profitability.

- Continued uncertainty in renovation and potential inflation in raw materials pose risks to revenue and margin growth for Armstrong World Industries.

Catalysts

About Armstrong World Industries- Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

- Armstrong World Industries is seeing significant growth in its Architectural Specialties segment, driven by recent acquisitions and activities in the transportation vertical, particularly with large airport projects. This is expected to drive stronger revenue and earnings growth in the future.

- The company is focused on energy efficiency and sustainability, including products like Templok energy-saving ceiling products, which are positioned to meet new building codes and standards. This focus is likely to support long-term revenue growth through increased demand for energy-efficient building solutions.

- Armstrong is seeing increased bidding activity turning into orders, supported by federal funding for transportation projects, providing a multiyear growth opportunity and a positive outlook for future revenue.

- Manufacturing productivity improvements are running ahead of targets, leading to expanded margins. Continued emphasis on improving plant efficiency is expected to further enhance net margins and profitability.

- Armstrong maintains a strong capital allocation strategy, supported by consistent free cash flow. This strategy includes reinvestment in the business and acquisitions, which are expected to enhance earnings growth over time.

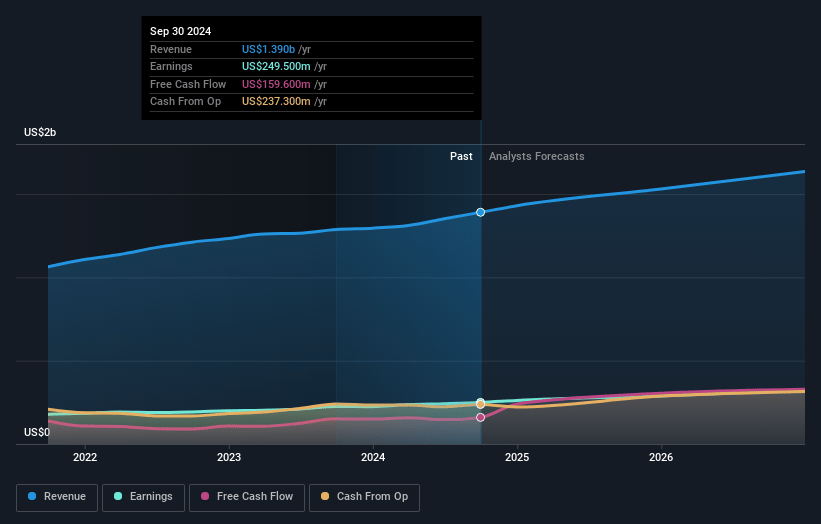

Armstrong World Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Armstrong World Industries's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.9% today to 20.3% in 3 years time.

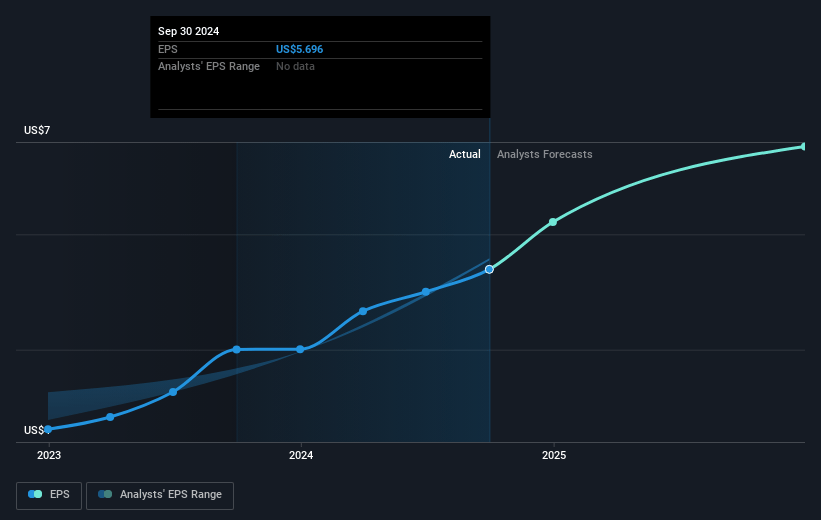

- Analysts expect earnings to reach $349.0 million (and earnings per share of $8.4) by about November 2027, up from $249.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.8x on those 2027 earnings, down from 26.8x today. This future PE is lower than the current PE for the US Building industry at 22.2x.

- Analysts expect the number of shares outstanding to decline by 1.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.38%, as per the Simply Wall St company report.

Armstrong World Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued uncertainty in renovation activity, particularly in the commercial office market, could pose a risk to revenue growth expectations for Armstrong World Industries.

- The potential inflation in raw materials in 2025, despite recent deflation in input costs like energy and freight, could impact net margins if not managed effectively.

- The emphasis on energy-saving ceiling products might not yield substantial immediate revenue contributions, affecting overall growth projections in the short term.

- External factors, such as slow discretionary renovation work and stabilization in market conditions, may lead to slower-than-expected volume growth in key segments, affecting earnings projections.

- Challenges or execution issues related to recent acquisitions like 3form and BOK Modern might impact the expected value and anticipated earnings from the Architectural Specialties segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $149.75 for Armstrong World Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.7 billion, earnings will come to $349.0 million, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $153.67, the analyst's price target of $149.75 is 2.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives