Last Update 20 Sep 25

Fair value Increased 2.16%Global Emissions Trends Will Drive Advanced Filtration Demand

Atmus Filtration Technologies’ consensus price target was raised from $46.20 to $47.20 as analysts cited strong execution, record Q2 performance, and increased 2025 guidance, underscoring resilience and reinforced multi-year growth prospects.

Analyst Commentary

- Bullish analysts note strong execution from Atmus Filtration Technologies, even amid challenging demand conditions.

- Upward price target revisions are attributed to record Q2 results and a raised full-year 2025 guidance.

- Management engagement, including insights from the CFO, reassured analysts about ongoing multi-year growth initiatives.

- The company's ability to deliver stellar results despite awaiting broader market recovery underpins positive sentiment.

- Analysts emphasize a growing track record of outperformance and operational resilience.

What's in the News

- Quarterly dividend increased by 10% to $0.055 per common share.

- Earnings guidance for 2025 raised; revenue expected between $1,685 million and $1,735 million.

- Company is actively seeking M&A opportunities and balancing this with potential share repurchases, emphasizing growth via both organic and inorganic strategies.

- Completed repurchase of 1,329,110 shares (1.6% of share count) for $50.36 million under the announced buyback program.

- Added to multiple Russell value and defensive indices, including the Russell 2000, 2500, and 3000 series.

Valuation Changes

Summary of Valuation Changes for Atmus Filtration Technologies

- The Consensus Analyst Price Target has risen slightly from $46.20 to $47.20.

- The Future P/E for Atmus Filtration Technologies has risen slightly from 17.27x to 17.65x.

- The Discount Rate for Atmus Filtration Technologies remained effectively unchanged, moving only marginally from 8.33% to 8.35%.

Key Takeaways

- Accelerating environmental regulations and industrial modernization are fueling recurring demand, margin expansion, and broader market opportunities for Atmus through advanced filtration solutions and OEM partnerships.

- Improved supply chain flexibility, expanding aftermarket and industrial presence, and investments in innovation position Atmus for sustainable earnings growth and stronger shareholder returns.

- Heavy reliance on legacy markets and key customers, combined with regulatory, structural, and market uncertainties, puts revenue growth and long-term profitability at significant risk.

Catalysts

About Atmus Filtration Technologies- Designs, manufactures, and sells filtration products under the Fleetguard brand in the United States and internationally.

- Intensifying global emissions and environmental regulations are driving OEMs to seek out advanced filtration solutions, positioning Atmus as a beneficiary of recurring demand; management's continued OEM partnership expansion and "first-fit" market share gains indicate a strong pipeline for future top-line growth and margin improvement as regulatory trends accelerate.

- Rising globalization of supply chains and increased freight/industrial activity are expanding the need for filtration solutions in logistics and transportation; with full control over its global distribution network and an expanding multi-channel aftermarket platform, Atmus is well-positioned to capture aftermarket revenue growth and realize higher gross margins due to its premium service and product breadth.

- The company's push into industrial filtration (beyond automotive)-both through disciplined M&A and organic new product launches-taps into the growing replacement and modernization needs of automated and digitized industrial environments, expanding the total addressable market and supporting both revenue growth and margin diversification.

- Successful transformation of the supply chain and operational separation from Cummins has unlocked flexibility, improved inventory/service levels, and reduced one-time costs, directly supporting improved free cash flow conversion and enabling more aggressive capital deployment for growth initiatives and shareholder returns (such as buybacks).

- Management's focus on higher-margin aftermarket segments, coupled with ongoing R&D investment into technologically advanced products, sets the stage for sustainable net margin expansion and more stable, recurring earnings, potentially reducing risk and warranting a higher valuation multiple as secular replacement and regulatory trends play out.

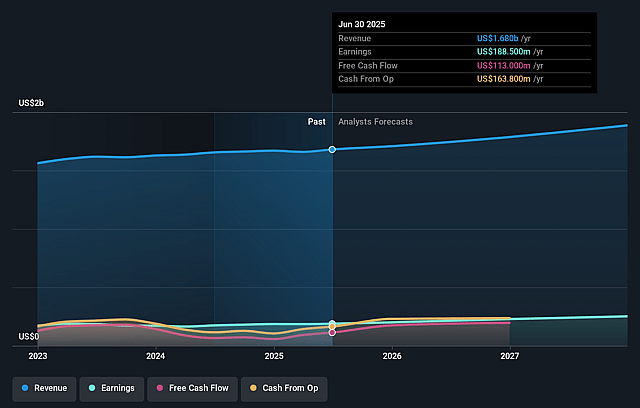

Atmus Filtration Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Atmus Filtration Technologies's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.2% today to 14.0% in 3 years time.

- Analysts expect earnings to reach $268.6 million (and earnings per share of $3.05) by about September 2028, up from $188.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 19.8x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 1.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.33%, as per the Simply Wall St company report.

Atmus Filtration Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lack of clarity surrounding regulatory emissions requirements and ongoing evolution of tariff policies are creating an uncertain economic backdrop and weak U.S. first-fit market, leading to expectations of a 15% to 25% decline in this key segment and pressuring top-line revenue growth.

- High reliance on the aftermarket (86% of business) exposes Atmus to risk from structural trends such as decreasing replacement rates driven by longer-life engine designs and electrification, which may shrink the replacement aftermarket and negatively affect recurring revenue and gross margins.

- Continued operational and financial dependence on Cummins (as former parent and major customer/partner) poses concentration risk; loss or reduction of business from Cummins after full separation could result in significant revenue loss and margin pressure.

- Slow, modest progress in diversifying into industrial filtration markets-where organic growth contribution is currently minimal-means Atmus could be slow to adapt to long-term shifts away from internal combustion engines, threatening revenue growth and long-term product relevance.

- Volatile and evolving global tariffs, FX headwinds, and slow decision-making from OEM partners due to a complex trade and regulatory landscape create unpredictable input costs and pricing environments that may erode net profit margins and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.2 for Atmus Filtration Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $268.6 million, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $45.44, the analyst price target of $46.2 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.