Narratives are currently in beta

Key Takeaways

- Strategic initiatives in technology and predictive analytics could boost revenue through enhanced sales productivity and optimized resource allocation.

- Expansion into new facilities and investments in engineered solutions may drive higher margins and capitalize on growth in advanced robotics and machine vision.

- Mixed market demand and external disruptions challenge revenue stability, while rising SG&A expenses and financial uncertainties pressure margins and profitability.

Catalysts

About Applied Industrial Technologies- Distributes industrial motion, power, control, and automation technology solutions in the United States, Canada, Mexico, Australia, New Zealand, Singapore, and Costa Rica.

- Applied Industrial Technologies is focusing on strategic initiatives such as leveraging investments in technology and predictive analytics to enhance sales productivity, which could lead to increased revenue growth by optimizing resource allocation and improving customer engagement.

- The company is expanding into new facilities and investing in advanced tooling and machining capabilities in its Engineered Solutions segment, potentially driving higher margins and increased revenue by positioning itself in high-growth areas such as specialized robotics and machine vision.

- Applied Industrial Technologies is strategically targeting acquisitions and retaining a strong balance sheet, with nearly $2 billion in balance sheet capacity, enabling them to pursue both organic investments and accretive acquisitions which can enhance their earnings and expand their market reach.

- Investments in automation, robotics, and high-tech fluid power systems are positioning the company to capitalize on reshoring and infrastructure spending trends, potentially increasing their future revenue and enhancing their competitive advantage in an evolving industrial landscape.

- The company's focus on capital deployment through share buybacks and increasing dividends aligns with their confidence in future earnings growth by balancing reinvestment in the business with returning value to shareholders.

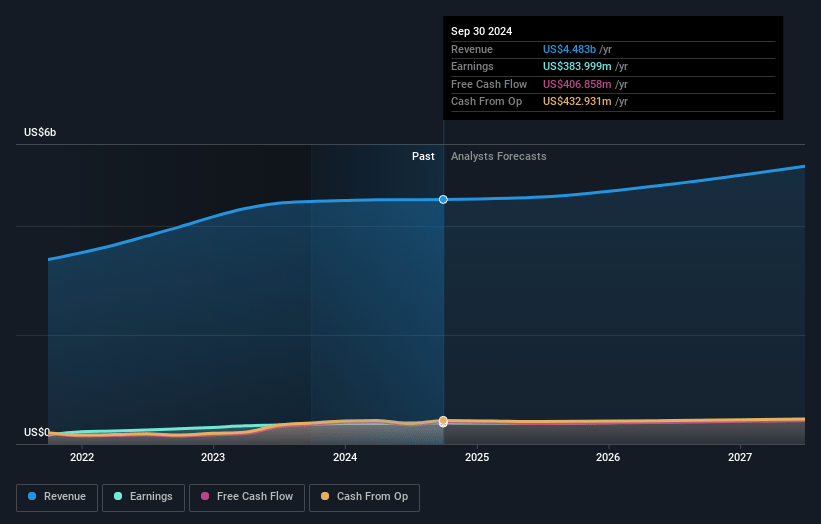

Applied Industrial Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Applied Industrial Technologies's revenue will grow by 4.0% annually over the next 3 years.

- Analysts are assuming Applied Industrial Technologies's profit margins will remain the same at 8.6% over the next 3 years.

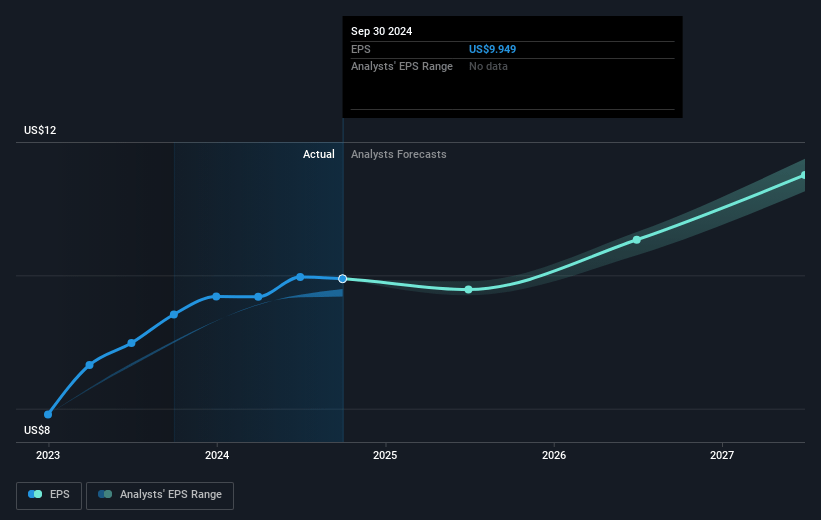

- Analysts expect earnings to reach $434.6 million (and earnings per share of $11.08) by about November 2027, up from $384.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.7x on those 2027 earnings, up from 27.2x today. This future PE is greater than the current PE for the US Trade Distributors industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 0.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Applied Industrial Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite positive September trends, organic daily sales declined by 3% over the prior year, reflecting mixed broader end market demand. This uncertainty in market demand could impact future revenues and organic growth.

- Sustained weakness in certain machinery end markets, such as fluid power mobile OEM customers, could contribute to lower sales in those segments, impacting overall revenue growth.

- The decline in sales through the early fiscal second quarter, compounded by potential disruptions from external factors like hurricanes and U.S. election uncertainties, poses a risk to maintaining stable revenues.

- Challenges in maintaining operating costs due to higher SG&A expenses and potential deleveraging with sales declines could impact net margins and bottom-line profitability.

- Although there has been positive order growth for automation and technology-focused fluid power customers, the reliance on potential easing of interest rates and U.S. election outcomes introduces financial uncertainties that could affect earnings and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $261.43 for Applied Industrial Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.0 billion, earnings will come to $434.6 million, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $271.62, the analyst's price target of $261.43 is 3.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives