Last Update 11 Dec 25

Fair value Increased 22%AGX: AI-Driven Gas Projects Will Support Backlog While Execution Risks Persist

Analysts have raised their price target on Argan to $361 from $295.75, citing the company’s unique leverage to growing combined cycle gas power generation demand, a deepening multi-year backlog, and expanding gas turbine pricing tailwinds that support a higher future earnings multiple, despite slightly tempered growth and margin assumptions.

Analyst Commentary

Bullish analysts emphasize that Argan’s role as a pure play contractor on combined cycle gas projects positions the company as a direct beneficiary of structurally higher power demand, particularly from artificial intelligence data centers. They point to a growing pipeline of large gas-fired projects and a record backlog as key supports for sustained revenue and earnings growth.

Recent price target increases, along with initiation at premium targets from major firms, reflect confidence that Argan’s earnings power and cash generation are still underappreciated in the current valuation. Analysts argue that the combination of robust project visibility, favorable gas turbine pricing, and disciplined balance sheet management can support a higher multiple over the medium term.

Bullish Takeaways

- Bullish analysts see Argan as a leading direct way to gain exposure to the combined cycle gas buildout, which they believe supports above-market growth and provides justification for higher long term valuation multiples.

- Multi year visibility from record backlog, including new large scale Texas gas projects, underpins forecasts for strong topline and EBITDA growth into 2027 and beyond.

- Favorable gas turbine pricing and Argan’s localized scale in high growth regions are expected to drive margin expansion and upside versus current Street estimates.

- Major firms such as Goldman and JPMorgan highlight the company’s strong balance sheet and exposure to AI driven power demand as catalysts for continued rerating and positive estimate revisions.

Bearish Takeaways

- Bearish analysts caution that Argan’s concentration in large gas generation projects could expose results to project timing risk and permitting or regulatory delays, adding volatility to quarterly execution.

- Staffing constraints and the need for regional cross staffing to deliver multiple large projects simultaneously could pressure execution quality and limit upside if workloads peak faster than expected.

- Expectations for 4 to 5 GW of annual capacity additions and sustained pricing tailwinds may prove optimistic if macro conditions soften or if alternative generation sources reclaim share.

- With the stock already reflecting higher growth and margin assumptions, any slip in backlog conversion or delays in new awards could lead to multiple compression from elevated valuation levels.

What's in the News

- Gemma Power Systems secured an EPC contract and full notice to proceed for an approximately 860 MW natural gas fired power plant in the ERCOT market. The full contract value is expected to be added to Argan's October 31, 2025 project backlog (Key Developments).

- Argan's subsidiary Gemma received full notice to proceed on the CPV Basin Ranch Energy Center in Ward County, Texas. This is a 1,350 MW 2 1x1 combined cycle plant using GE 7HA.03 turbines and designed with optional carbon capture capability, with construction starting this fall and completion targeted for 2028 (Key Developments).

- The CPV Basin Ranch project is positioned to deliver reliable, efficient and environmentally responsible power while reinforcing local grid infrastructure, supporting economic development and contributing to cleaner energy goals in the region (Key Developments).

- Management reiterated a focus on pursuing M&A opportunities that are additive or complementary to current capabilities or geographic reach. This will be pursued alongside disciplined risk management, improved project execution and organic growth as part of Argan's long term capital allocation strategy (Key Developments).

Valuation Changes

- Fair Value: Raised significantly to $361 from $295.75, reflecting higher expected earnings power and an expanded valuation range.

- Discount Rate: Edged down slightly from 8.40 percent to approximately 8.40 percent, providing a modest uplift to the discounted cash flow valuation.

- Revenue Growth: Trimmed slightly from about 16.15 percent to roughly 15.79 percent, indicating marginally more conservative top line expectations.

- Net Profit Margin: Reduced slightly from about 11.64 percent to approximately 11.49 percent, suggesting a modestly more cautious view on long term profitability.

- Future P/E: Increased meaningfully from 31.4x to about 39.5x, implying a higher expected earnings multiple despite the marginally lower growth and margin assumptions.

Key Takeaways

- Diversified project backlog and strong industry trends position Argan for multi-year revenue and margin growth, with expanded capabilities in energy, water, and recycling sectors.

- Robust financial health enables strategic investments and project execution advantages, supporting continued earnings growth and improved long-term profitability.

- Heavy dependence on large gas power projects and centralized infrastructure exposes Argan to significant risks from sector decarbonization, project volatility, and shifts in regulatory or market trends.

Catalysts

About Argan- Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

- The aging North American power infrastructure and rising electricity demand-driven by widespread electrification and the proliferation of AI data centers-are resulting in record project backlog and robust pipeline visibility for Argan. This is likely to drive sustained top-line revenue growth for several years.

- Strong secular investment momentum in grid modernization and the ongoing energy transition is accelerating the need for new construction of both natural gas-fired and renewable energy facilities. Argan's diversified capabilities position it to capitalize on this trend, potentially expanding its addressable market and supporting revenue growth.

- Record backlog and continued project wins across gas, renewables, water treatment, and recycling plants provide multi-year revenue visibility, indicating potential for increased operating leverage and higher gross margins as larger projects are executed successfully.

- Argan's reputation for on-time, on-budget project delivery and its expanded workforce enable it to handle more and larger projects than competitors, which is likely to support earnings growth and improve net margin stability over time.

- The company's strong balance sheet and consistently high net cash position allow it to pursue strategic M&A and invest in team expansion, enabling further scale and resilience, which can enhance earnings consistency and long-term profitability.

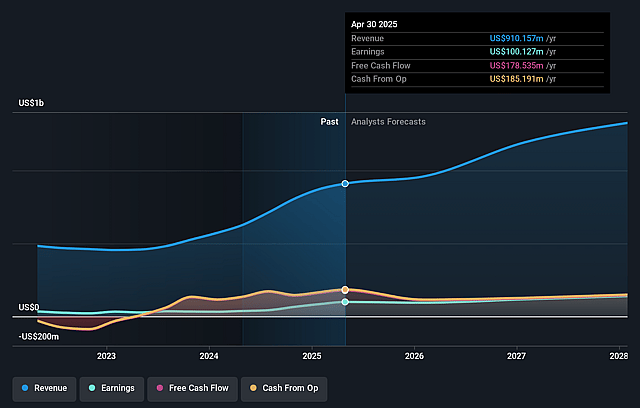

Argan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Argan's revenue will grow by 18.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.7% today to 9.4% in 3 years time.

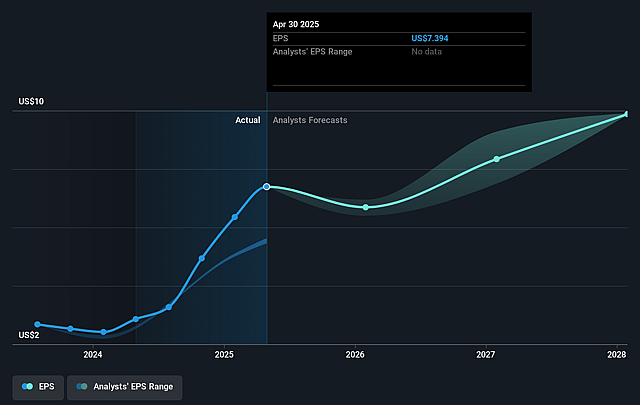

- Analysts expect earnings to reach $142.0 million (and earnings per share of $9.95) by about September 2028, up from $117.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from 25.6x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 2.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Argan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Argan's backlog is heavily weighted toward natural gas-fired projects (61%), and management expects this trend to continue, exposing the company to long-term risk if the energy sector accelerates its transition to renewables and shifts away from gas plants; this could reduce project opportunities and future revenue over time.

- The company relies on a relatively small universe of large, complex EPC (Engineering, Procurement, Construction) projects, meaning any major project delays, cost overruns, or cancellations could lead to significant variability or declines in quarterly and annual earnings and net margins.

- While gross margins have recently improved due to strong project execution, management notes the margins are "lumpy" and cautions that sustainability at current levels is uncertain, particularly if competitive pressures intensify or project execution challenges arise; this may introduce volatility or downward pressure on long-term profitability.

- Despite record backlog and current industry demand, Argan's growth is tied to the cyclical nature of infrastructure and power-plant spending, which depends on favorable macroeconomic and regulatory conditions; shifts in government budgets, permitting, or utility investment cycles could cause unpredictable swings in revenue and net income.

- Although Argan is expanding its workforce and capacity, its business model remains concentrated in large-scale centralized power projects; a secular trend toward distributed generation, modular energy solutions, or more rapid decarbonization efforts could erode its core markets and lead to long-run revenue declines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $230.333 for Argan based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $142.0 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $217.41, the analyst price target of $230.33 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Argan?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.