Key Takeaways

- Strategic focus on high-performance computing and aerospace sectors could significantly drive revenue growth and improve margins.

- Licensing agreements from patent cases may boost net margins with higher-margin income streams.

- Increased operating expenses, product delays, and legal challenges pose threats to revenue growth, net margins, and financial stability despite a favorable book-to-bill ratio.

Catalysts

About Vicor- Designs, develops, manufactures, and markets modular power components and power systems for converting electrical power in the United States, Europe, the Asia Pacific, and internationally.

- The successful ramp-up of Vicor's new ChiP fab, achieving short cycle times and high yield goals, will enhance manufacturing efficiency and customer responsiveness, potentially increasing revenue and improving net margins.

- The strategic focus on the high-performance computing market, particularly through the successful development and deployment of the second-generation VPD and Gen 5 VPD systems, may drive significant revenue growth as the AI and network processor markets expand.

- The growing aerospace and defense business, maintaining a double-digit growth trajectory, alongside new opportunities in the satellite market, will likely contribute to increasing revenues and possibly improve operating margins as these markets typically have higher entry barriers and less competition.

- The final determination by the ITC in Vicor’s first NBM patent infringement case has resulted in new licensing agreements, which are expected to increase royalty income and, consequently, boost net margins due to higher-margin income streams.

- The anticipated ramp-up in the automotive sector, through ongoing OEM and Tier 1 collaborations and progression to design win status, is expected to generate significant future revenue streams and contribute positively to operating income as production scales.

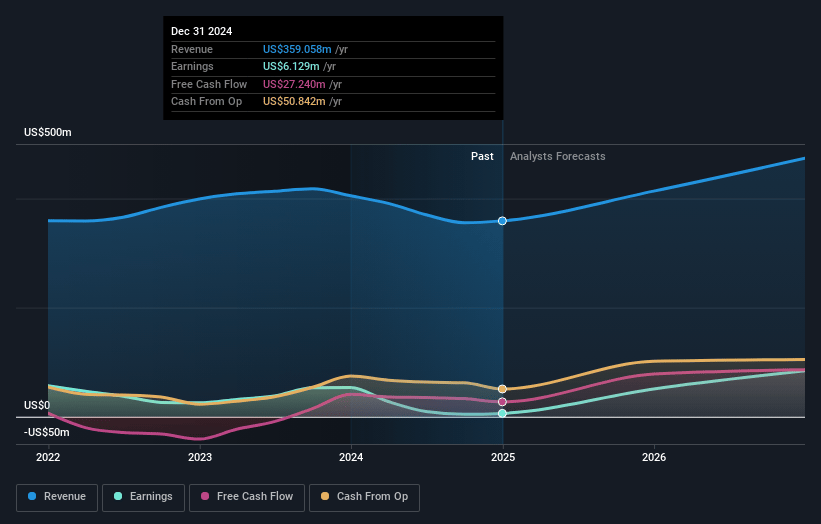

Vicor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vicor's revenue will grow by 14.5% annually over the next 3 years.

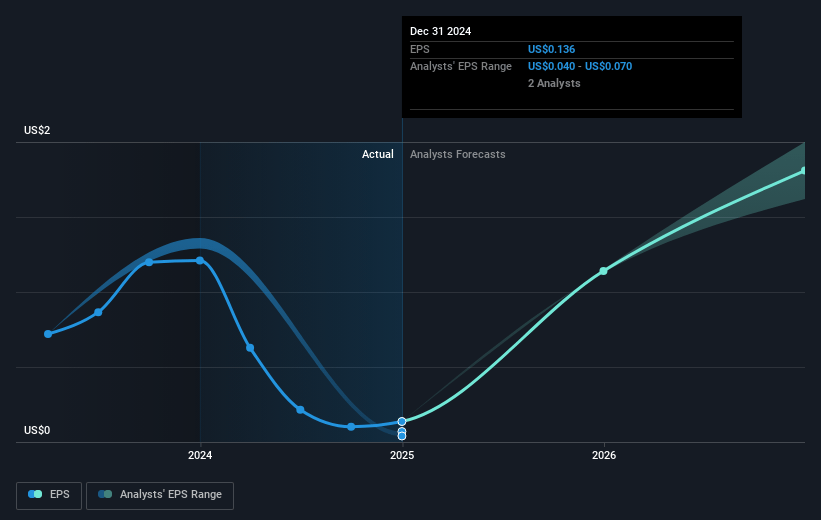

- Analysts assume that profit margins will increase from 1.7% today to 28.6% in 3 years time.

- Analysts expect earnings to reach $154.3 million (and earnings per share of $3.28) by about March 2028, up from $6.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.8x on those 2028 earnings, down from 360.8x today. This future PE is lower than the current PE for the US Electrical industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 1.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Vicor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenues for the year-ended December 31, 2024, decreased 11.4% compared to the prior year, indicating potential challenges in maintaining sales growth and affecting overall revenue.

- The operating expenses increased as a percentage of revenue, leading to an operating loss for the full year 2024; this could negatively impact net margins and earnings.

- Delays in delivering new high-density, high-bandwidth VPD systems and extended development times for next-gen products could hinder revenue growth from key customer segments, impacting future earnings.

- Despite a reported increase in the book-to-bill ratio, there is uncertainty in capitalizing on opportunities and resolving uncertainties, which could lead to unpredictable revenue and profit outcomes.

- Legal and IP-related challenges, including ongoing litigation to enforce patent rights, could result in significant costs and uncertainties, impacting net income and potentially affecting financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $60.0 for Vicor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $539.2 million, earnings will come to $154.3 million, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $48.94, the analyst price target of $60.0 is 18.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives