Key Takeaways

- Ultralife's focus on cost reduction and productivity improvements is expected to boost net margins significantly.

- Strategic acquisitions and new market expansions with innovative products aim to drive substantial revenue growth.

- Declining revenues, rising costs, potential military spending cuts, and supply chain issues threaten Ultralife's future revenue growth and margin stability.

Catalysts

About Ultralife- Designs, manufactures, installs, and maintains power, and communication and electronics systems worldwide.

- Ultralife's focus on material cost deflation is expected to result in future savings in the hundreds of thousands of dollars per year, potentially boosting net margins.

- Lean productivity improvements across facilities are anticipated to reduce waste and inefficiencies, leading to cost improvements of 2% to 3% in key areas, positively affecting net margins.

- The acquisition of Electrochem is seen as a synergistic opportunity to advance growth strategy and drive revenue growth through increased scale and manufacturing efficiencies.

- Expansion into new markets with transformational new products, such as EL8000 server cases and thin cell batteries, is expected to drive future revenue growth.

- The growing sales funnel in targeted markets such as medical, government, defense, and oil and gas sectors, supported by new product developments, is anticipated to enhance future earnings.

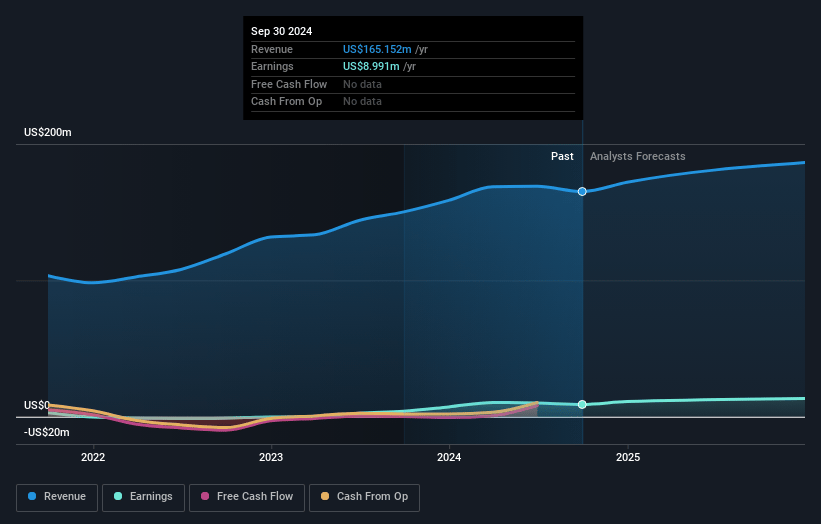

Ultralife Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ultralife's revenue will grow by 25.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 8.0% in 3 years time.

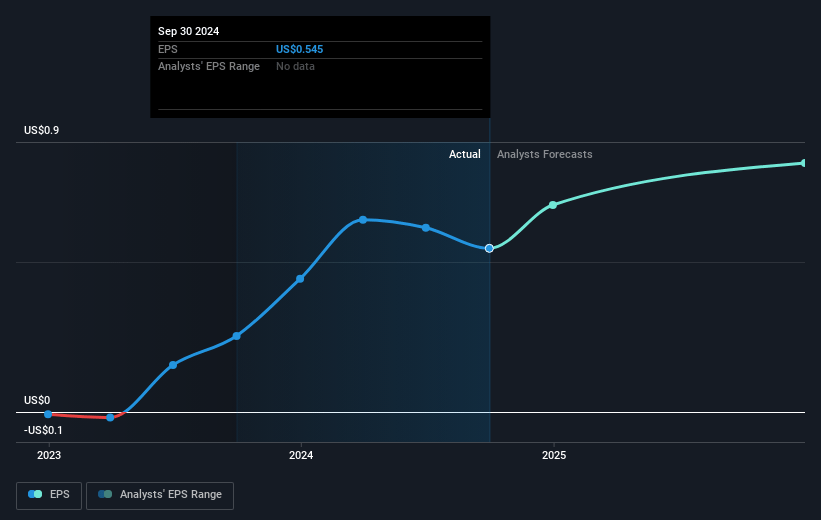

- Analysts expect earnings to reach $25.9 million (and earnings per share of $1.56) by about March 2028, up from $9.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, up from 10.0x today. This future PE is lower than the current PE for the US Electrical industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

Ultralife Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in consolidated revenues from $39.5 million in Q3 2023 to $35.7 million in Q3 2024, along with a significant drop of 58% in Communication Systems sales, could negatively impact future revenue growth.

- The increase in operating expenses by 7% compared to the previous year, coupled with the lower operating margin of 1.4%, down from 5.4%, indicates rising costs, which could pressure net margins.

- Ultralife faces risks from potential reductions in US and foreign military spending and global conflicts, which could adversely impact their earnings from government defense contracts.

- Supply chain disruptions and order delays, which have already led to inventory build-up and increased costs, present ongoing risks to revenue stability and margins.

- The post-COVID return to normalized order flow and distribution of backlog indicate potential challenges in maintaining revenue levels without the previously elevated backlog, impacting long-term earnings predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.0 for Ultralife based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $323.2 million, earnings will come to $25.9 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of $5.4, the analyst price target of $14.0 is 61.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.