Narratives are currently in beta

Key Takeaways

- Innovation with products like the 2kV system could enhance solar efficiency, cost-effectiveness, and market share.

- Expanding CC&I and battery storage sectors may boost revenue, leveraging MSAs and strategic positioning.

- Project delays, cost pressures, and regulatory uncertainty could negatively impact revenue, margins, and earnings growth for Shoals Technologies Group.

Catalysts

About Shoals Technologies Group- Provides electrical balance of system (EBOS) solutions and components for solar, battery energy, and electric vehicle (EV) charging applications in the United States and internationally.

- Shoals Technologies' strategy focuses on innovation with new products like the 2kV electrical system, expected to significantly improve efficiency and cost-effectiveness in solar installations, potentially increasing revenue and market share.

- The company has signed multiple master supply agreements (MSAs), including a 12-gigawatt agreement that isn't yet reflected in the backlog, indicating potential future revenue growth as these agreements materialize.

- Shoals is expanding its commercial and industrial (CC&I) market presence with a focused team and strong initial quoting and product delivery, which could lead to increased revenue streams by utilizing existing strengths and capabilities.

- Investments in battery energy storage solutions, with market projections to more than double by 2027, suggest strategic positioning for future revenue and market expansion.

- Shoals' legal and patent strategies aim to protect IP and engage new customers, as seen with the favorable ITC ruling, which could lead to potential damages and strengthened market position, bolstering earnings.

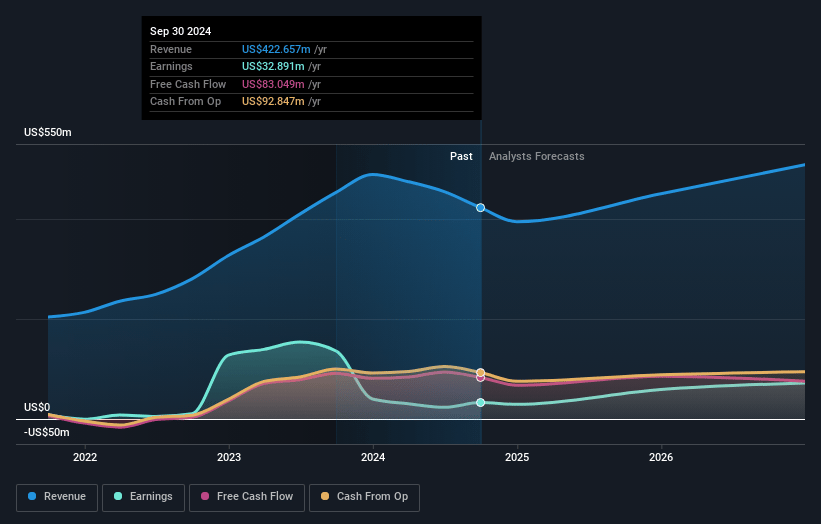

Shoals Technologies Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shoals Technologies Group's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 14.5% in 3 years time.

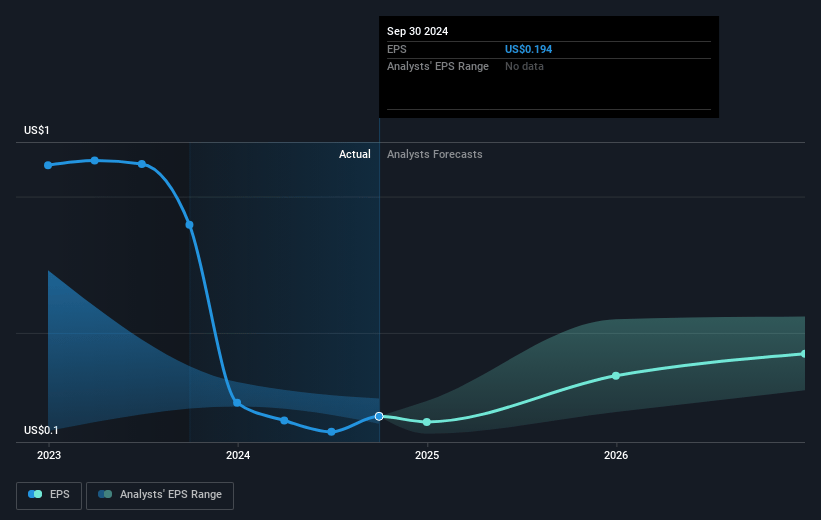

- Analysts expect earnings to reach $79.6 million (and earnings per share of $0.44) by about November 2027, up from $23.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $92 million in earnings, and the most bearish expecting $52.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.2x on those 2027 earnings, down from 34.6x today. This future PE is lower than the current PE for the US Electrical industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 2.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.45%, as per the Simply Wall St company report.

Shoals Technologies Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Project delays, including those due to permitting and renegotiations of power purchase agreements, are increasing, which may impact expected revenues as these delays push out the realization of the associated cash flows.

- Competitive dynamics, volume discounts, and the mix of customers in key markets could negatively affect gross margins and hinder earnings growth.

- Supply chain disruptions and the availability and cost of components and materials pose a risk to maintaining consistent revenue streams and profitability.

- Litigation and product defect issues, such as the wire insulation shrink back matter, could result in significant costs, impacting net margins and earnings negatively.

- Uncertain policy and regulatory changes, particularly relating to clean energy incentives, could affect demand for Shoals’ products, impacting future revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.32 for Shoals Technologies Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $547.9 million, earnings will come to $79.6 million, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $4.85, the analyst's price target of $8.32 is 41.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives