Last Update01 May 25Fair value Decreased 0.78%

Key Takeaways

- Streamlining costs and refining product focus through Project Quantum Leap can enhance net margins and improve facility utilization.

- Strategic ventures and growth in the Electrolyzer sector could drive revenue growth and positively impact earnings in established markets.

- Slower hydrogen market growth, financial dependency on collaborations, and past over-enthusiasm impact Plug Power's revenue, profitability, and financial stability.

Catalysts

About Plug Power- Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

- Project Quantum Leap is expected to streamline costs, reduce staff, refine product focus, and consolidate facilities, with annualized cost savings of $150 million to $200 million, likely leading to improved net margins.

- The completion of price renegotiations and transition from PPA to direct sales in the Material Handling sector is expected to increase sales and facility utilization, enhancing revenue and gross margins.

- The launch of a new joint venture facility in Louisiana is projected to improve Hydrogen margins and is expected to significantly impact net margins and earnings positively.

- Electrolyzer business is poised for significant growth due to global demand and large-scale projects, potentially boosting revenue and cash flow.

- Strategic focus on Material Handling, supporting Hydrogen Production, and profitable Electrolyzer sales is expected to drive revenue growth, while cash-generating assets in established markets improve earnings.

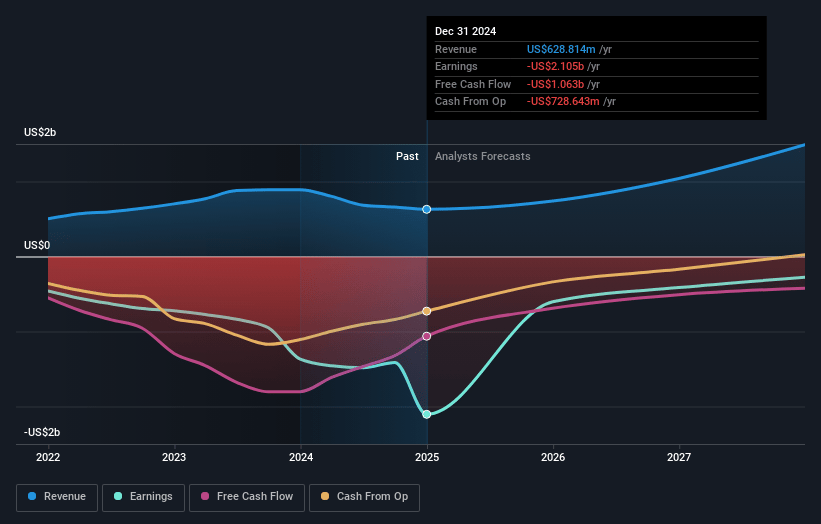

Plug Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Plug Power's revenue will grow by 31.7% annually over the next 3 years.

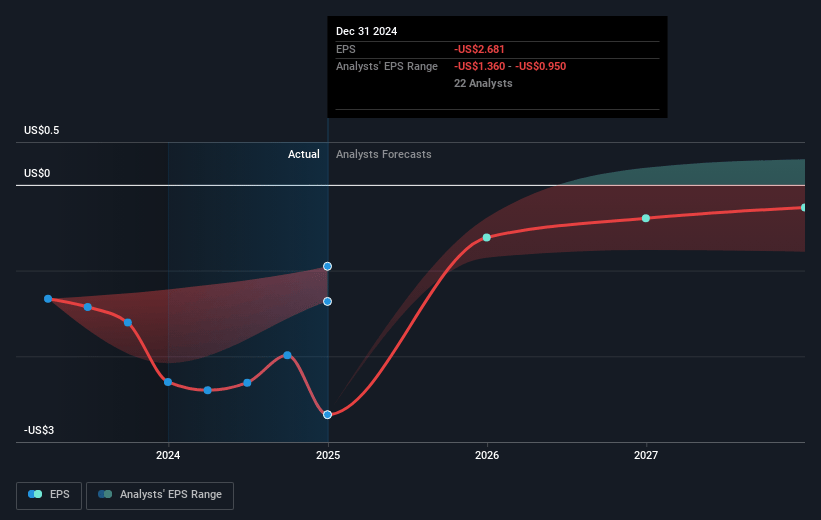

- Analysts are not forecasting that Plug Power will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Plug Power's profit margin will increase from -334.7% to the average US Electrical industry of 10.5% in 3 years.

- If Plug Power's profit margin were to converge on the industry average, you could expect earnings to reach $150.1 million (and earnings per share of $0.13) by about May 2028, up from $-2.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $194.4 million in earnings, and the most bearish expecting $-700.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, up from -0.4x today. This future PE is greater than the current PE for the US Electrical industry at 22.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.43%, as per the Simply Wall St company report.

Plug Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slower-than-anticipated development of the hydrogen market, influenced by policy delays, geopolitical conflicts, and higher project execution costs, could impact revenue growth.

- Product margins in Material Handling remain tied to sales and factory utilization, which were previously slowed due to price renegotiations and sales transitions, affecting profitability.

- Past over-enthusiasm in the sector has led to noncash charges of approximately $971 million for asset impairments and bad debts, impacting net earnings and shareholder equity.

- Revenue expectations were not met due to customer program delays, production issues, and strategic decisions not to ship products, leading to lower-than-expected quarterly and annual revenue.

- Financial dependency on collaboration and external investments for project funding, such as for the Texas hydrogen plant, creates risks related to future revenue and equity positions if partnerships don't materialize as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.145 for Plug Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $0.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $150.1 million, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 10.4%.

- Given the current share price of $0.96, the analyst price target of $2.15 is 55.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.