Key Takeaways

- Transitioning to R290 in refrigeration and strong display solutions performance positions LSI for sustained demand and potential revenue growth.

- EMI integration enhances profitability through operational synergies, while innovation in lighting diversifies products and improves margins.

- Operational inefficiencies, demand fluctuations, and regulatory transitions create pressure on LSI Industries' revenue stability, earnings consistency, and net margins.

Catalysts

About LSI Industries- Produces and sells non-residential lighting and retail display solutions in the United States, Canada, Mexico, and Latin America.

- The projected recovery and surge in demand within the Grocery segment, following legal clarity around a major merger, suggests a potential increase in future revenues through the release of previously postponed projects and programs.

- The transition from R448 to R290 in Refrigeration products in response to EPA rulings provides a competitive advantage and positions LSI for sustained product demand, likely supporting future revenue growth.

- Strong performance and growth in the Display Solutions segment, driven by the refueling/c-store vertical and specific customer programs, signal continued revenue growth and margin improvement as these projects develop further.

- The introduction of new products, such as the V-LOCITY outdoor lighting fixture, demonstrates LSI's commitment to innovation and product diversification, which can drive future sales and potentially improve net margins through increased efficiency and reduced installation times.

- The integration of EMI has provided immediate asset value, with growth and operational synergies contributing to heightened earnings and margin improvements, positioning LSI for continued profitability in future periods.

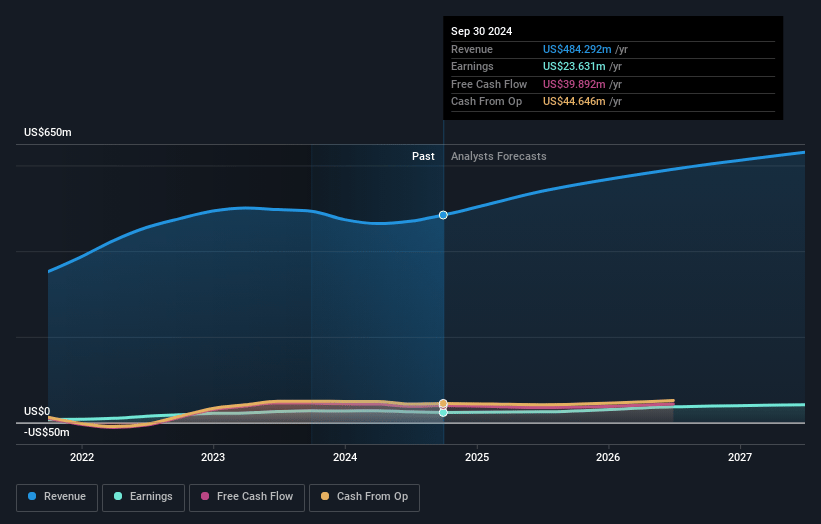

LSI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LSI Industries's revenue will grow by 9.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.5% today to 6.9% in 3 years time.

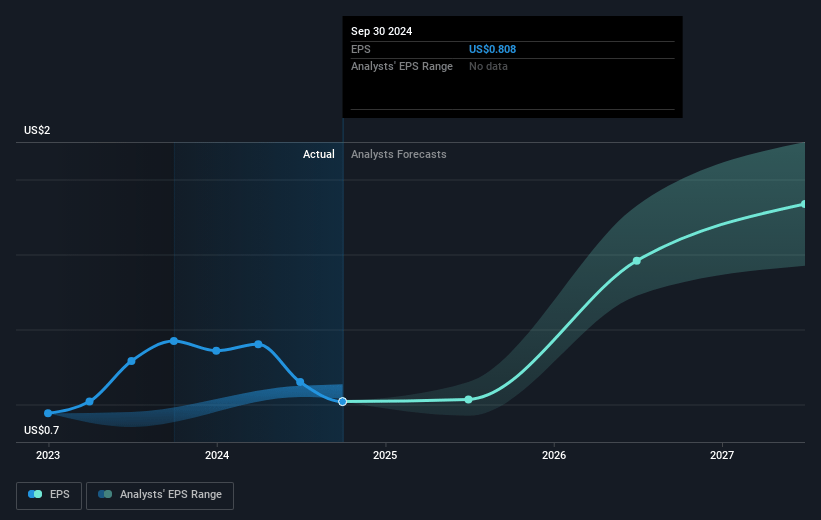

- Analysts expect earnings to reach $46.7 million (and earnings per share of $1.49) by about April 2028, up from $23.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.8x on those 2028 earnings, up from 19.4x today. This future PE is greater than the current PE for the US Electrical industry at 21.8x.

- Analysts expect the number of shares outstanding to grow by 2.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.81%, as per the Simply Wall St company report.

LSI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The lighting segment experienced top line pressures in Q2 and fluctuating demand across verticals, which may impact revenue stability and growth.

- Choppy order timing and mix cause uncertainty, potentially affecting LSI's ability to maintain consistent earnings and profit margins.

- Ramp-up inefficiencies due to a surge in demand led to increased operating costs, which could pressure net margins if future demand spikes are unanticipated.

- The unsuccessful merger of grocery players in the United States created temporary demand surges, but the long-term ramifications on revenue from this market segment remain unclear.

- Transitioning refrigeration products to comply with new EPA regulations results in temporary inefficiencies, which may impact operating margins and future product competitiveness.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.667 for LSI Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $679.5 million, earnings will come to $46.7 million, and it would be trading on a PE ratio of 23.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of $15.72, the analyst price target of $28.67 is 45.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.