Key Takeaways

- Defense budget increases and strategic contracts position Kratos for significant future revenue growth and enhanced earnings potential.

- Renewing contracts at higher rates and partnerships with firms like RAFAEL offer pathways to improved margins and earnings expansion.

- Industry-specific risks and financial assumptions threaten Kratos' revenue, while supply chain issues and capital expenditures could further strain margins and cash flow.

Catalysts

About Kratos Defense & Security Solutions- Kratos Defense & Security Solutions, Inc.

- The United States and allied defense budget increases and the recapitalization of defense and strategic weapon systems offer significant opportunities for Kratos to capture more revenue, as these areas reflect core competencies for the company. (Impact: Potential revenue growth)

- Renewing long-term fixed-price contracts at higher rates beginning in 2026 offers Kratos a chance to offset past inflation-driven cost increases, thereby improving net margins and resulting profitability. (Impact: Improved net margins)

- Strategic program awards such as the MACH-TB hypersonic contract and intended facility investments position Kratos for solid future revenue growth and increased operating leverage, which could enhance earnings as production ramps. (Impact: Revenue growth and earnings leverage)

- Partnerships and joint ventures, like the Prometheus Energetics joint venture with RAFAEL, provide Kratos a clearer path to seeing large-scale revenue and operational scale, which can fuel significant earnings expansion once these initiatives are fully operational. (Impact: Earnings potential)

- Continued demand for Kratos' tactical and target drones, driven by increased emphasis on air defense and potential new program wins, could significantly drive revenue growth over the forecast period should these opportunities materialize as expected. (Impact: Revenue growth potential)

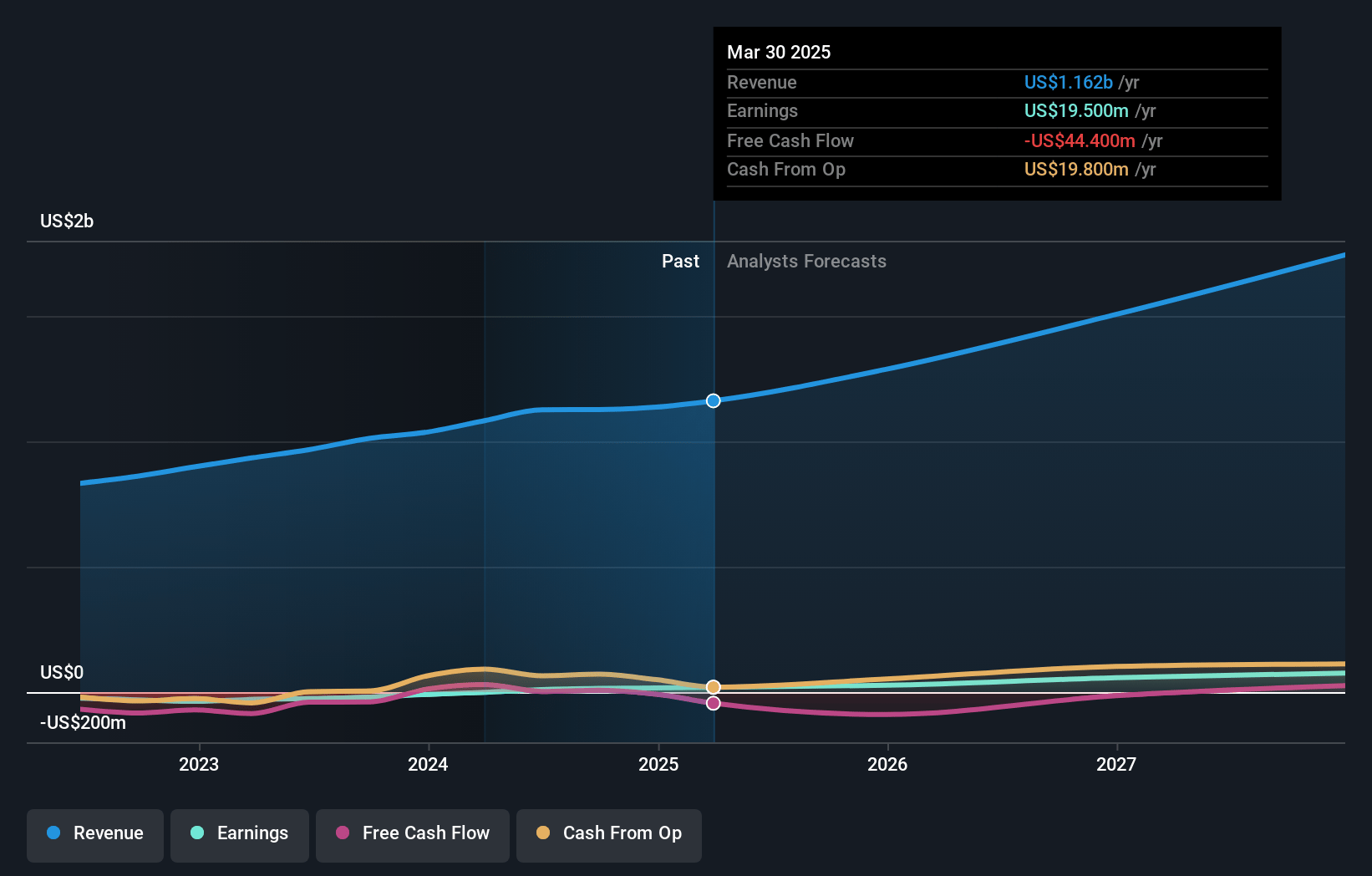

Kratos Defense & Security Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kratos Defense & Security Solutions's revenue will grow by 13.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 3.2% in 3 years time.

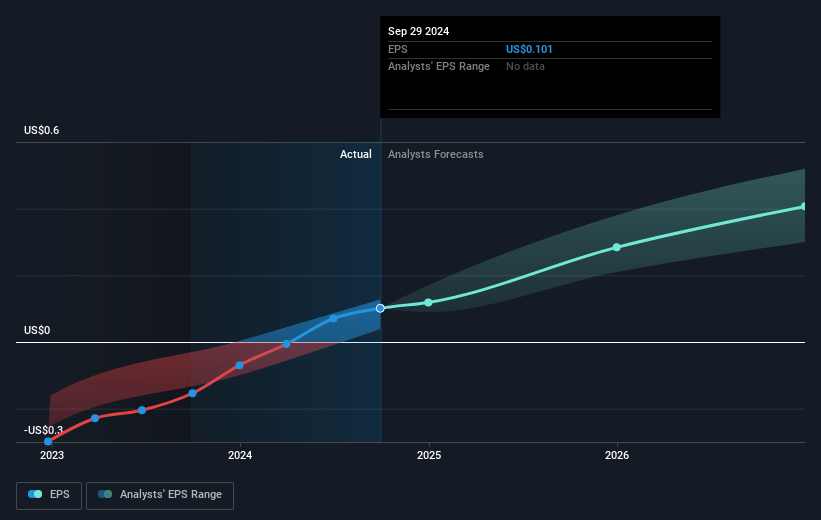

- Analysts expect earnings to reach $53.9 million (and earnings per share of $0.39) by about May 2028, up from $16.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $65.6 million in earnings, and the most bearish expecting $45.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 126.4x on those 2028 earnings, down from 340.7x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 32.4x.

- Analysts expect the number of shares outstanding to grow by 1.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Kratos Defense & Security Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing industry and company-specific risks associated with operating under a continuing resolution authorization (CRA) can create financial uncertainty, which may affect future government contracts and thereby impact revenue.

- Kratos' financial guidance includes assumptions that current CRAs will be resolved by specific deadlines and that there will be no unexpected funding cuts, if these assumptions prove incorrect, there could be adverse effects on revenue and financial performance.

- Anticipated increases in supply chain and material costs, as well as challenges in obtaining skilled technical personnel, pose risks of higher operational costs, potentially impacting net margins.

- There is a risk that revenue from the commercial satellite business might be adversely affected by manufacturing delays of software-defined satellites by OEMs, which could limit top-line growth from this business segment.

- Kratos' strategy involves significant upfront capital expenditures and facility build-outs, which, if the anticipated contracts do not materialize or are delayed, could strain cash flow and return on investment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.818 for Kratos Defense & Security Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $53.9 million, and it would be trading on a PE ratio of 126.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of $36.23, the analyst price target of $34.82 is 4.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.