Key Takeaways

- Regulatory changes favoring reclaimed refrigerants and strategic acquisitions boost Hudson Technologies' revenue, profitability, and operational efficiency.

- A strong cash position without debt facilitates strategic growth initiatives, enhancing earnings and shareholder value.

- Continuous price declines in refrigerants and lower contract revenues challenge Hudson Technologies' revenue growth, potentially compressing margins and impacting future earnings stability.

Catalysts

About Hudson Technologies- Through its subsidiary, Hudson Technologies Company, engages in the provision of solutions to recurring problems within the refrigeration industry in the United States.

- The phasedown of HFC refrigerants and increased regulatory mandates for the use of reclaimed refrigerants represent significant growth opportunities for Hudson Technologies' reclamation business. This is likely to improve revenue and gross margins as reclaimed refrigerants command higher prices compared to newly manufactured ones.

- The company’s strategic acquisition of assets from USA Refrigerants in 2024 enhances its recovery and reclamation capabilities, likely contributing to higher gross margins and more efficient operations, thus positively impacting profitability.

- Hudson’s investment in promoting recovery practices and technician training aligns with regulatory shifts favoring reclaimed refrigerants, which could boost sales and expand its customer base, supporting revenue growth.

- The diverse sales channels and established customer relationships position Hudson Technologies to better manage HFC price fluctuations, which could result in more stable revenues and resilient earnings despite market volatility in refrigerant prices.

- A strong unlevered balance sheet with $70 million in cash and no debt provides Hudson the flexibility to pursue strategic acquisitions and organic growth, which could enhance future earnings and shareholder value.

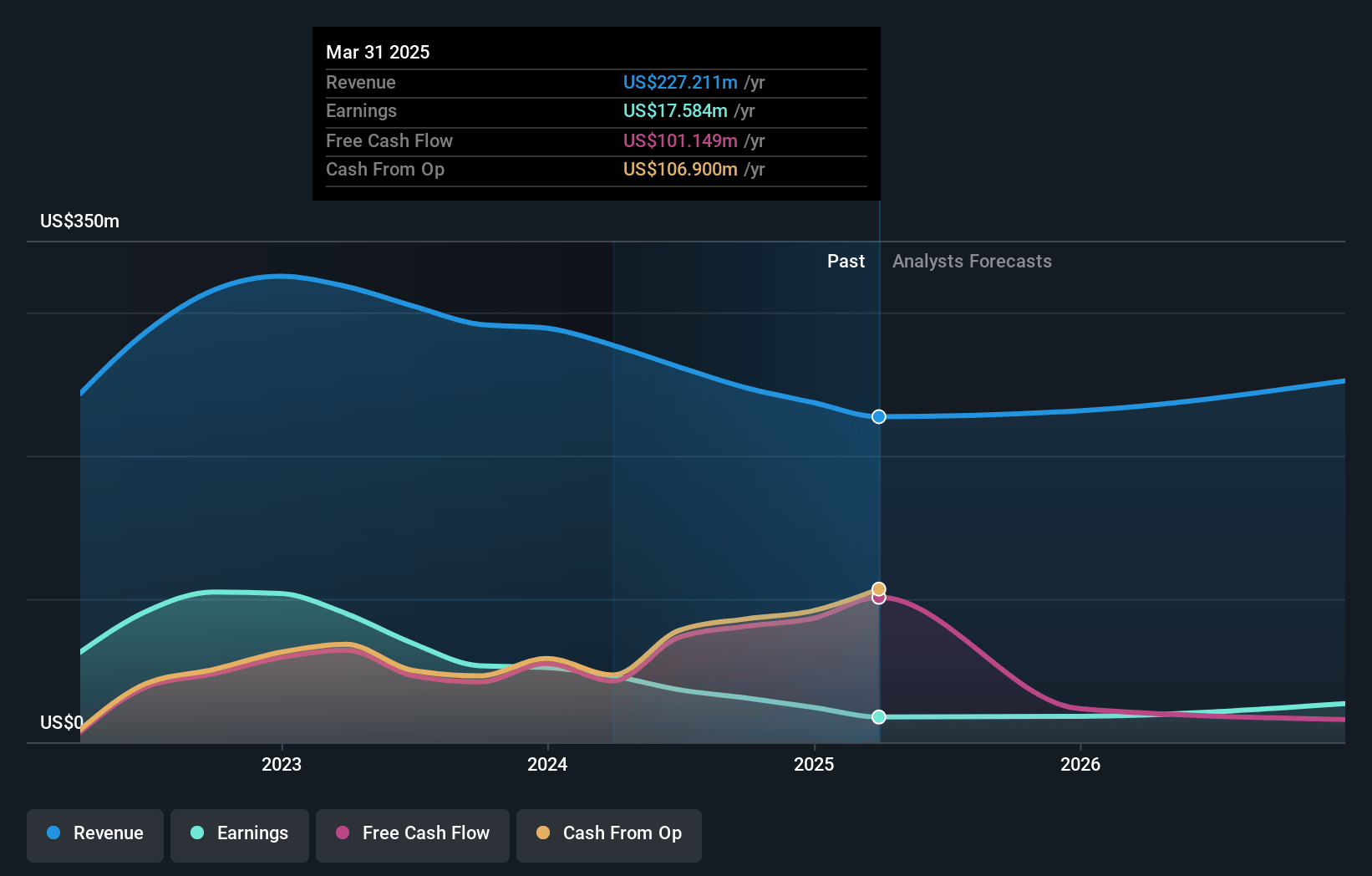

Hudson Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hudson Technologies's revenue will grow by 2.6% annually over the next 3 years.

- Analysts are assuming Hudson Technologies's profit margins will remain the same at 10.3% over the next 3 years.

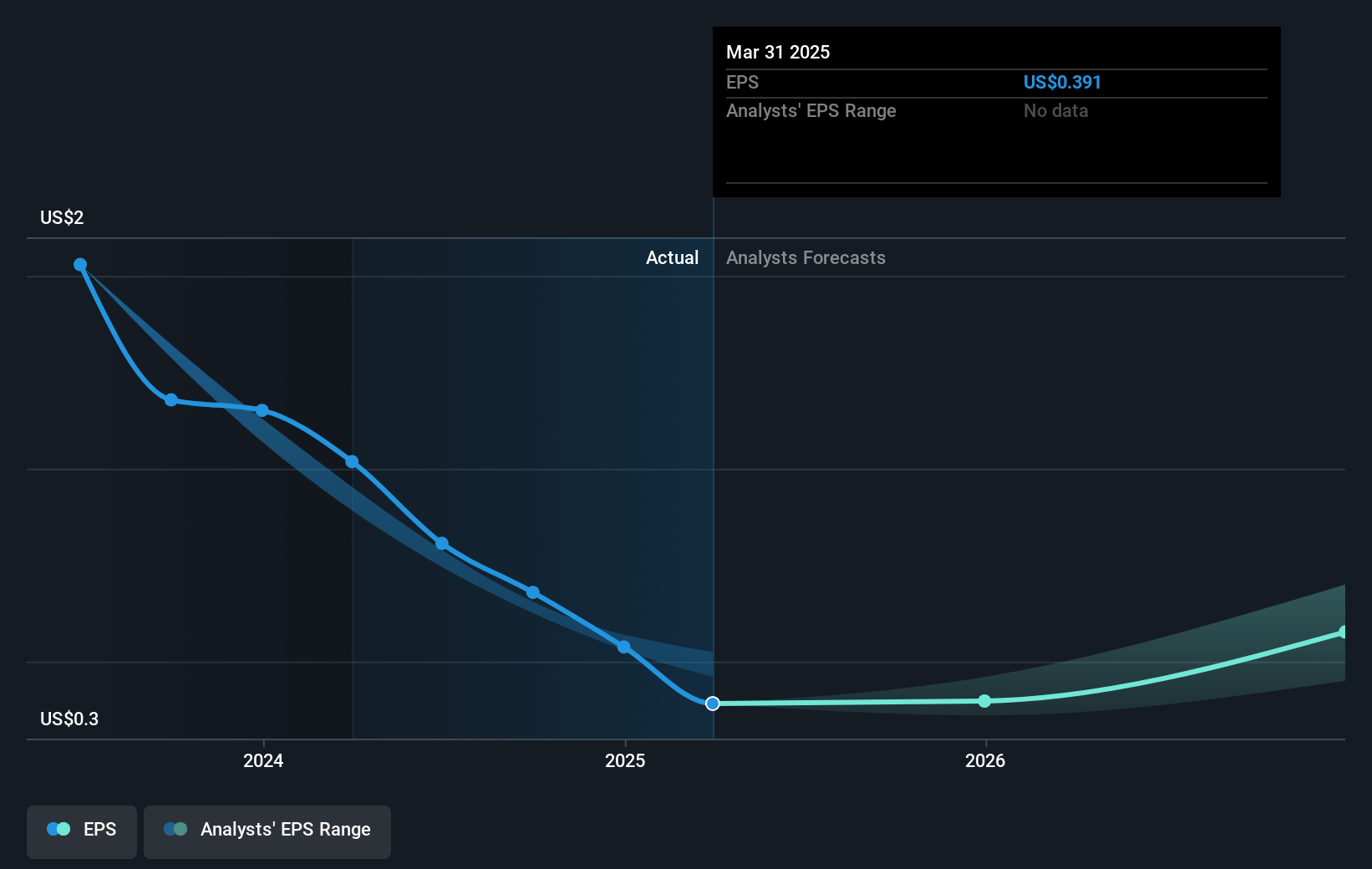

- Analysts expect earnings to reach $26.2 million (and earnings per share of $0.55) by about March 2028, up from $24.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 10.6x today. This future PE is lower than the current PE for the US Trade Distributors industry at 18.1x.

- Analysts expect the number of shares outstanding to decline by 2.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.25%, as per the Simply Wall St company report.

Hudson Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Decreased pricing for certain refrigerants, specifically HFCs, negatively impacted revenue, with 2024 seeing a 45% decline in prices, which could further compress net margins if the trend continues.

- Lower revenue from the company's DLA contract in 2024 compared to a peak in 2023 contributed to a revenue shortfall, and normalized DLA purchasing levels anticipated for 2025 may not reach prior highs, potentially impacting earnings.

- High upstream inventories of refrigerants pose a risk of further price declines, which could hinder revenue growth and gross margins if supply does not align with demand.

- The 18% decline in 2024 revenue compared to 2023, primarily due to market price declines for refrigerants, suggests challenges in maintaining revenue growth amid fluctuating prices.

- Despite an increase in refrigerant sales volume, margin compression due to lower market prices resulted in decreased operating income, indicating risks of further earnings declines if price pressures persist.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.562 for Hudson Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $255.8 million, earnings will come to $26.2 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of $5.82, the analyst price target of $6.56 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.