Key Takeaways

- Expanding FMI technology and digital footprint aims to boost revenue through efficiency and increased sales representation.

- Diversifying supply chains outside China and focusing on on-site distribution could improve margins, customer retention, and offset rising costs.

- Trade tensions and tariff costs could strain Fastenal's supply chain, elevate expenses, and pressure margins, necessitating cost management and digital growth strategies.

Catalysts

About Fastenal- Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

- The company is expanding its Fastenal Managed Inventory (FMI) technology which currently represents over 43% of revenue, aiming to enhance revenue growth by increasing efficiency in customer supply chains.

- Fastenal aims to increase its digital footprint to represent 66-68% of sales, up from 61%, potentially boosting revenue by optimizing purchasing and operational efficiency.

- Significant emphasis is being placed on diversifying the supply chain, particularly outside of China, which could improve net margins by mitigating costs associated with tariffs and supply chain disruptions.

- Fastenal is focusing on on-site distribution models, which are seeing growth and could enhance customer retention and revenue from high-value accounts, positively impacting earnings.

- Recent pricing actions that are expected to contribute 3-4% in the second quarter with potential doubling in the second half could provide a significant uplift to revenue and offset increased costs, thereby supporting earnings growth.

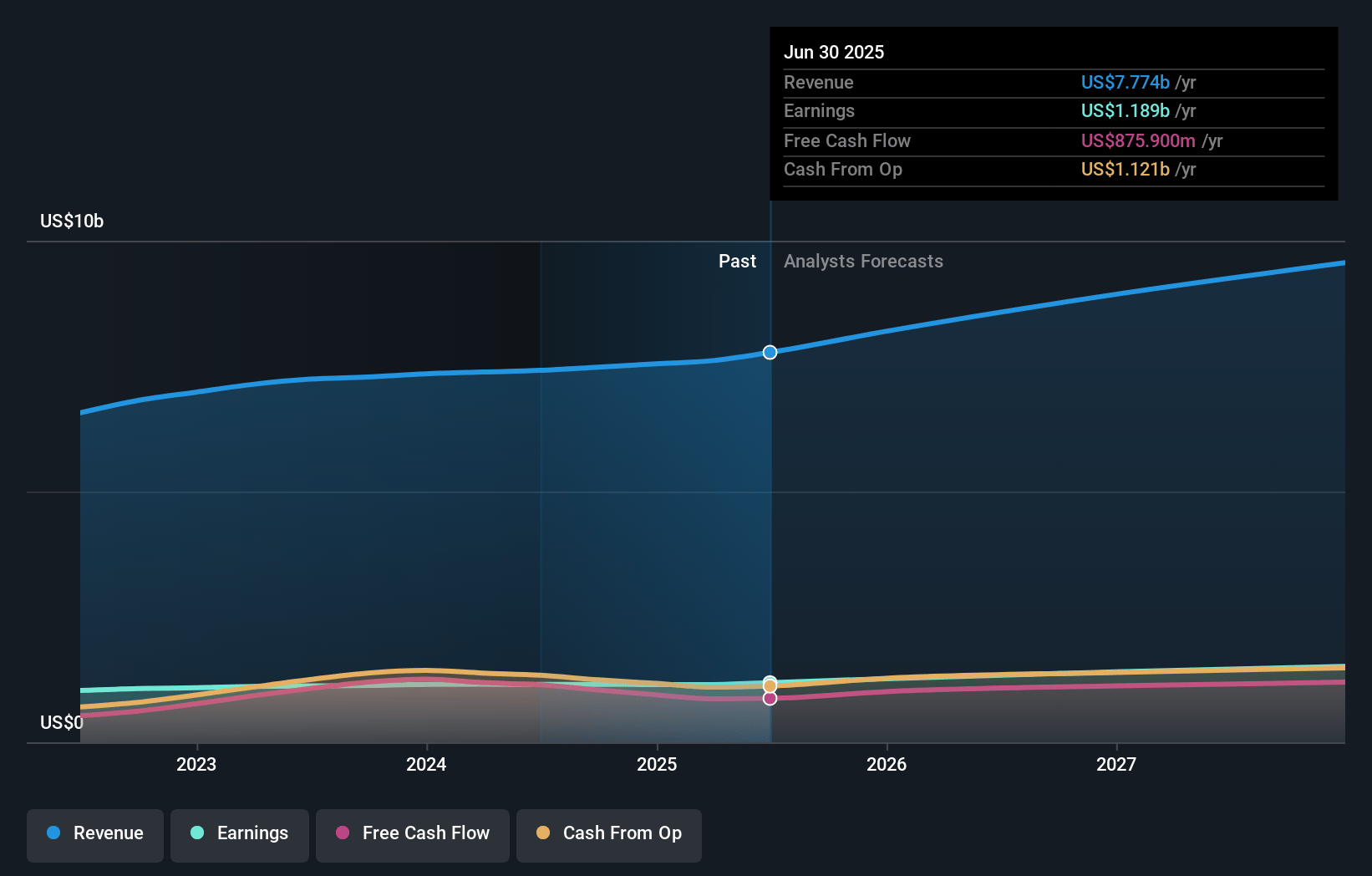

Fastenal Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fastenal's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.1% today to 15.8% in 3 years time.

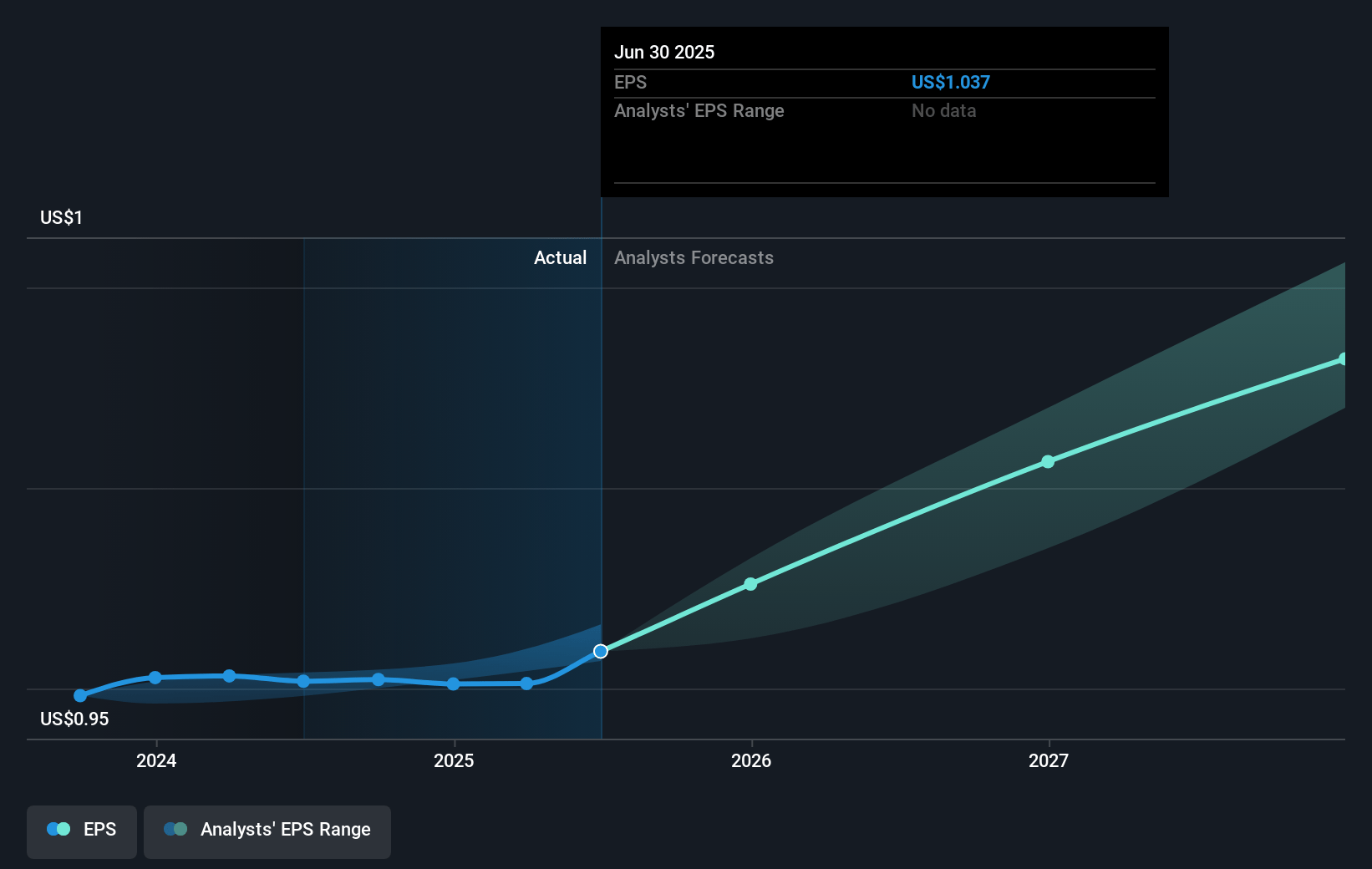

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $2.63) by about April 2028, up from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.9x on those 2028 earnings, down from 40.1x today. This future PE is greater than the current PE for the US Trade Distributors industry at 18.4x.

- Analysts expect the number of shares outstanding to grow by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.15%, as per the Simply Wall St company report.

Fastenal Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing trade tensions and tariffs, especially on China-sourced products, could impact Fastenal's supply chain and increase costs, potentially affecting gross margins and net income.

- The company's reliance on self-help initiatives and internal execution to drive sales growth, due to a sluggish market environment, suggests external demand may not support revenue increases.

- The increased inventory levels to counter potential supply chain disruptions and absorb tariff costs may lead to higher working capital needs, affecting cash flow and financial flexibility.

- Competition and customer behaviors shifting towards digital purchasing platforms highlight Fastenal's need to improve its e-commerce capabilities, which could impact the capture of small under-$5,000 accounts and ultimately revenue.

- Expected continued pressures on operating margins from various cost factors, including elevated SG&A and freight expenses, may threaten net earnings if not offset by revenue growth or cost management.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $76.203 for Fastenal based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $86.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.5 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 35.9x, assuming you use a discount rate of 7.2%.

- Given the current share price of $80.45, the analyst price target of $76.2 is 5.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.