Narratives are currently in beta

Key Takeaways

- Strategic expansion into wastewater and CO2 markets indicates potential revenue growth and diversification with energy-efficient innovations.

- Focus on mega desalination projects and cost control measures suggests sustained growth and improved profitability.

- Heavy reliance on specific regions and large projects poses risks of revenue concentration, volatility, and delays amidst evolving competition and economic uncertainties.

Catalysts

About Energy Recovery- Designs, manufactures, and sells energy efficiency technology solutions in the Americas, the Middle East, Africa, Asia, and Europe.

- The strategic plan or Playbook to be revealed in the upcoming investor webinar, which includes growth plans for desalination, wastewater, and CO2, presents a future catalyst potentially impacting revenue growth.

- Expansion into wastewater market, with a reported 46% increase in signed contracts compared to the previous year, highlights growth potential that could enhance future revenue and diversification.

- Development and commercialisation of the second generation PX G in the CO2 sector, with promising energy-saving results and plans for further site installations, may drive future revenue and improve net margins due to energy efficiency gains.

- High growth potential in mega desalination projects, with strong demand in regions like the Middle East, North Africa, and India, is a catalyst for sustained revenue growth and market leadership.

- Significant reduction in operating expenses guidance and gross margin improvement suggest enhanced cost control and efficiency, which could lead to higher net margins and profitability.

Energy Recovery Future Earnings and Revenue Growth

Assumptions

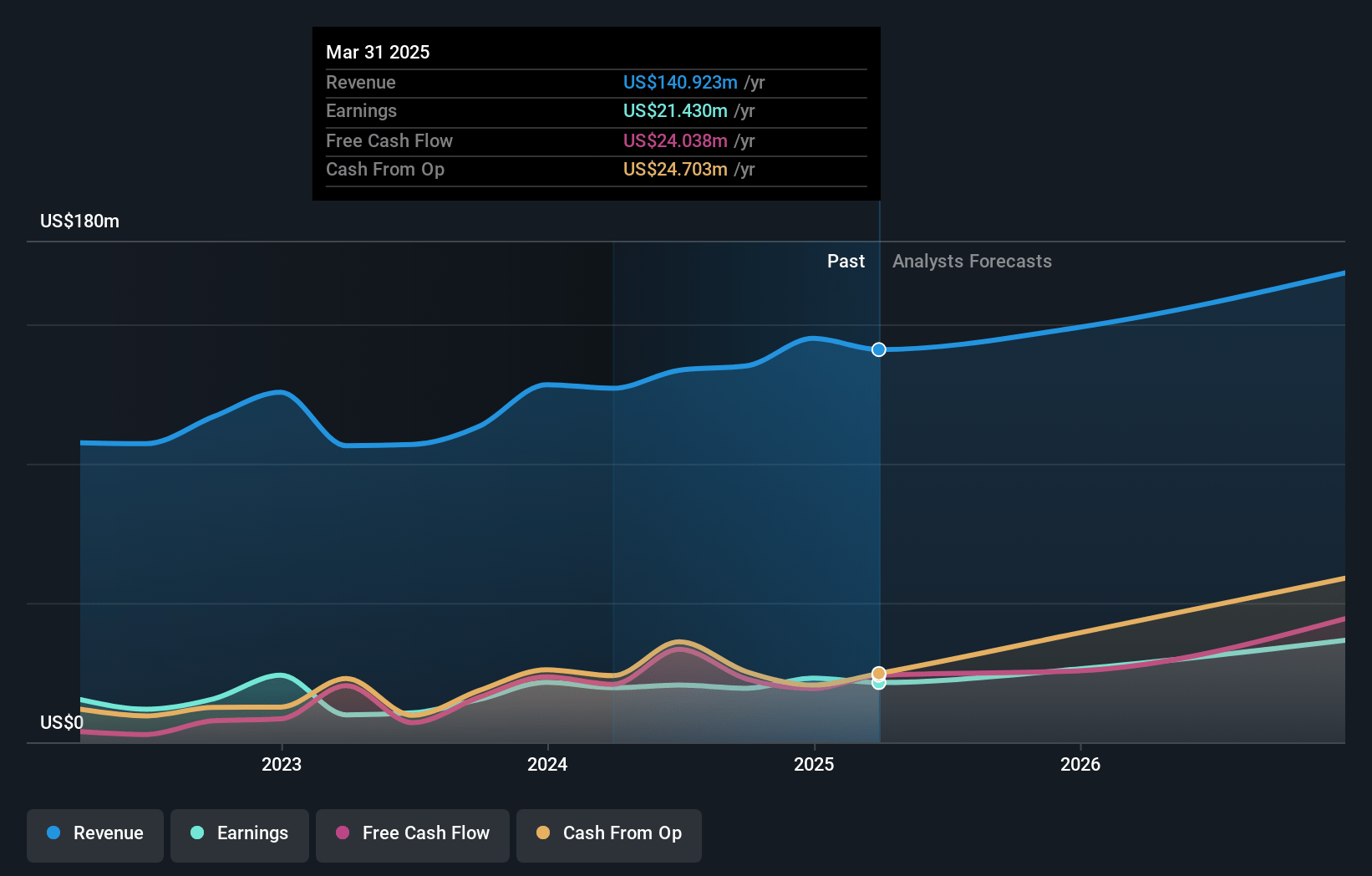

How have these above catalysts been quantified?- Analysts are assuming Energy Recovery's revenue will grow by 23.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.4% today to 20.8% in 3 years time.

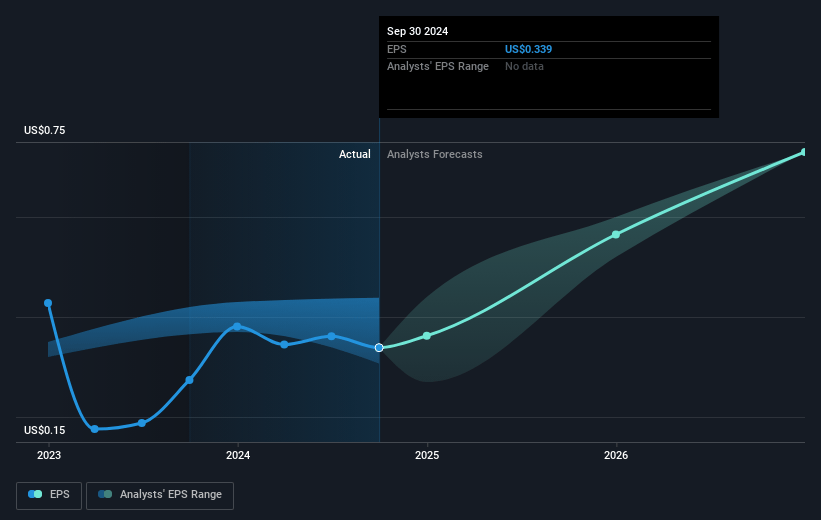

- Analysts expect earnings to reach $53.3 million (and earnings per share of $0.94) by about November 2027, up from $19.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2027 earnings, down from 57.3x today. This future PE is greater than the current PE for the US Machinery industry at 24.6x.

- Analysts expect the number of shares outstanding to decline by 0.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.76%, as per the Simply Wall St company report.

Energy Recovery Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on the Middle East and Africa for revenue, as over 70% of revenue came from these regions, poses a risk of geographic concentration which could impact future revenue diversity and stability.

- The project-driven nature of the company's revenue, with significant reliance on a few large projects which represent approximately 50% of quarterly revenue, creates a risk of revenue volatility if any project faces delays or cancellations.

- The competitive landscape, particularly in CO2 applications, may evolve, potentially introducing new competitors that could erode market share or pricing power, affecting future revenue and margins.

- Economic and geopolitical factors such as rising interest rates, inflationary pressures, and global economic uncertainties could impact market conditions, potentially affecting revenue growth and profitability.

- The transition of major wastewater projects to longer-term phased arrangements, such as the NEOM project, might delay expected revenue, impacting short-term financial outcomes and increasing the risk of capital being tied up.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.25 for Energy Recovery based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $256.2 million, earnings will come to $53.3 million, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $19.17, the analyst's price target of $21.25 is 9.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives