Narratives are currently in beta

Key Takeaways

- Expansion in production capacity and strategic partnerships are aimed at driving revenue growth and broadening market reach internationally.

- New battery innovations and superior gross profit margins are expected to capture market share and stabilize financial performance amidst pricing pressures.

- Vulnerabilities in production and market demand, along with strategic risks and capacity constraints, could impact future revenue growth and profitability.

Catalysts

About CBAK Energy Technology- CBAK Energy Technology, Inc., together with its subsidiaries, manufacture, commercialization, and distribution of lithium ion high power rechargeable batteries in Mainland China, the United States, Europe, and internationally.

- CBAK Energy Technology is expanding its production capacity, particularly with the Nanjing factory, which is expected to begin mass production of new battery models by the second half of next year. This expansion is likely to drive continued revenue growth.

- The company has secured significant orders with strong partners like Anker and Viessmann Group, indicating a robust demand pipeline that is expected to positively impact future revenue figures.

- CBAK is planning to establish overseas factories in response to significant client demand, which could broaden market reach and potentially increase revenue in international markets.

- The development and launch of new battery models, such as the 40135 large cylindrical battery and the fast-charging 26650 tablet model, could capture more market share and enhance revenue growth due to high market demand for these innovations.

- The company benefits from maintaining a higher-than-average gross profit margin compared to industry competitors, which is expected to stabilize financial performance and improve net margins even if industry-wide pricing pressures persist.

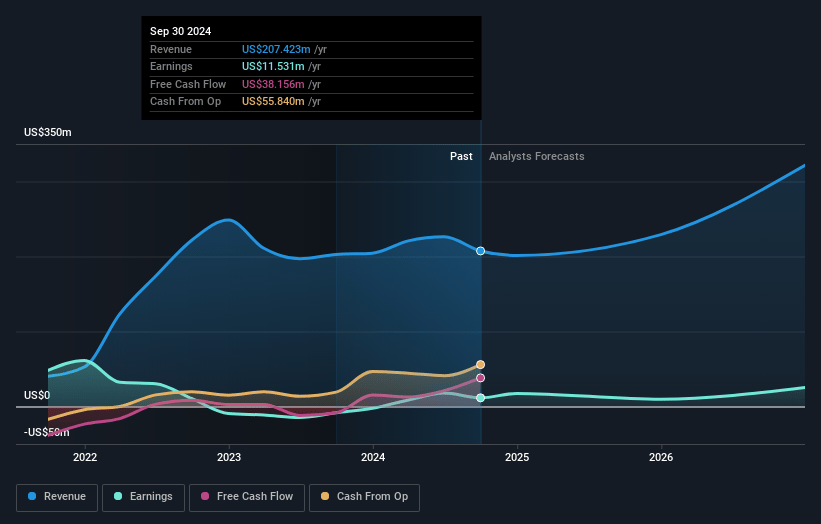

CBAK Energy Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CBAK Energy Technology's revenue will grow by 20.3% annually over the next 3 years.

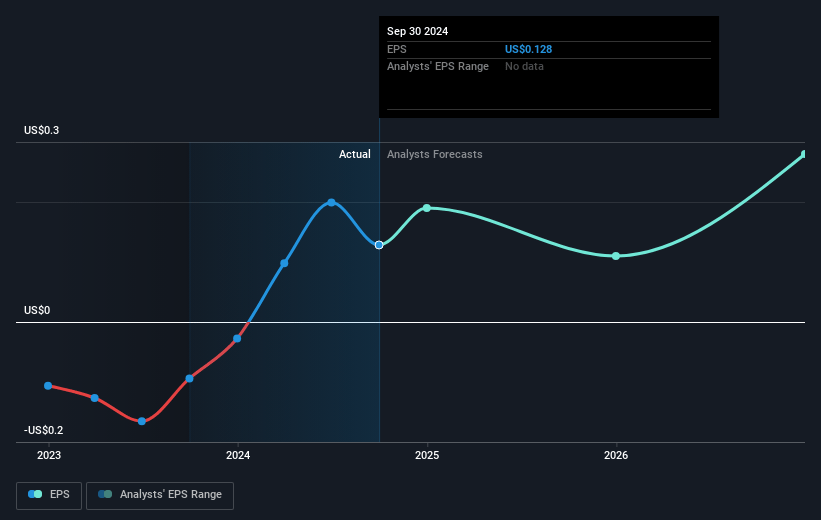

- Analysts assume that profit margins will increase from 5.6% today to 7.5% in 3 years time.

- Analysts expect earnings to reach $27.0 million (and earnings per share of $0.3) by about November 2027, up from $11.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2027 earnings, up from 6.6x today. This future PE is lower than the current PE for the US Electrical industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.17%, as per the Simply Wall St company report.

CBAK Energy Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The one-month suspension of the Dalian production line due to high energy costs indicates a vulnerability to operational disruptions, which can negatively impact quarterly revenues and profit margins.

- Despite an overall increase in battery business revenue for the year, a significant decline in revenue from the energy storage sector and EV batteries suggests potential market demand fluctuations, impacting future earnings.

- The high demand leading to a supply shortage at the Nanjing factory indicates capacity constraints, which may limit the company's ability to meet market demand and impact revenue growth.

- The anticipated gradual return to more typical gross margin levels, despite being higher than competitors, suggests potential pressure on profitability in the future.

- The necessity of finding international partners for potential overseas expansion poses strategic and execution risks, possibly affecting long-term strategic growth and future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.0 for CBAK Energy Technology based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $361.2 million, earnings will come to $27.0 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 9.2%.

- Given the current share price of $0.85, the analyst's price target of $2.0 is 57.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives