Key Takeaways

- Expanding online sales channels and introducing higher margin products aim to capture new markets and improve revenue and gross margins.

- Partnerships and strategic U.S. sourcing are designed to enhance customer engagement, reduce costs, and stabilize supply chains, improving overall margins.

- Shifting supply chains to the U.S. and high dependency on Amazon increase costs and risks, potentially impacting Byrna's margins, liquidity, and competitive positioning.

Catalysts

About Byrna Technologies- A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

- Byrna Technologies is actively expanding its online sales channels, particularly through Amazon and implementing Buy with Prime on byrna.com. This strategy is expected to fuel revenue growth by capturing a larger share of the burgeoning e-commerce market.

- The introduction of the highly anticipated Compact Launcher, which boasts a higher profit margin compared to existing products, is anticipated to drive revenue growth and expand gross margins as it targets the critical women's market and segments preferring smaller launchers.

- The partnership with Sportsman's Warehouse, involving 54 locations with point-of-sale displays and experiential shooting lanes, aims to enhance customer engagement and increase conversion rates, thereby boosting revenue and potentially bettering net margins.

- Byrna has strategically increased its U.S. sourcing to 87%-92%, significantly reducing exposure to tariff impacts and enhancing supply chain reliability. This move is expected to stabilize gross margins and potentially improve net margins due to reduced costs and increased operational efficiencies.

- Production of ammunition at the new facility with an annual capacity of 8 million rounds allows Byrna to avoid tariffs and meet supply demands associated with the Compact Launcher release, positioning for increased earnings by sustaining supply at favorable costs.

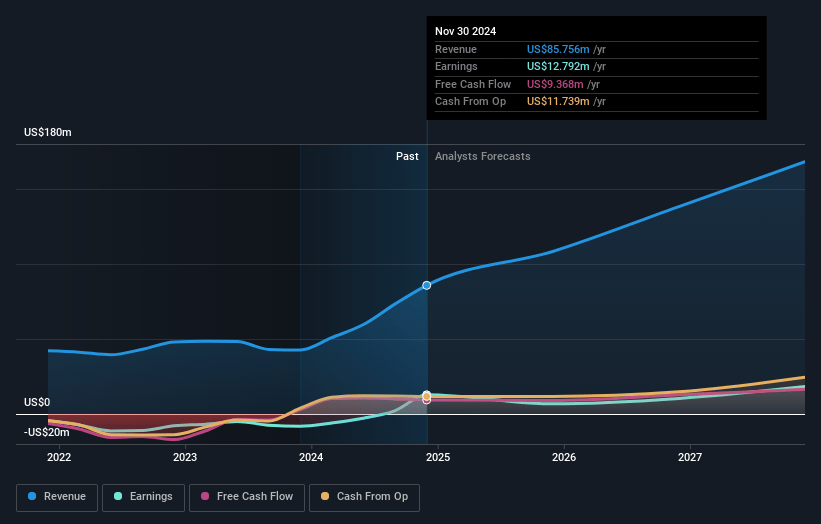

Byrna Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Byrna Technologies's revenue will grow by 24.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.2% today to 10.9% in 3 years time.

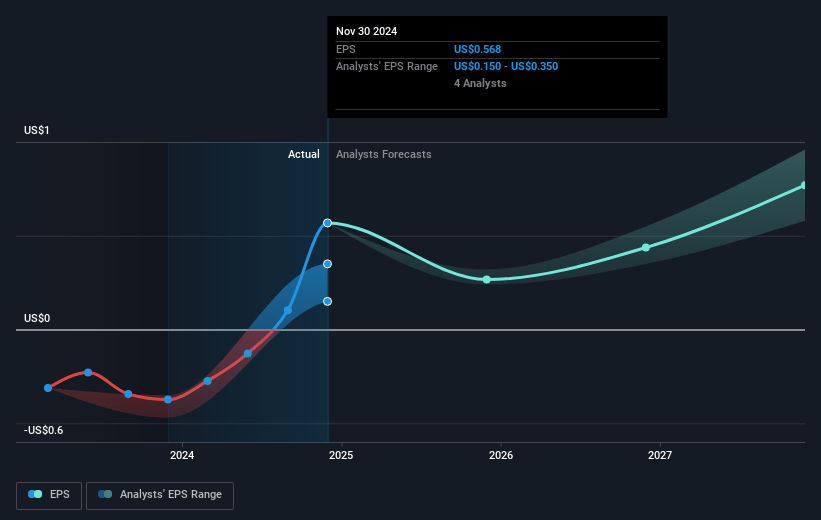

- Analysts expect earnings to reach $19.9 million (and earnings per share of $0.75) by about April 2028, up from $14.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $23.4 million in earnings, and the most bearish expecting $16.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.3x on those 2028 earnings, up from 33.2x today. This future PE is greater than the current PE for the CA Aerospace & Defense industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 0.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Byrna Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Moving the supply chain to U.S. suppliers has increased costs for Byrna, resulting in a 16% increase in the cost of their launcher, which could potentially impact gross margins and profitability if not offset by raised prices or efficiencies.

- The company experienced a decrease in cash, cash equivalents, and marketable securities from $25.7 million to $19.3 million, which may impact its liquidity and ability to invest in future growth opportunities.

- New tariffs and relocating the supply chain to avoid reliance on China add complexity and risk, potentially affecting cost structures and thus impacting net margins.

- The introduction of tariffs and domestic production could result in competitive disadvantages if foreign competitors can produce similar products at lower costs, potentially impacting revenue and market share.

- High reliance on Amazon, with 32.6% of their DTC sales occurring there, exposes Byrna to risks related to Amazon's policies and fees, which could affect net margins if Amazon's fee structures change adversely for suppliers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.625 for Byrna Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $181.9 million, earnings will come to $19.9 million, and it would be trading on a PE ratio of 47.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of $21.13, the analyst price target of $35.62 is 40.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.