Key Takeaways

- Strategic acquisitions and expansion of greenfield branches enhance Beacon's market presence, likely driving revenue and earnings growth.

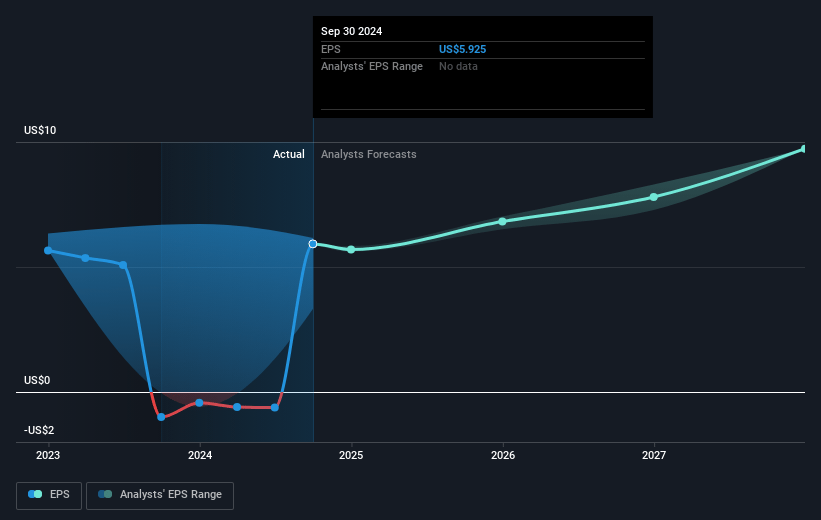

- Emphasis on digital sales and private label products boosts margins, while significant share buybacks enhance earnings per share.

- Slowing market activity and reliance on acquisitions risk revenue stability, while price pressures and rising costs threaten margins and financial flexibility.

Catalysts

About Beacon Roofing Supply- Engages in the distribution of residential and non-residential roofing materials, and complementary building products to contractors, home builders, building owners, lumberyards, and retailers in the United States and Canada.

- Beacon Roofing Supply is focused on expanding its footprint with greenfield branches, having opened 62 new locations since 2022, which can reduce delivery distances and potentially increase market share, impacting future revenue growth.

- Acquisitions play a significant role in Beacon's growth strategy, with seven companies acquired in the third quarter alone. This M&A activity adds to its commercial footprint and diversifies its offerings, likely driving future revenue and earnings growth.

- Increased emphasis on digital sales, which have grown by approximately 28% year-over-year, improves customer loyalty and enhances margins by roughly 150 basis points compared to offline channels, impacting net margins positively.

- Introduction and expansion of private label products under the TRI-BUILT brand, which offer higher margins compared to branded alternatives, is anticipated to boost net margins and earnings.

- The accelerated share repurchase program, deploying more than $1.5 billion in buybacks, is expected to significantly reduce share count and drive EPS growth, benefiting future earnings.

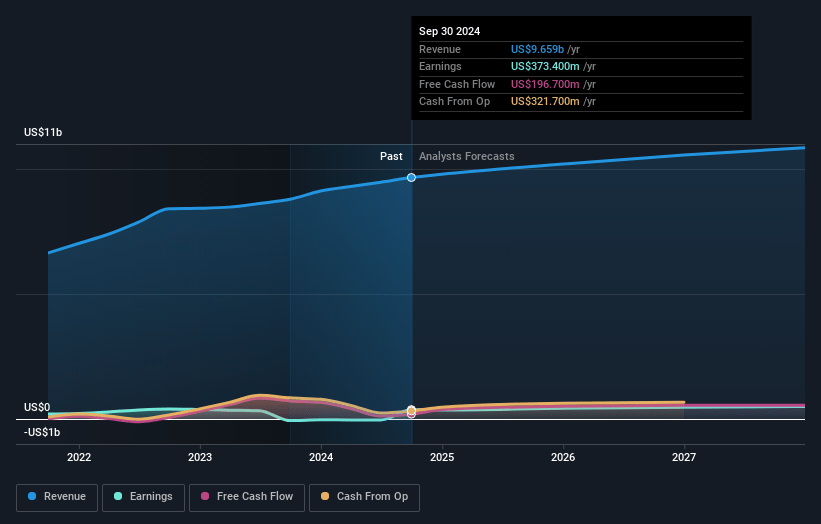

Beacon Roofing Supply Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Beacon Roofing Supply's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 4.7% in 3 years time.

- Analysts expect earnings to reach $505.8 million (and earnings per share of $8.45) by about May 2028, up from $361.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, down from 21.2x today. This future PE is lower than the current PE for the US Trade Distributors industry at 19.4x.

- Analysts expect the number of shares outstanding to decline by 3.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Beacon Roofing Supply Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The overall level of activity came in lower than anticipated in the third quarter, which could potentially point to a broader slowing trend in the market, impacting future revenue projections.

- There was a noted decrease in organic volumes in both residential and nonresidential sectors, suggesting that reliance on acquisitions for growth may not be sustainable long-term, potentially affecting revenue stability.

- The continued pressure on prices due to market conditions, especially in residential markets like Florida, indicates potential for margin compression if cost control or price management does not keep pace, thus impacting net margins.

- Higher operating expenses associated with acquisitions and inflationary costs, including wages, have led to increased adjusted OpEx, which, if not managed, could squeeze net margins further.

- The balance between maintaining adequate inventory levels and ensuring product availability amidst recent hurricane activities could strain cash flow and working capital management, potentially limiting the ability to reinvest or redistribute to shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $124.296 for Beacon Roofing Supply based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $111.71.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.8 billion, earnings will come to $505.8 million, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of $124.17, the analyst price target of $124.3 is 0.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.