Key Takeaways

- New manufacturing facility enhances supply chain resilience, reduces costs, and boosts margins by domesticating components and ensuring supply continuity.

- Product innovation and strategic investments drive competitive edge, top-line growth, and efficiency improvements, while robust U.S. market demand boosts 2025 revenue.

- Declines in revenue, net margins, and near-term earnings stability are driven by market headwinds, currency devaluation, and asset impairments in Brazil and the U.S.

Catalysts

About Array Technologies- Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

- The completion and operational readiness of a new state-of-the-art manufacturing facility in Albuquerque by early 2025, which is expected to enhance supply chain resilience and domesticate more components, thus reducing costs and increasing margins. This could positively impact net margins by lowering enterprise risk and ensuring supply continuity.

- The launch of innovative products like the smart OmniTrack terrain-following tracker and SmartTrack software solutions, which have been well-received in the market, enhances Array's competitive edge and revenue growth. This could lead to increased revenues as these products expand the addressable market and provide differentiated value to customers, especially in terrains with diverse needs.

- The strategic investment in Swap Robotics is aimed at integrating advanced automation technology, potentially leading to cost reductions and efficiency improvements in project cycle times and installation processes. This is expected to impact net margins positively by optimizing capital expenditures and reducing project costs.

- The increased traction and order book growth in the domestic U.S. market, bolstered by a robust utility-scale solar demand projection, is expected to drive significant revenue growth in 2025. Array projects top-line growth exceeding market averages, which should reflect directly in increased revenues.

- Advocacy and strategic positioning within industry trade groups against unfavorable policy changes, particularly related to renewable energy incentives like the 45X tax credit, ensuring continued profitability and stable gross margins by reducing regulatory uncertainty.

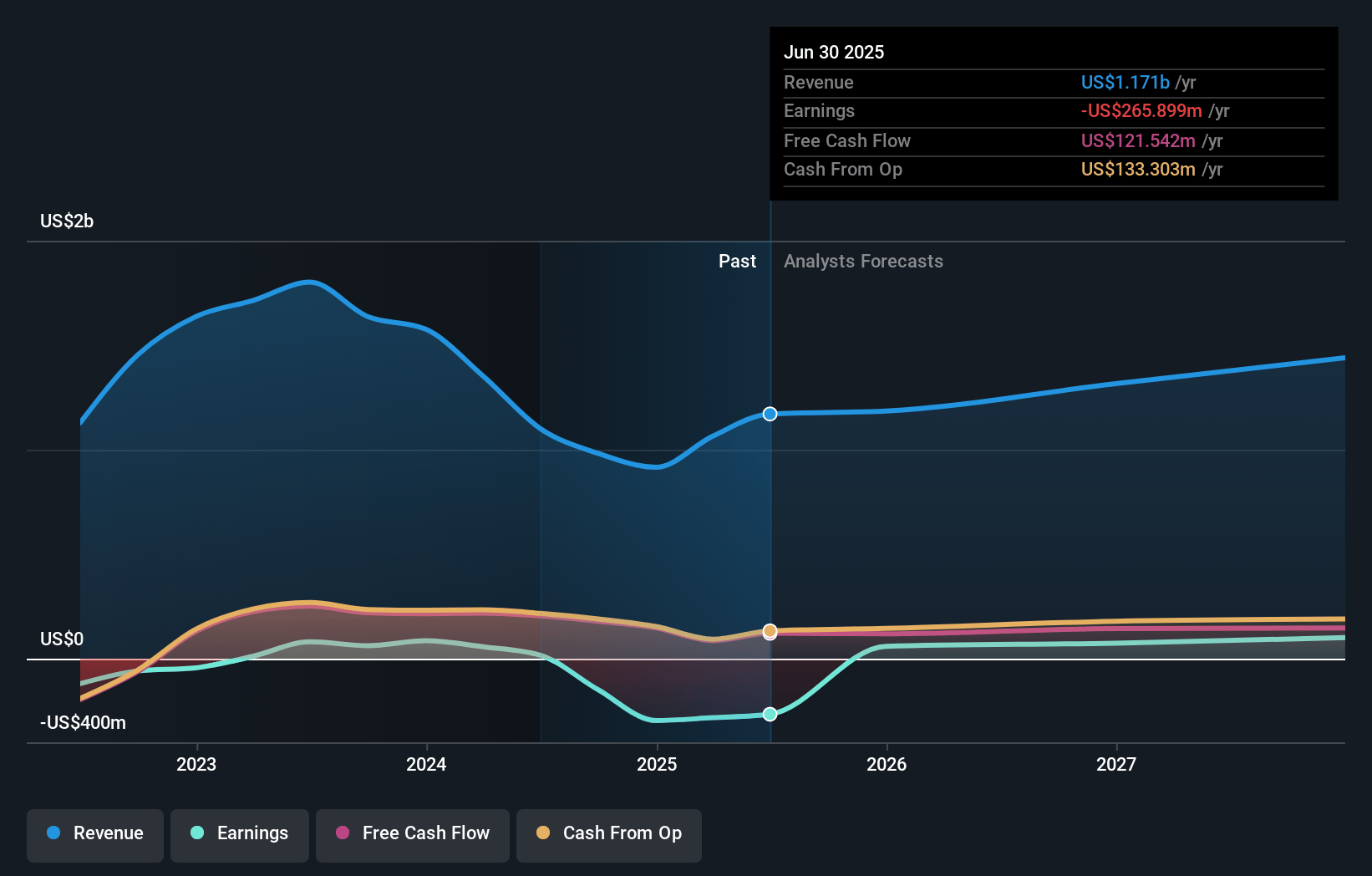

Array Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Array Technologies's revenue will grow by 13.1% annually over the next 3 years.

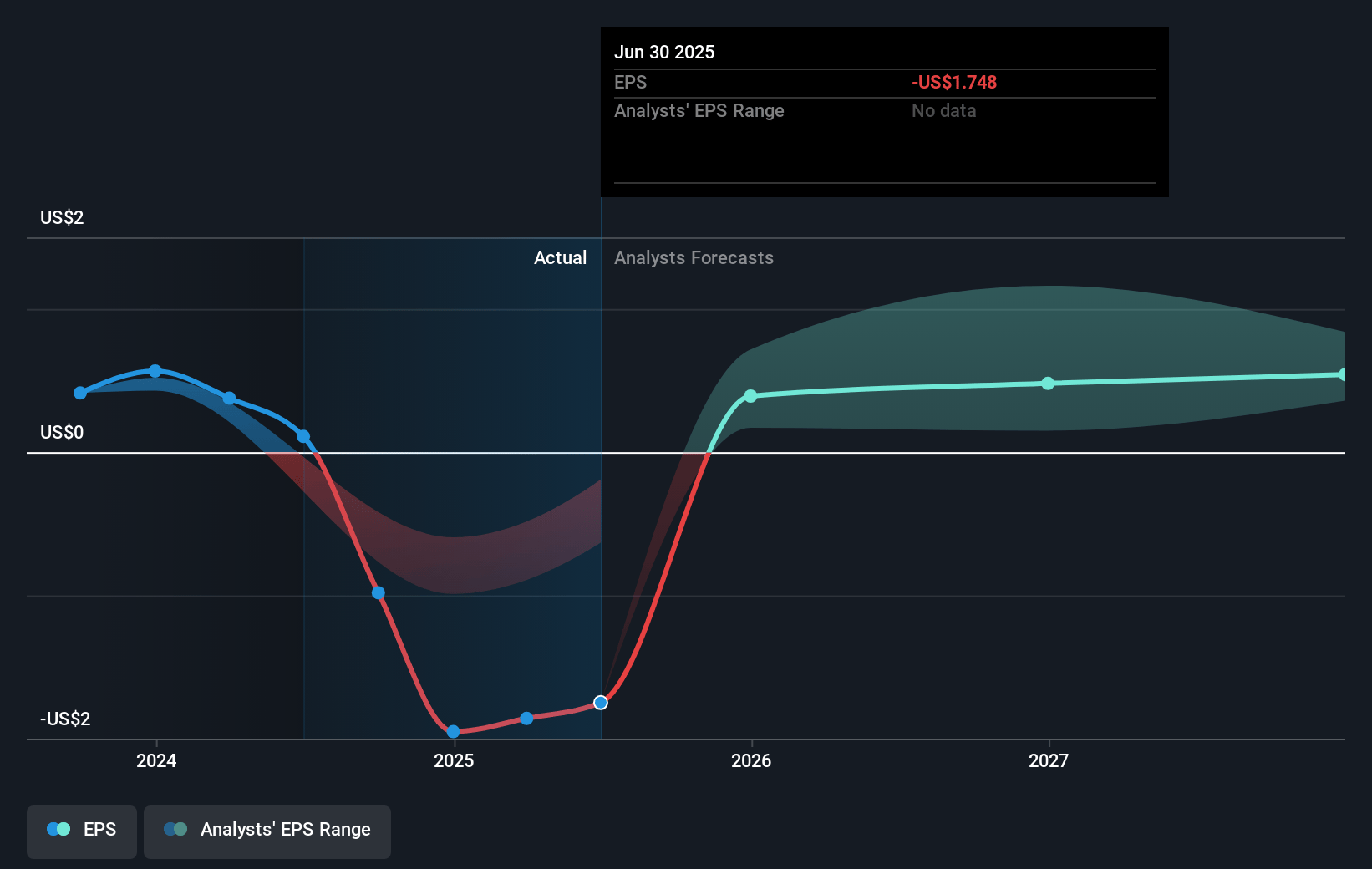

- Analysts assume that profit margins will increase from -32.3% today to 6.8% in 3 years time.

- Analysts expect earnings to reach $89.8 million (and earnings per share of $0.47) by about May 2028, up from $-296.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $134 million in earnings, and the most bearish expecting $63 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from -2.7x today. This future PE is lower than the current PE for the US Electrical industry at 22.8x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.83%, as per the Simply Wall St company report.

Array Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The devaluation of the Brazilian real, a volatile interest rate environment, and newly introduced tariffs on solar components have significantly slowed market growth in Brazil, which may continue for 3 to 4 more quarters, affecting potential revenue from this region.

- Declines in both volume and average selling prices (ASPs), primarily due to commodity price declines, resulted in a 42% decrease in revenue in 2024 compared to 2023, impacting potential revenue growth.

- The company experienced a $236 million noncash goodwill impairment charge and a $91.9 million noncash long-lived intangible asset write-down related to the 2022 STI acquisition, affecting net margins due to increased operating expenses.

- Array is facing ongoing industry headwinds that push project timelines, primarily noted in the U.S., which may influence near-term revenue recognition and overall earnings stability.

- Array expects slight declines in year-on-year adjusted gross margin and EBITDA margin due to factors such as headwinds in Brazil and working through legacy fixed-price volume commitment agreements, impacting net earnings for 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.1 for Array Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $89.8 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 9.8%.

- Given the current share price of $5.29, the analyst price target of $8.1 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.