Last Update 30 Jul 25

Fair value Increased 11%The upward revision in Stellar Bancorp’s analyst price target is supported by improvements in both revenue growth forecasts and net profit margin, resulting in a new fair value estimate of $31.60.

What's in the News

- Reported net charge-offs of $206,000 in Q2 compared to net recoveries of $1,000 a year ago.

- Completed repurchase of 112,066 shares (0.21%) for $3.09 million under recent buyback program.

- Dropped from multiple indices, including the Russell Microcap, Russell Microcap Value, Russell 3000E, and Russell 3000E Value indices.

Valuation Changes

Summary of Valuation Changes for Stellar Bancorp

- The Consensus Analyst Price Target has significantly risen from $28.36 to $31.60.

- The Consensus Revenue Growth forecasts for Stellar Bancorp has significantly risen from 1.2% per annum to 1.5% per annum.

- The Net Profit Margin for Stellar Bancorp has risen from 18.69% to 20.25%.

Key Takeaways

- High expectations for margin growth and branch-driven advantage may underestimate risks from digital disruption and declining relevance of physical branches.

- Valuation overlooks challenges from geographic concentration, integration risks, and rising compliance and technology costs, threatening long-term earnings stability.

- Favorable market trends, strong expense discipline, and strategic investments position Stellar Bancorp for resilient growth, improved profitability, and continued shareholder value enhancement.

Catalysts

About Stellar Bancorp- Operates as the bank holding company that provides a range of commercial banking products and services primarily to small and medium-sized businesses, professionals, and individual customers.

- Share price appears to reflect high expectations that Stellar Bancorp can effectively defend and grow margins through core deposit growth and disciplined relationship banking, despite intensifying competition from digital-first banks and fintechs, posing risk to long-term revenue and net margin stability if digital disruption accelerates.

- The current valuation seems to assume continued organic loan growth and sustained market share gains, banking on robust Texas/Southwest economic trends and small business expansion, while underestimating risk from geographic concentration and potential regional economic downturns that could pressure loan growth and future earnings.

- Investors seem to discount the challenge of rising compliance, technology, and ESG-related costs, as increased regulatory and stakeholder requirements may outpace operational leverage improvements, resulting in longer-term net margin compression.

- The share price likely prices in full and timely realization of merger-related synergies from Allegiance and CBTX, with little room for integration setbacks or cost overhang, which could dampen near-term earnings and inflate the expense base if synergies fall short.

- Valuation appears to presume that branch network relevancy and relationship banking will drive sustainable competitive advantage, discounting structural headwinds from declining physical branch usage and secular shift to online engagement, factors that could weaken cross-sell rates and constrain revenue growth over time.

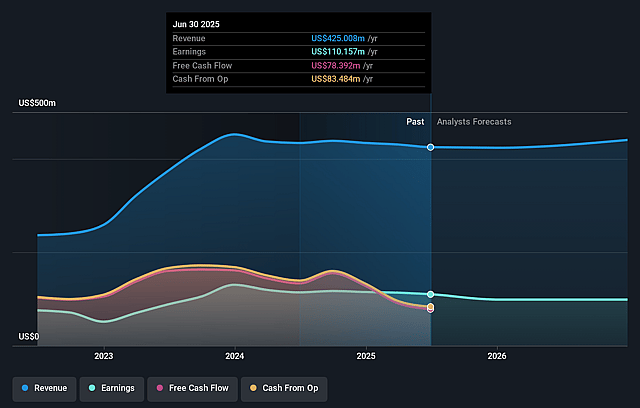

Stellar Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Stellar Bancorp's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.9% today to 20.2% in 3 years time.

- Analysts expect earnings to reach $89.9 million (and earnings per share of $1.83) by about September 2028, down from $110.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from 14.6x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 3.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Stellar Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Stellar Bancorp operates in a rapidly growing Texas market benefiting from favorable demographic and business migration trends, which underpins sustained commercial banking and small business loan demand and could drive ongoing revenue and earnings growth.

- The company has demonstrated effective expense management and positive operating leverage, reporting flat or improved non-interest expenses alongside growing net income and tangible book value, suggesting the potential for expanding net margins and stronger long-term profitability.

- Recent strategic investments in new talent, digital platforms, and expansion of C&I lending offer opportunities to further diversify revenue streams, improve customer acquisition and retention, and reduce risk concentrations, supporting more resilient earnings over time.

- Stellar's strong capital position (risk-based capital ratio of 15.98%), robust liquidity, and active share repurchase program provide the financial flexibility to pursue opportunistic growth via organic expansion or selective M&A, which could enhance shareholder value and buffer earnings volatility.

- The ability to maintain a structurally strong core net interest margin-currently above industry averages-and the likelihood of margin improvement should rates decline or funding composition continues to favor core sources, position Stellar Bancorp to defend and potentially grow net interest income and overall profitability in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.6 for Stellar Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $444.2 million, earnings will come to $89.9 million, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $31.33, the analyst price target of $31.6 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.