Key Takeaways

- Successful deposit growth and loan repricing improve liquidity and net interest margin outlook, supporting future revenue growth opportunities for SouthState.

- The sale-leaseback transaction and merger integration offer capital deployment and cost savings, potentially boosting earnings and expanding growth in key markets.

- Federal rate cuts and economic uncertainties may pressure SouthState's net interest income, liquidity projections, and revenue growth, increasing credit risk and operating expenses.

Catalysts

About SouthState- Operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies.

- SouthState's successful deposit growth in all regions, despite cutting deposit rates, indicates improved liquidity and more rational deposit pricing. This improvement supports future revenue growth and a positive net interest margin (NIM) outlook.

- The sale-leaseback transaction will free up $225 million of off-balance sheet capital, which can be converted into future revenue growth, potentially boosting earnings by deploying this capital into higher-yielding investments.

- The early approval and expected integration of Independent Financial by Memorial Day 2025 presents cost savings opportunities and the chance to accelerate growth in attractive markets like Texas and Colorado, which could drive earnings expansion post-integration.

- The continued repricing of SouthState's legacy loan book from the high 4% range into the high 6%-7% range offers a significant opportunity for NIM expansion, projected to add around 3 basis points per quarter, potentially boosting net interest income.

- Potential securities portfolio restructuring using excess capital from both the sale-leaseback and merger marks could neutralize anticipated additional lease expenses and further expand NIM by approximately 5 basis points, enhancing overall earnings.

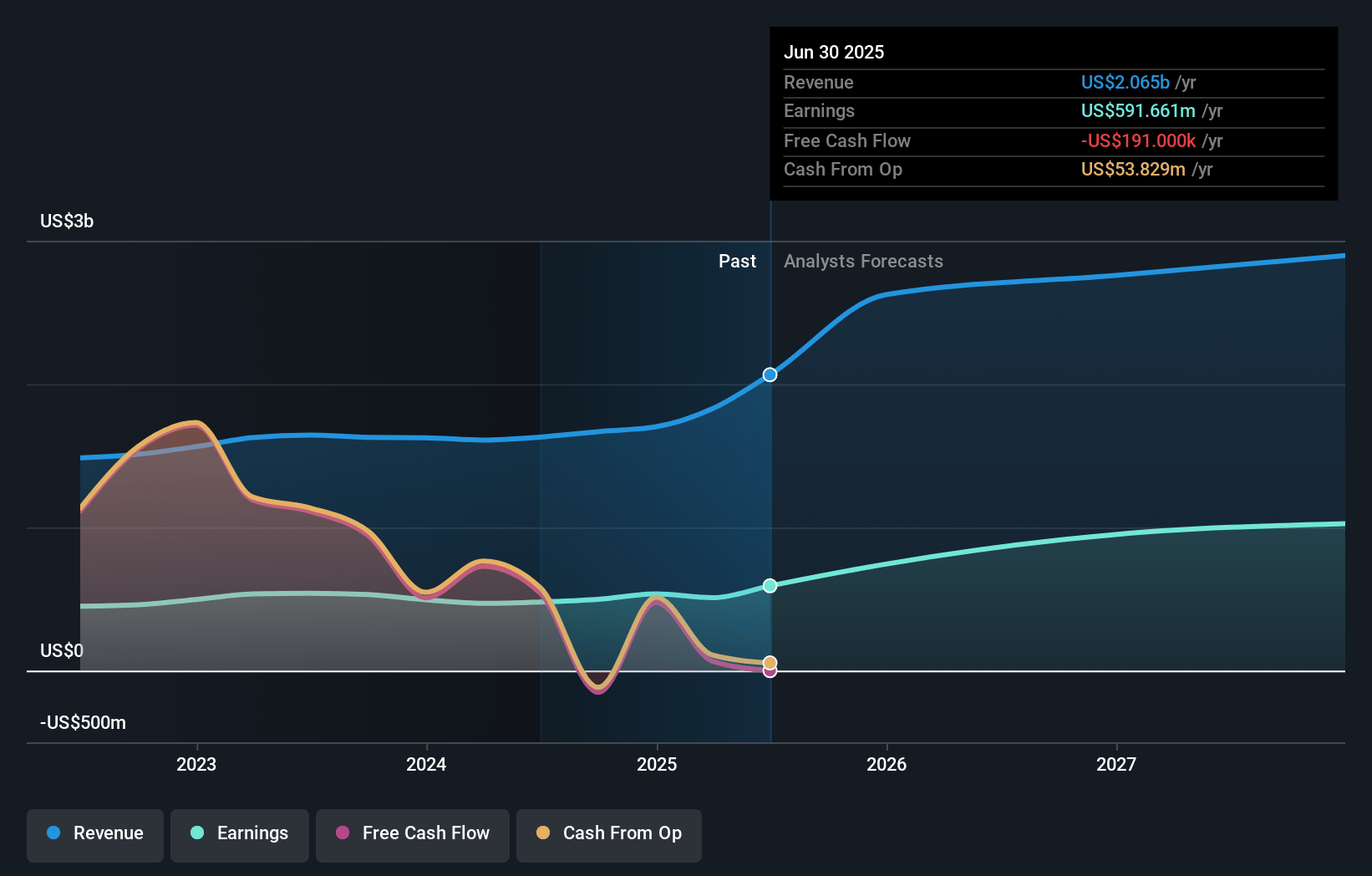

SouthState Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SouthState's revenue will grow by 19.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.4% today to 36.0% in 3 years time.

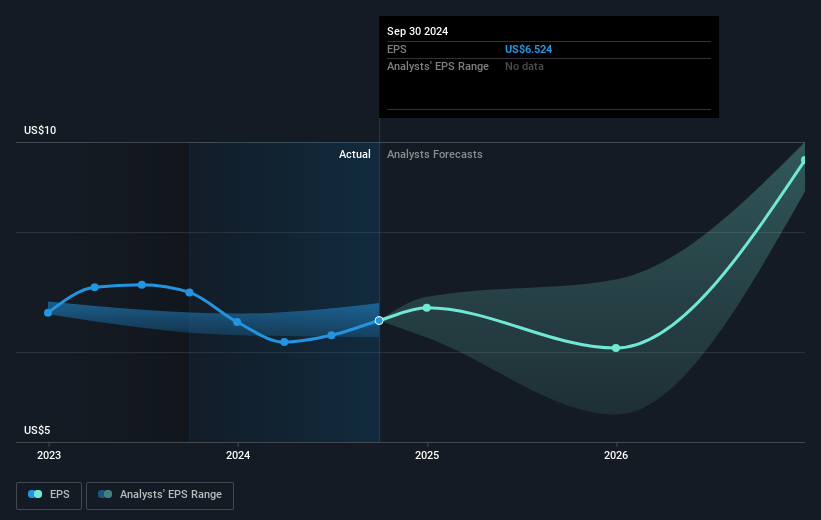

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $10.23) by about March 2028, up from $534.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.6x on those 2028 earnings, which is the same as it is today today. This future PE is greater than the current PE for the US Banks industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

SouthState Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Federal Reserve's rate cuts in September could pressure SouthState's net interest margin if lower rates affect loan pricing more than deposit costs, potentially decreasing future net interest income and profits.

- Seasonal and municipal deposit growth seen in the fourth quarter might inflate deposit figures temporarily; a reliance on these could overstate liquidity improvements and thus future revenue projections.

- The sale-leaseback transaction could increase future non-interest expenses because of higher lease costs, which might erode net earnings and operating leverage if not offset by additional revenue streams.

- A slowdown in loan pipeline growth, especially in key markets, could affect revenue growth targets, particularly given current economic uncertainties and interest rate fluctuations.

- Classified asset increases due to rising floating interest rates, even with positive client payment performance, may increase credit risk and loan loss provisions, impacting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $124.333 for SouthState based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $109.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 17.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $92.93, the analyst price target of $124.33 is 25.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives