Narratives are currently in beta

Key Takeaways

- Strategic securities sales and reinvestment aim to enhance net interest income, boosting revenue growth.

- A strong loan pipeline and lower funding costs are projected to drive revenue and improve net margins.

- Strategic sale of securities and growth strategy over increasing assets could reveal balance sheet issues, higher costs, and regulatory pressures impacting net income and margins.

Catalysts

About National Bank Holdings- Operates as the bank holding company for NBH Bank that provides various banking products and financial services to commercial, business, and consumer clients in the United States.

- The strategic sale of investment securities and reinvestment in higher-yielding securities is set to enhance net interest income in 2025. This is expected to positively impact revenue growth.

- Projected mid-single digit loan growth for 2025, supported by a strong loan pipeline and economic activity, is expected to drive revenue increases.

- The proactive execution of a deposit strategy, leading to lower funding costs, is likely to maintain a strong net interest margin and improve net margins.

- Continued growth in tangible book value and a solid capital base provide optionality for M&A and strategic market expansion, potentially boosting future earnings.

- The ongoing development and eventual rollout of the 2UniFi platform, with increased investments in 2025, could diversify and increase noninterest income if successful, positively impacting earnings.

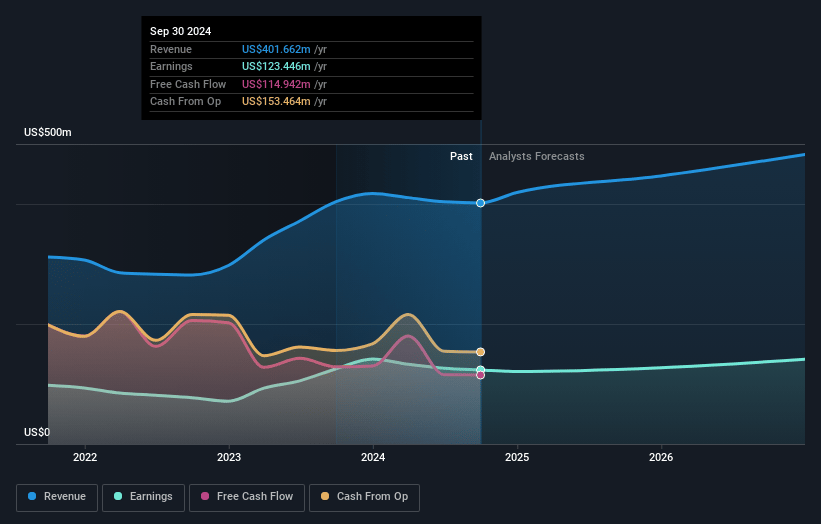

National Bank Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National Bank Holdings's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.7% today to 28.3% in 3 years time.

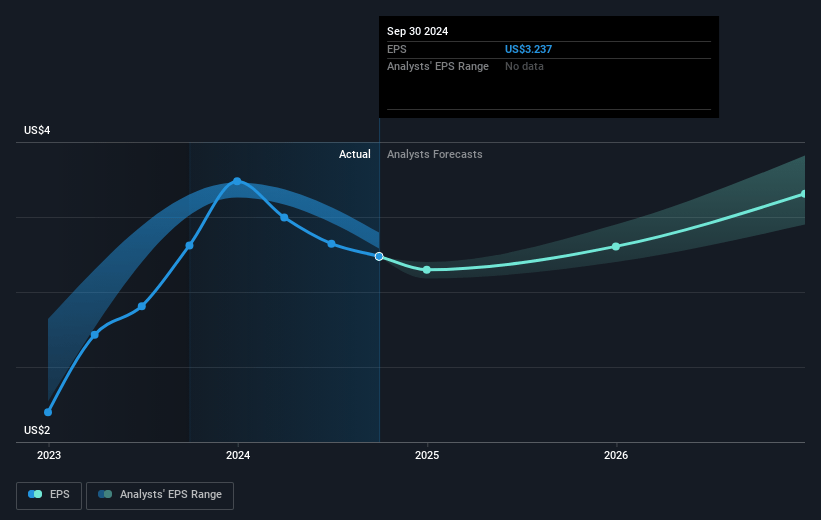

- Analysts expect earnings to reach $147.8 million (and earnings per share of $3.81) by about January 2028, up from $118.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 13.7x today. This future PE is greater than the current PE for the US Banks industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

National Bank Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strategic sale of $130 million in investment securities, resulting in a $5 million after-tax loss, could signal potential issues in balance sheet management, impacting net income.

- The guidance for 2025 does not account for potential future interest rate changes by the Fed, which could negatively affect net interest margin predictions if rates rise unexpectedly, impacting earnings.

- There is reliance on the development of 2UniFi, with projected expenses of $27-29 million, but no forecasted revenue yet, posing a risk to future profit margins if the platform does not generate the expected returns.

- The potential rise in nonperforming assets, particularly in the transportation sector, could pose risks to asset quality and impact future net income through increased provisioning or charge-offs.

- The growth strategy over $10 billion in assets could lead to increased regulatory costs and the Durbin impact, which might put pressure on net margins if not offset by sufficient revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $49.0 for National Bank Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $521.3 million, earnings will come to $147.8 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of $42.9, the analyst's price target of $49.0 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives