Narratives are currently in beta

Key Takeaways

- Exiting BaaS and securing replacement deposits positions Metropolitan Bank Holding for market share growth and improved net interest income.

- Investments in technology and expansion of net interest margin should support scalable growth, enhanced profitability, and increased shareholder value.

- The company's exit from BaaS, significant tech investments, and reliance on new deposit growth risk hurting revenue and net earnings due to potential execution and growth shortfalls.

Catalysts

About Metropolitan Bank Holding- Operates as the bank holding company for Metropolitan Commercial Bank that provides a range of business, commercial, and retail banking products and services to small businesses, middle-market enterprises, public entities, and individuals in the New York metropolitan area.

- The exit from the BaaS business and the ability to economically replace associated deposit runoff with increased deposits positions Metropolitan Bank Holding to expand market share, positively impacting net interest income.

- Ongoing investment in a new technology stack is already yielding returns, particularly within the payments platform, which should support scalable growth and potentially increase earnings.

- Expected expansion of the net interest margin (NIM) through 2025 should contribute to enhanced profitability and earnings, aiming for a robust core NIM approaching 3.75% or 3.8%.

- Focus on capturing additional market share through traditional channels and strategic opportunities could drive revenue growth and enhance shareholder value.

- Healthy asset quality and strong credit metrics, without any broad-based negative trends, support stable net margins and secure positive earnings potential moving forward.

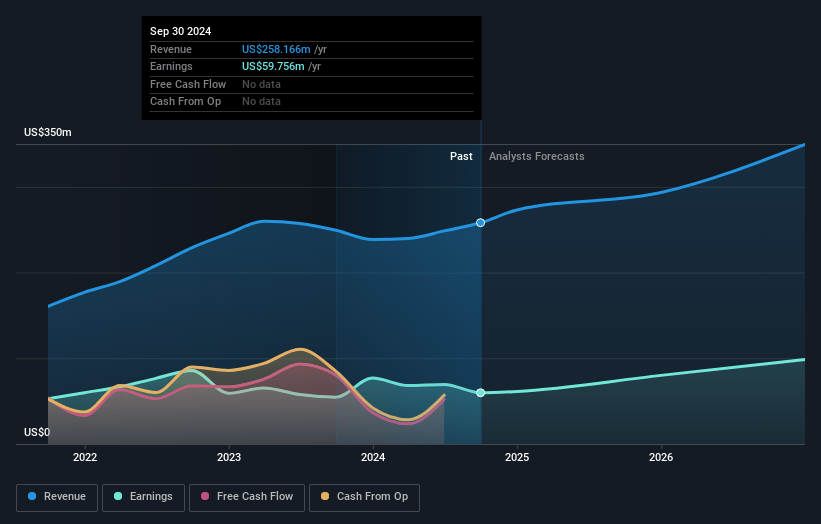

Metropolitan Bank Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Metropolitan Bank Holding's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.6% today to 32.8% in 3 years time.

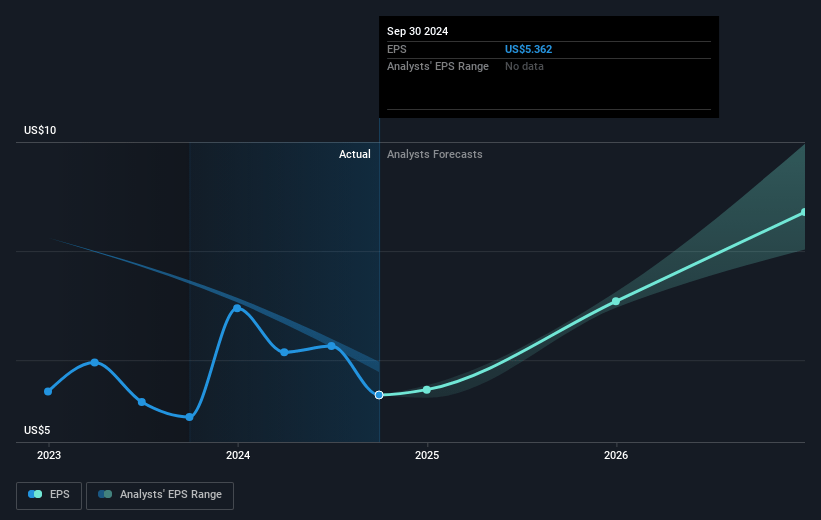

- Analysts expect earnings to reach $121.4 million (and earnings per share of $10.58) by about January 2028, up from $66.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.0x on those 2028 earnings, down from 10.9x today. This future PE is lower than the current PE for the US Banks industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.41%, as per the Simply Wall St company report.

Metropolitan Bank Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The exit from the BaaS business, despite being successfully managed, could potentially lead to a short-term negative impact on deposit balances and associated revenue, as the previous contributions from this business segment are removed. This could affect overall revenue stability.

- The company's significant investment in a new technology stack and digital transformation comes with inherent risk of execution delays and budget overruns. These could increase operational expenses, ultimately impacting net margins negatively if returns on these investments do not materialize as projected.

- The forecasted decrease in noninterest income due to the cessation of GPG-related revenue could negatively impact net earnings. With such income streams being unrecoverable, future profitability might be pressured if not compensated by growth in other areas.

- The expectation of significant onetime costs related to IT initiatives and the planned digital transformation project could elevate operational expenses, reducing net earnings if these projects do not deliver anticipated efficiencies or revenue enhancements in the short to medium term.

- The reliance on core deposit growth and the introduction of new deposit verticals to compensate for lost GPG deposits presents a risk. Should these new initiatives fail to meet expectations, there could be negative implications for liquidity management and earnings projections in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $82.17 for Metropolitan Bank Holding based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $369.8 million, earnings will come to $121.4 million, and it would be trading on a PE ratio of 9.0x, assuming you use a discount rate of 6.4%.

- Given the current share price of $64.66, the analyst's price target of $82.17 is 21.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives