Narratives are currently in beta

Key Takeaways

- The firm faces revenue pressure from deposit margin compression and potential declines in net interest income due to unpredictable interest rate changes.

- Rising credit costs driven by increased charge-offs in consumer credit and uncertainty in capital deployment may stress net margins and earnings.

- Strategic market positions, strong asset management, and investments in AI and tech indicate potential for enhanced efficiencies, stable earnings, and revenue growth.

Catalysts

About JPMorgan Chase- Operates as a financial services company worldwide.

- JPMorgan Chase expects ongoing deposit margin compression and lower deposit balances in Banking & Wealth Management, which could impact future revenue growth negatively as traditional deposit-taking becomes less profitable.

- The firm sees potential sequential declines in net interest income (NII) due to the yield curve and expected deposit behavior, suggesting potential negative effects on future earnings if interest rates continue to fluctuate unpredictably.

- Credit costs are being driven higher by increased net charge-offs primarily in Card, which may indicate stress in consumer credit and could negatively affect net margins and earnings if these trends persist.

- Despite increasing expenses due to investments in technology and employee compensation, the firm maintains a cautious outlook on expenditures, which could pressure net margins unless growth in revenue streams compensates for the higher costs.

- There is uncertainty concerning the capital deployment strategy, particularly surrounding potential future regulatory changes and higher shareholder returns in a high capital environment, which could lead to question marks over future EPS if capital is not effectively deployed or returned.

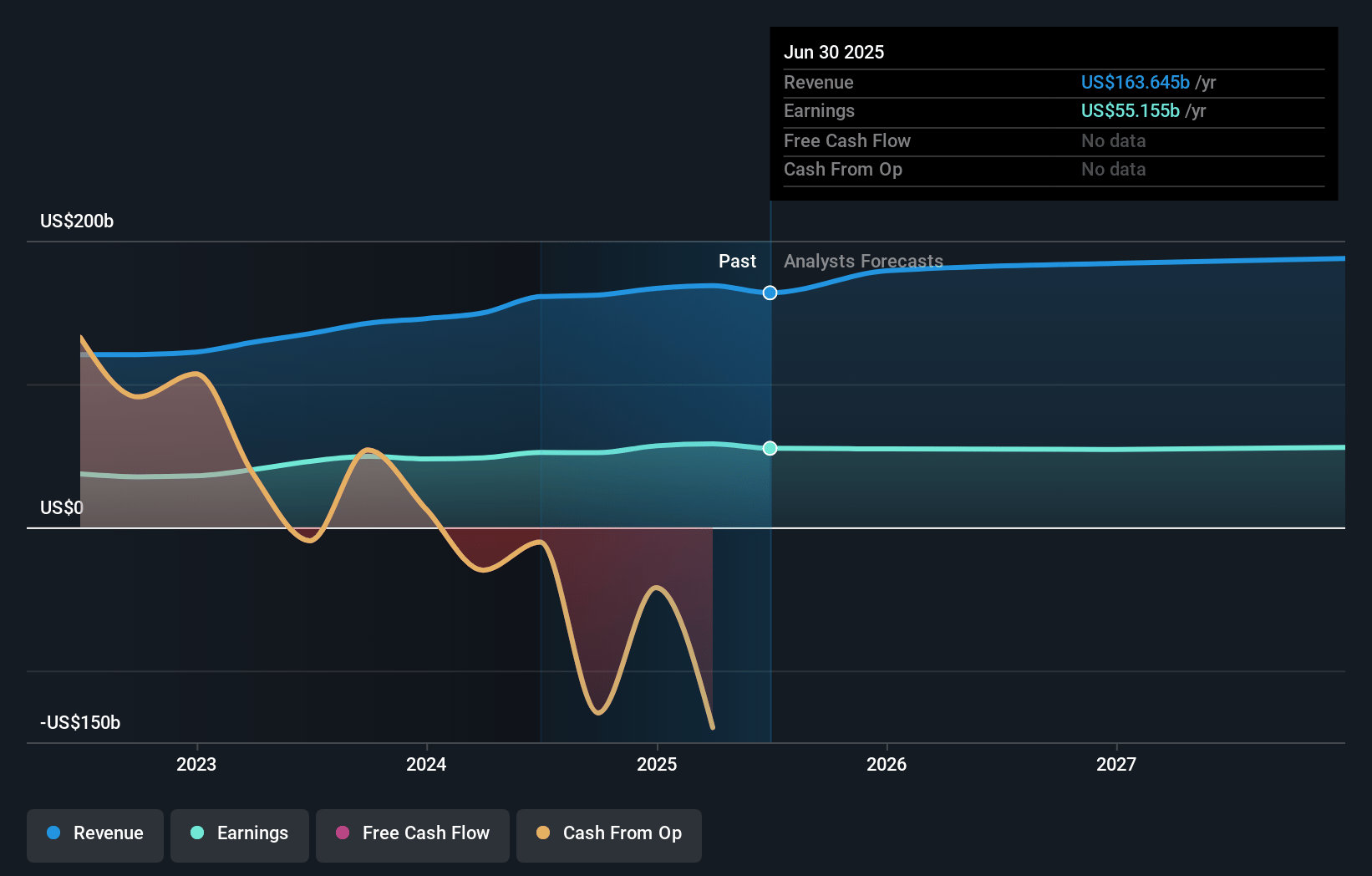

JPMorgan Chase Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming JPMorgan Chase's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.1% today to 27.2% in 3 years time.

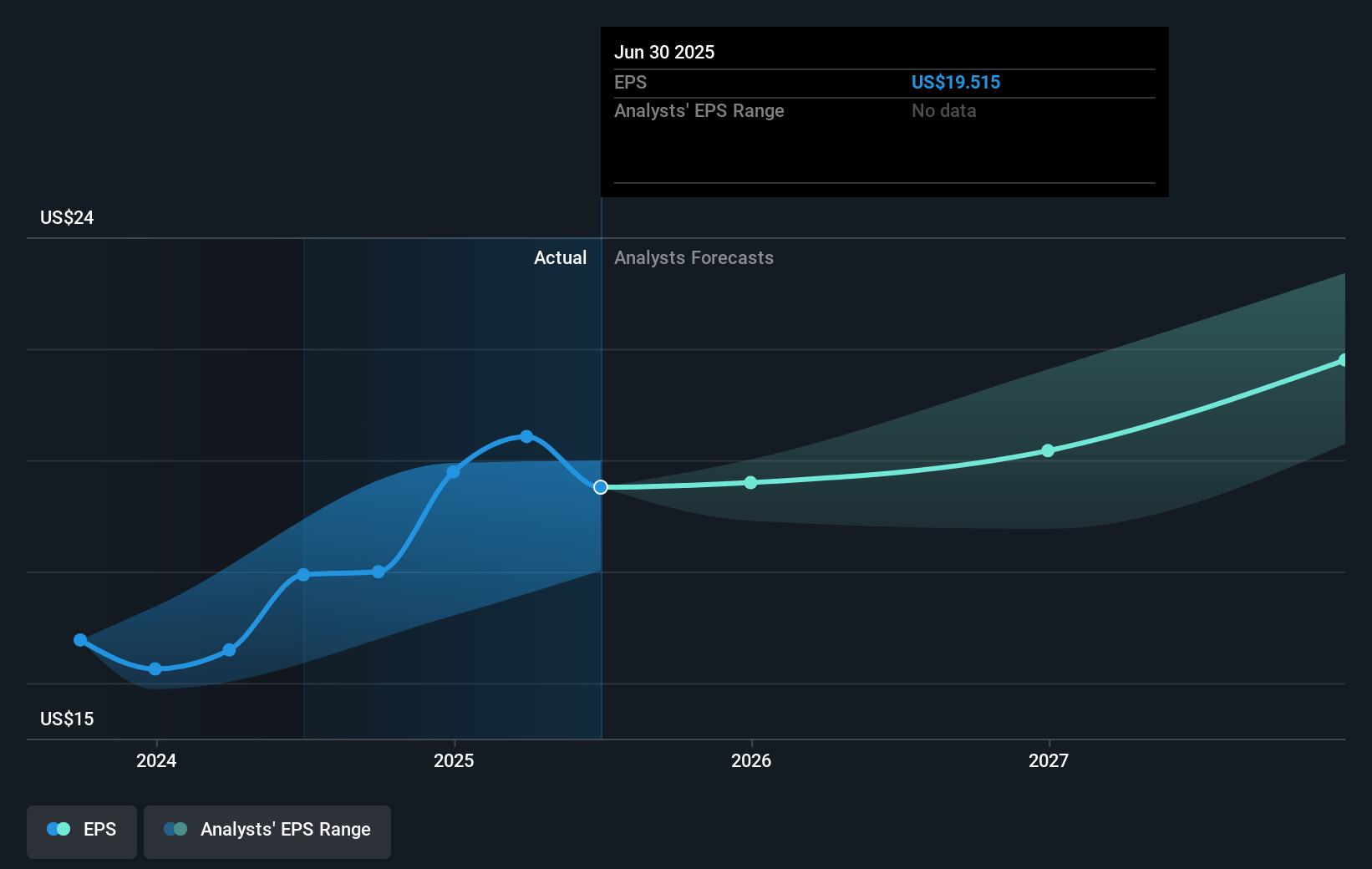

- Analysts expect earnings to reach $45.3 billion (and earnings per share of $17.3) by about November 2027, down from $52.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.9x on those 2027 earnings, up from 13.1x today. This future PE is greater than the current PE for the US Banks industry at 12.8x.

- Analysts expect the number of shares outstanding to decline by 2.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

JPMorgan Chase Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- JPMorgan Chase reported strong financial performance in the third quarter of 2024, with net income reaching $12.9 billion and revenues growing by 6% year-on-year, which suggests healthy earnings and resilient profit margins.

- The company maintained its #1 position in retail deposit share, and ranked highly in investment banking fees; strong market positioning may contribute to steady revenue streams and future revenue growth.

- JPMorgan Chase saw record quarterly revenues and long-term flows in Asset and Wealth Management, indicating effective management and growth in client assets, which can lead to higher management fee revenues and improved net margins.

- The firm reported healthy credit performance with well-managed credit costs and a robust CET1 ratio of 15.3%, indicating strong capital adequacy and risk management, which are favorable for maintaining earnings stability.

- Growing interest in markets and asset management, combined with strategic investments in AI and technology, suggest potential for boosting efficiencies and margins, which could positively influence future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $237.81 for JPMorgan Chase based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $270.0, and the most bearish reporting a price target of just $178.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $166.7 billion, earnings will come to $45.3 billion, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of $243.09, the analyst's price target of $237.81 is 2.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives