Narratives are currently in beta

Key Takeaways

- Expected growth in net interest income and strong fee growth in wealth and global markets suggest potential revenue and earnings increases.

- Investment in digital services and significant capital returns to shareholders may improve margins and drive future earnings per share growth.

- Slower growth and rate uncertainties threaten Bank of America's future revenues and earnings, while digital expansion's potential is capped by existing adoption levels.

Catalysts

About Bank of America- Through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

- Bank of America expects net interest income (NII) to grow in the coming quarters, even in the face of anticipated rate cuts. This is due to the repricing of fixed-rate assets into higher-yielding ones, indicating potential revenue growth.

- The bank continues to see strong year-over-year fee growth in its Wealth and Investment Management business and its Global Markets businesses, driven by increases in sales and trading revenue and brokerage fees, potentially boosting future earnings.

- Organic growth in consumer banking with net new checking accounts and increases in digital engagement indicate potential for future revenue increases and efficiency improvements, impacting net margins positively.

- Investment in digital capabilities and the expansion of online banking services have led to high levels of digital engagement among clients, which could enhance customer experience and reduce operational costs, thereby improving net margins.

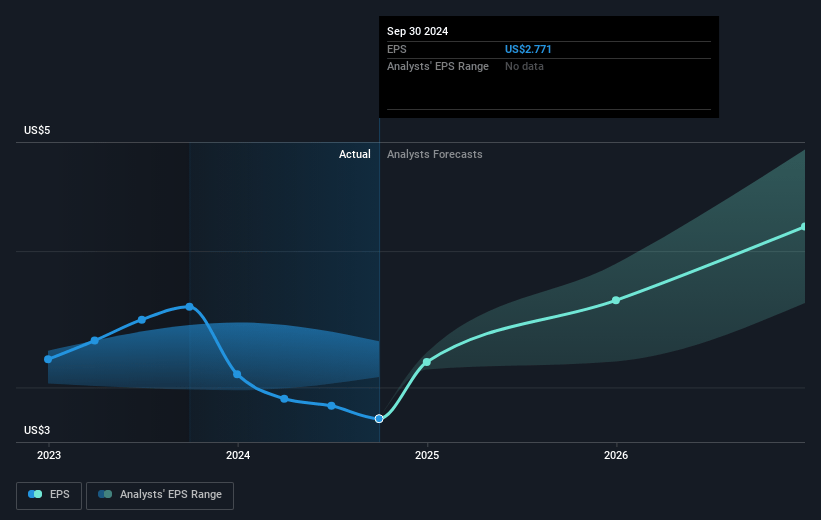

- Bank of America is returning significant capital to shareholders through share buybacks, with $5.6 billion returned this quarter. This could drive earnings per share (EPS) growth in the future if continued.

Bank of America Future Earnings and Revenue Growth

Assumptions

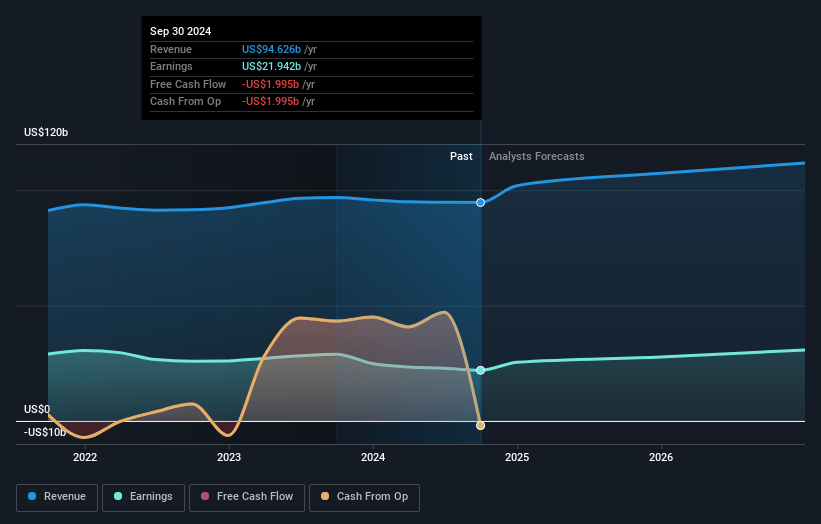

How have these above catalysts been quantified?- Analysts are assuming Bank of America's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.2% today to 26.7% in 3 years time.

- Analysts expect earnings to reach $30.3 billion (and earnings per share of $4.19) by about January 2028, up from $21.9 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $35.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, down from 16.1x today. This future PE is greater than the current PE for the US Banks industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.16%, as per the Simply Wall St company report.

Bank of America Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The current economic environment is characterized by slower growth and falling inflation, which might negatively impact future revenue growth prospects for Bank of America.

- Uncertainty around interest rates and potential rate cuts can impact net interest income, with significant fluctuations likely to affect future earnings.

- While consumer credit quality remains strong, increasing borrowing costs for small and medium-sized businesses could lead to a slow uptake in commercial loans, affecting overall loan growth and net margins.

- Expense growth driven by sales and trading incentives and investments may impact net margins if the anticipated fee-based revenue growth does not materialize.

- While digital expansion is emphasized, the high level of existing digital adoption raises questions about further incremental revenue growth opportunities in this area.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $50.85 for Bank of America based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $58.0, and the most bearish reporting a price target of just $39.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $113.6 billion, earnings will come to $30.3 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 7.2%.

- Given the current share price of $46.08, the analyst's price target of $50.85 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

RI

Equity Analyst and Writer

Underwater Bond Holdings Will Squeeze its Net Interest Margin

Key Takeaways Banks are being forced to offer higher rates to keep deposits. Lending will remain slow, which will squeeze net interest margins.

View narrativeUS$44.16

FV

5.4% overvalued intrinsic discount2.00%

Revenue growth p.a.

5users have liked this narrative

0users have commented on this narrative

8users have followed this narrative

2 months ago author updated this narrative

ST

Equity Analyst and Writer

Consolidation In The Banking Sector Will Increase Revenues

Key Takeaways BAC offers diverse services globally including banking, investments, risk management, and more to public and private clients. As a Big 4 US bank, it remains strong despite sector turmoil, poised for consolidation, and maintains a solid brand.

View narrativeUS$34.26

FV

35.8% overvalued intrinsic discount4.05%

Revenue growth p.a.

10users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

7 months ago author updated this narrative