Last Update 29 Oct 25

Fair value Decreased 0.37%Expanding Fintech Partnerships Will Drive Future Success

Analysts have revised Bancorp's fair value estimate slightly downward from $70.76 to $70.50 due to concerns about a significant projected decline in revenue growth, even though stronger profit margins are anticipated.

What's in the News

- TIAA Wealth Management & Advice Solutions launched new securities-backed lending and digital estate planning services through strategic partnerships with The Bancorp and Trust & Will. This expands holistic wealth management offerings (Key Developments).

- The Bancorp reaffirmed its earnings guidance and is maintaining a target of $5.25 earnings per share for 2025 (Key Developments).

- The company completed the repurchase of 1,438,343 shares for $75.01 million under its buyback plan, covering 3.05% of outstanding shares as of June 30, 2025 (Key Developments).

- On July 7, 2025, The Bancorp increased its equity buyback authorization by $350 million. This brings the total to $500 million and extends the plan through year-end 2026 (Key Developments).

Valuation Changes

- Fair Value Estimate has decreased slightly from $70.76 to $70.50.

- Discount Rate has risen from 6.21% to 6.78%.

- Revenue Growth outlook has shifted sharply. The projection has moved from an increase of 14.54% to an anticipated decline of 15.92%.

- Net Profit Margin is now projected significantly higher, increasing from 67.74% to 111.58%.

- Future P/E Ratio estimate has increased from 9.32x to 10.03x.

Key Takeaways

- Growth in Fintech Solutions through partnerships and credit sponsorship is expected to significantly boost revenue and earnings.

- Share buybacks and improved asset quality management are set to enhance earnings per share and net margins.

- Heavy reliance on fintech partners and REBL loans poses revenue and profitability risks amid potential market and regulatory changes and economic stress in the lending sector.

Catalysts

About Bancorp- Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

- The Bancorp is experiencing substantial growth in Fintech Solutions, driven by increasing volumes and expanded partnerships. This growth is expected to continue with credit sponsorship and higher fees from ACH, card, and payment processing. These initiatives are likely to boost revenue significantly in the coming years.

- The Fintech Solutions Group's addition of new partnerships and expansion of existing programs—particularly in credit sponsorship—is anticipated to drive significant increases in future earnings. This is due to expected balances reaching $1 billion by the end of 2025.

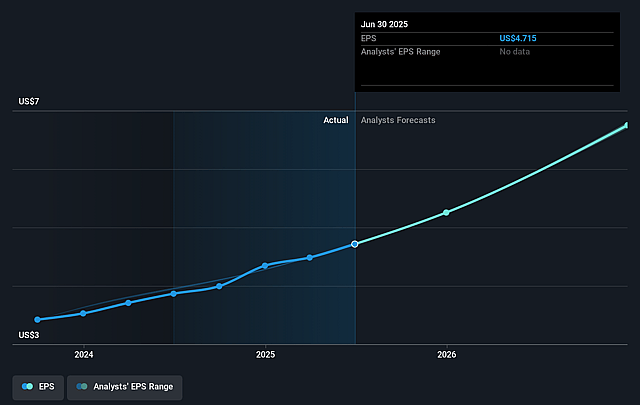

- The company plans substantial share buybacks totaling $150 million in 2025, which should reduce the number of shares outstanding and increase earnings per share (EPS).

- Improved management of substandard loans through portfolio sales and repayments indicates enhanced asset quality, potentially improving net margins by reducing provisions for credit losses.

- The anticipated adoption of higher-yielding loans with consumer fintech partnerships could lead to increased interest income alongside fee growth, bolstering overall earnings.

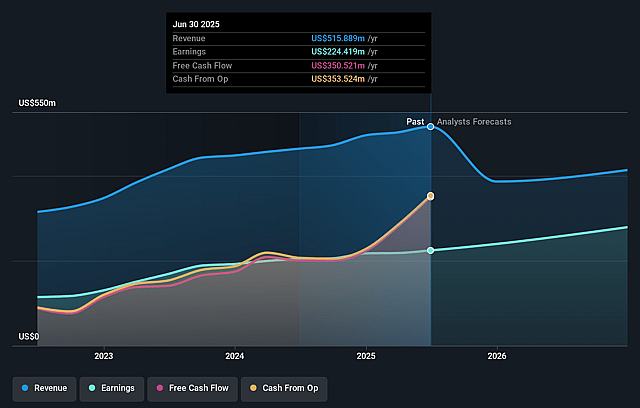

Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bancorp's revenue will decrease by 0.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 43.9% today to 67.7% in 3 years time.

- Analysts expect earnings to reach $337.0 million (and earnings per share of $7.86) by about April 2028, up from $217.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.3x on those 2028 earnings, down from 10.0x today. This future PE is lower than the current PE for the US Banks industry at 10.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant growth in fees from fintech activities, especially with credit sponsorship and payment processing, could become volatile if the fintech market faces regulatory changes or competition, potentially impacting revenue stability.

- The concentration in fintech partnerships might present a risk if any of these significant partners face financial difficulties, leading to potential revenue and profitability fluctuations due to dependency on a limited number of clients.

- Potential margin pressure is an ongoing risk, as the company's net interest margin has contracted due to cash balance growth driven by deposit increases, which may not be sustained if interest rates decline, impacting net income.

- The repayment of senior secured debt and potential future debt issuance related to buybacks may influence the firm's ability to maintain high levels of capital deployment for reinvestments or buybacks, affecting earnings growth expectations.

- The risks related to REBL loans and their portfolio stability could pose challenges if the real estate bridge lending sector experiences economic stress, potentially impacting net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $69.0 for Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $497.5 million, earnings will come to $337.0 million, and it would be trading on a PE ratio of 9.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of $45.82, the analyst price target of $69.0 is 33.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.