Key Takeaways

- Focused expansion and investment in digital banking strengthen growth prospects, customer retention, and operational efficiency within thriving regional markets.

- Strong capital base and disciplined risk management enable selective acquisitions and maintain financial stability through varying economic conditions.

- Persistent credit risk, subdued loan growth, rising expenses, and regional concentration threaten revenue and profit performance against competitors in an increasingly challenging banking environment.

Catalysts

About South Plains Financial- Operates as a bank holding company for City Bank that provides commercial and consumer financial services to small and medium-sized businesses and individuals.

- Expansion into rapidly growing Texas metro markets and ongoing recruitment of experienced lenders positions South Plains Financial to capture new loan and deposit relationships, supporting above-average long-term revenue growth.

- Healthy regional population and small business growth in the bank's footprint continues to drive organic loan demand and supports increased noninterest income through greater treasury and commercial banking activity, positively impacting core revenues and earnings stability.

- Accelerated investments in treasury management and digital banking are resulting in improved customer retention and a growing base of noninterest-bearing deposits, which is likely to further reduce funding costs and bolster net interest margins.

- The bank's strong capital position and favorable regulatory climate enable it to actively pursue selective, accretive M&A opportunities, creating potential for step-change growth, increased scale and long-term earnings expansion.

- Continued disciplined credit underwriting and conservative risk management, evidenced by solid credit quality metrics and proactive portfolio management, help maintain low credit costs and support stable, resilient net margins and earnings across economic cycles.

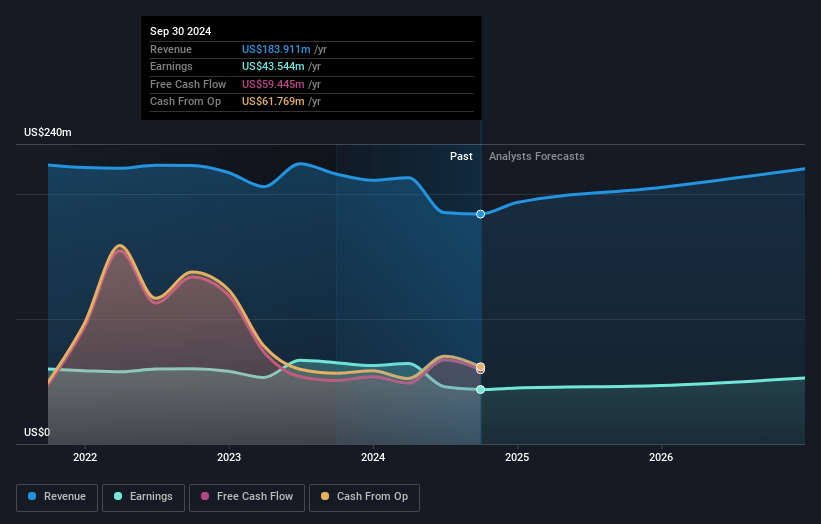

South Plains Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming South Plains Financial's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.4% today to 24.6% in 3 years time.

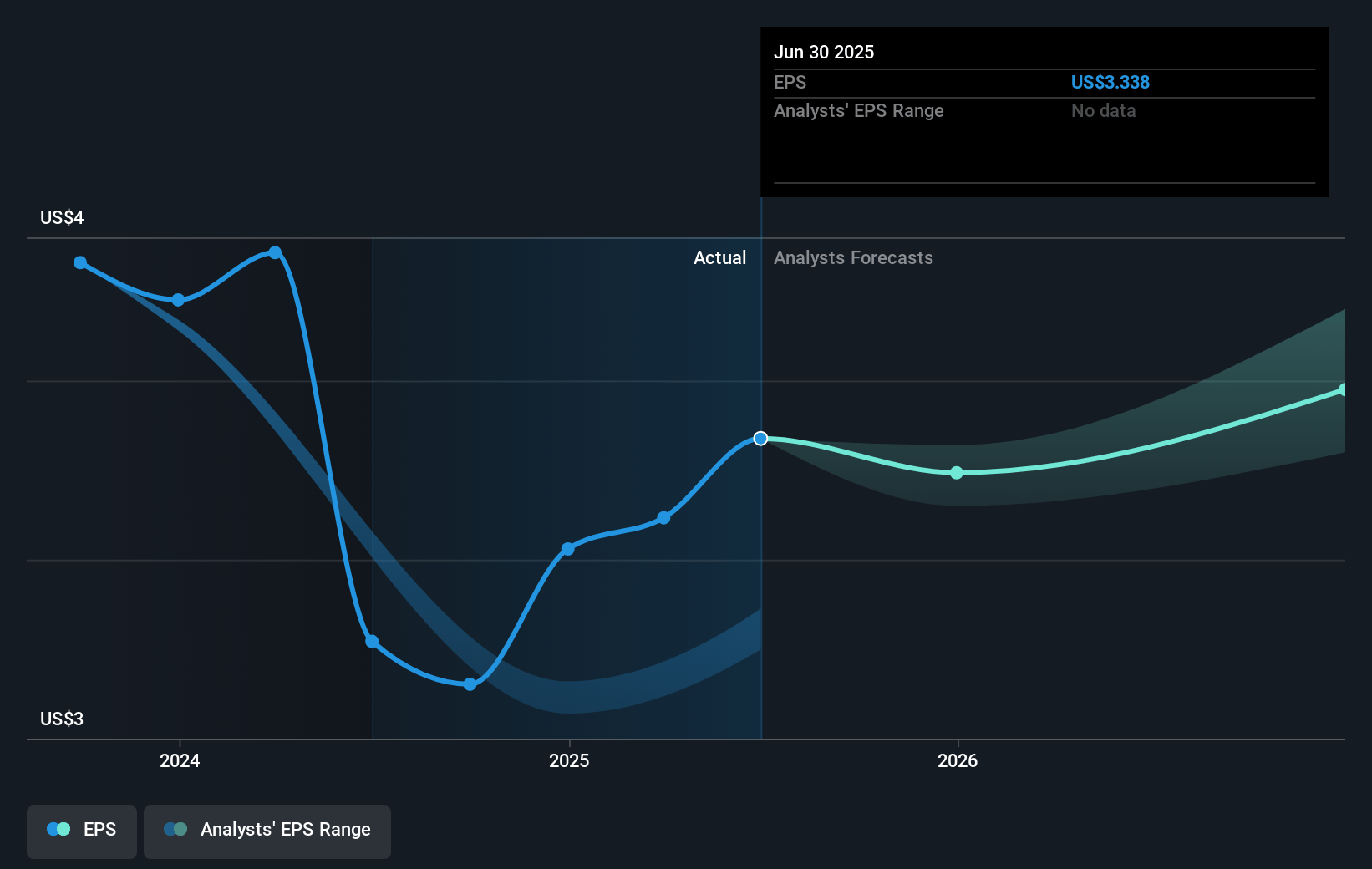

- Analysts expect earnings to reach $62.7 million (and earnings per share of $3.57) by about July 2028, up from $54.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.5x on those 2028 earnings, up from 12.2x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

South Plains Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent elevated loan payoffs, particularly in metro markets like Dallas, Houston, and El Paso, are outpacing new loan production and moderating portfolio growth, risking long-term stagnation in loan revenues and organic expansion.

- A rising provision for credit losses and specific credit quality downgrades, along with recent entries of loans into nonaccrual status, indicate growing credit risk, which could lead to higher net charge-offs and negatively impact net earnings and asset quality over time.

- The ongoing necessity to invest in hiring and infrastructure to drive future growth is contributing to higher noninterest expenses, which may outpace revenue growth if new hires do not quickly generate sufficient business, thus pressuring net margins.

- Declining indirect auto loan balances due to consumer behavior shifts and heightened caution around economic/tariff uncertainties signal vulnerability to external economic shocks, which could further weaken loan growth and contribute to revenue softness.

- Flat to low single-digit loan growth outlook, slow mortgage banking activity, and limited near-term NIM expansion (excluding one-time items), combined with ongoing regional concentration, present risks that South Plains Financial underperforms peers on revenue and profit growth in a highly competitive and consolidating banking landscape.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $43.5 for South Plains Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $254.6 million, earnings will come to $62.7 million, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 6.4%.

- Given the current share price of $41.17, the analyst price target of $43.5 is 5.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.