Narratives are currently in beta

Key Takeaways

- Diversifying into commercial and industrial loans reduces risk exposure and boosts revenue potential, while a high-touch service model improves net interest margins.

- Strong wealth management performance and a disciplined credit approach enhance earnings, supported by strategic M&A opportunities and effective deposit growth.

- Continued exposure to commercial real estate, particularly office spaces, poses risks to asset quality and revenue, with potential adverse impacts on profitability.

Catalysts

About Independent Bank- Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

- Independent Bank is actively managing its commercial real estate exposure and working to diversify its loan portfolio through strategic hires and an increased focus on commercial and industrial (C&I) loans. This diversification could enhance future revenue growth by reducing dependency on higher-risk segments.

- The growth in deposits, particularly noninterest-bearing accounts, will likely lead to an improved net interest margin, especially as the bank leverages its high-touch service model to maintain competitive deposit costs through potential Fed rate cuts. This positions the bank for margin expansion in the future.

- The bank’s strong performance in wealth management, with assets under administration reaching $7.2 billion, provides opportunities for increased noninterest income and cross-selling, which should enhance earnings over time.

- Independent Bank is focusing on disciplined credit underwriting and addressing problem loans proactively. This cautious approach could improve net margins by maintaining lower loan loss provisions and enhancing asset quality over time.

- With ample capital and historical success in mergers and acquisitions (M&A), the bank is poised to be an acquirer of choice, potentially boosting earnings through strategic acquisitions and operational synergies in the future.

Independent Bank Future Earnings and Revenue Growth

Assumptions

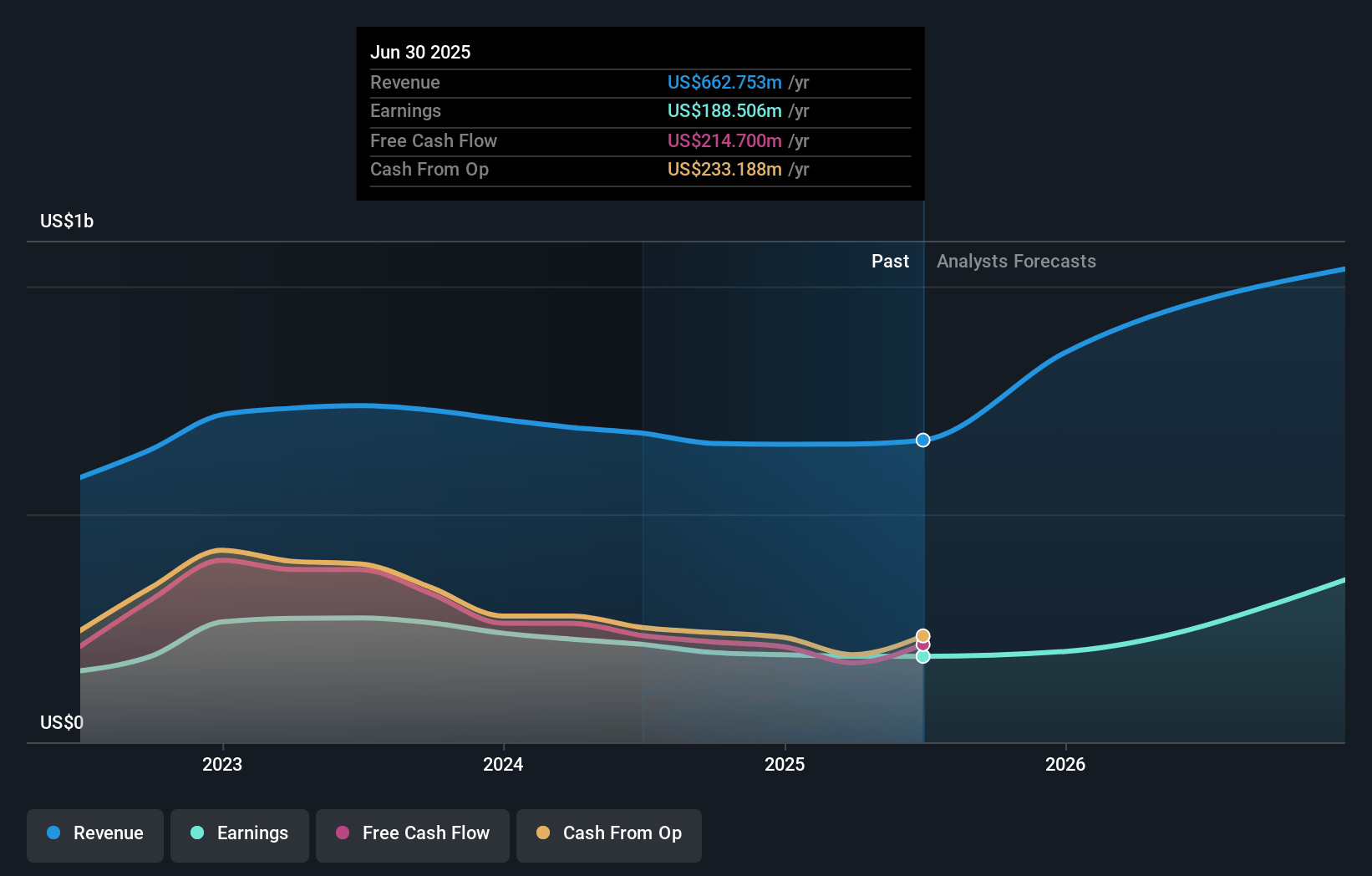

How have these above catalysts been quantified?- Analysts are assuming Independent Bank's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.0% today to 37.6% in 3 years time.

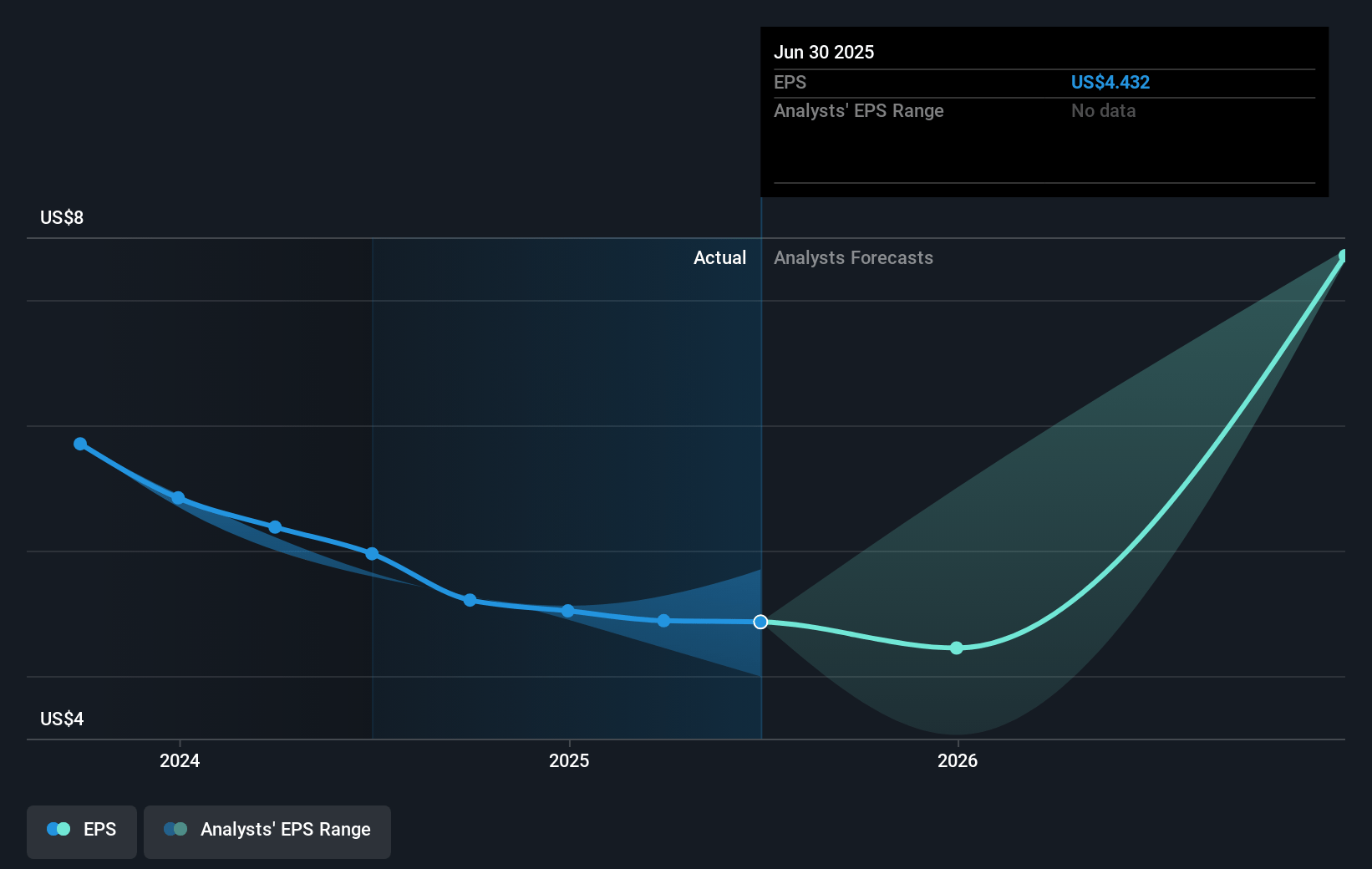

- Analysts expect earnings to reach $318.2 million (and earnings per share of $7.05) by about December 2027, up from $196.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $358.3 million in earnings, and the most bearish expecting $261.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2027 earnings, down from 15.4x today. This future PE is lower than the current PE for the US Banks industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 2.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Independent Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A large commercial real estate office loan maturing in early 2025 is experiencing stress, potentially impacting future earnings due to the uncertainty surrounding its resolution and the sizable reserve already established.

- Continued exposure to commercial real estate, particularly in office spaces, may present ongoing risks to asset quality and revenue, especially if market conditions for office space do not improve as anticipated.

- The downgrade of another $30 million syndicated office loan due to tenant loss could raise concerns about loan deterioration and ultimately pressure revenue if it leads to credit losses.

- The bank's heavy reliance on low-cost deposits and anticipated Fed rate cuts may lead to a narrower net interest margin and reduced revenue if deposit costs do not adjust downwards quickly enough.

- Given the possible rise in charge-offs associated with commercially acquired or non-performing loans, there could be an adverse impact on net margins and overall profitability in the near term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $74.0 for Independent Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $81.0, and the most bearish reporting a price target of just $64.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $846.8 million, earnings will come to $318.2 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $71.39, the analyst's price target of $74.0 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives