Key Takeaways

- Rapid fintech partnership growth and a branchless, digital model are boosting deposit efficiency, net margins, and operational scalability beyond market expectations.

- Strategic integration with fintechs and open banking migration position the company for long-term fee-based revenue and outsized market share growth.

- Elevated credit risks, asset concentration, greater competition, and rising compliance costs threaten earnings growth, customer retention, and sustainable profitability.

Catalysts

About First Internet Bancorp- Operates as the bank holding company for First Internet Bank of Indiana that provides various commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

- While analyst consensus expects strong loan growth and higher yields to continue, recent performance suggests that new originations-especially in high-demand commercial real estate and small business segments-could accelerate beyond expectations, driving a multi-year step-change in net interest income and revenue far above street forecasts.

- Analysts broadly agree that the growing impact of fintech partnership deposits will reduce deposit costs and improve net interest margin, but these partnerships are rapidly scaling, with deposit and fee income growth materially ahead of guidance; the bank's entrenched digital sponsor reputation may allow it to capture share at an accelerating rate, leading to ongoing margin and earnings outperformance.

- First Internet Bancorp's branchless, technology-driven model is now enabling operating leverage inflections, with ongoing cost discipline and automation driving sustainable improvements in efficiency ratio and long-run net margins, as digital adoption among both consumers and businesses structurally lowers cost-to-serve.

- As the regulatory environment around open banking continues to modernize, the company's early and successful integration with fintech partners positions it to capture new fee-based revenue streams and participate in industry consolidation-unlocking sources of long-term noninterest income growth not yet reflected in consensus.

- The accelerating, nationwide shift by businesses and consumers toward fully digital, remote, and personalized banking is increasing overall market share opportunity for digitally-native banks; as the only at-scale, branchless national lender in several specialty segments, First Internet Bancorp is poised for sustained loan and customer acquisition growth that could drive upside to both revenue and long-term earnings power.

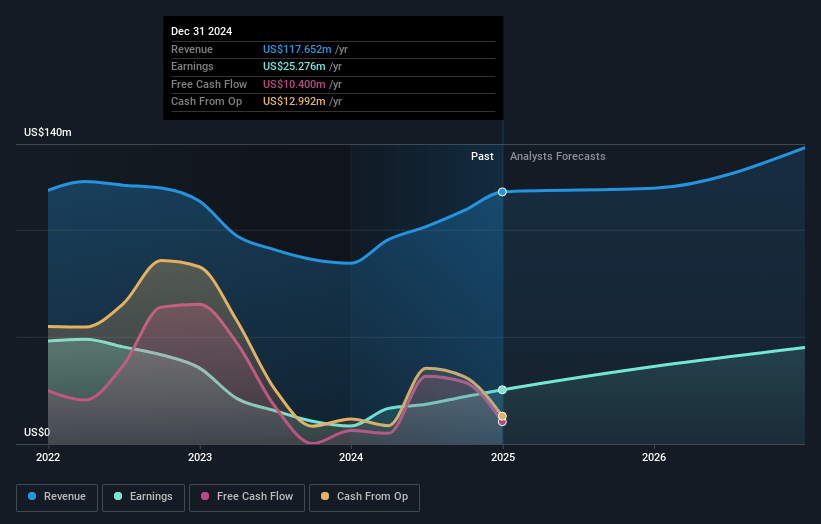

First Internet Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on First Internet Bancorp compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming First Internet Bancorp's revenue will grow by 17.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.4% today to 49.5% in 3 years time.

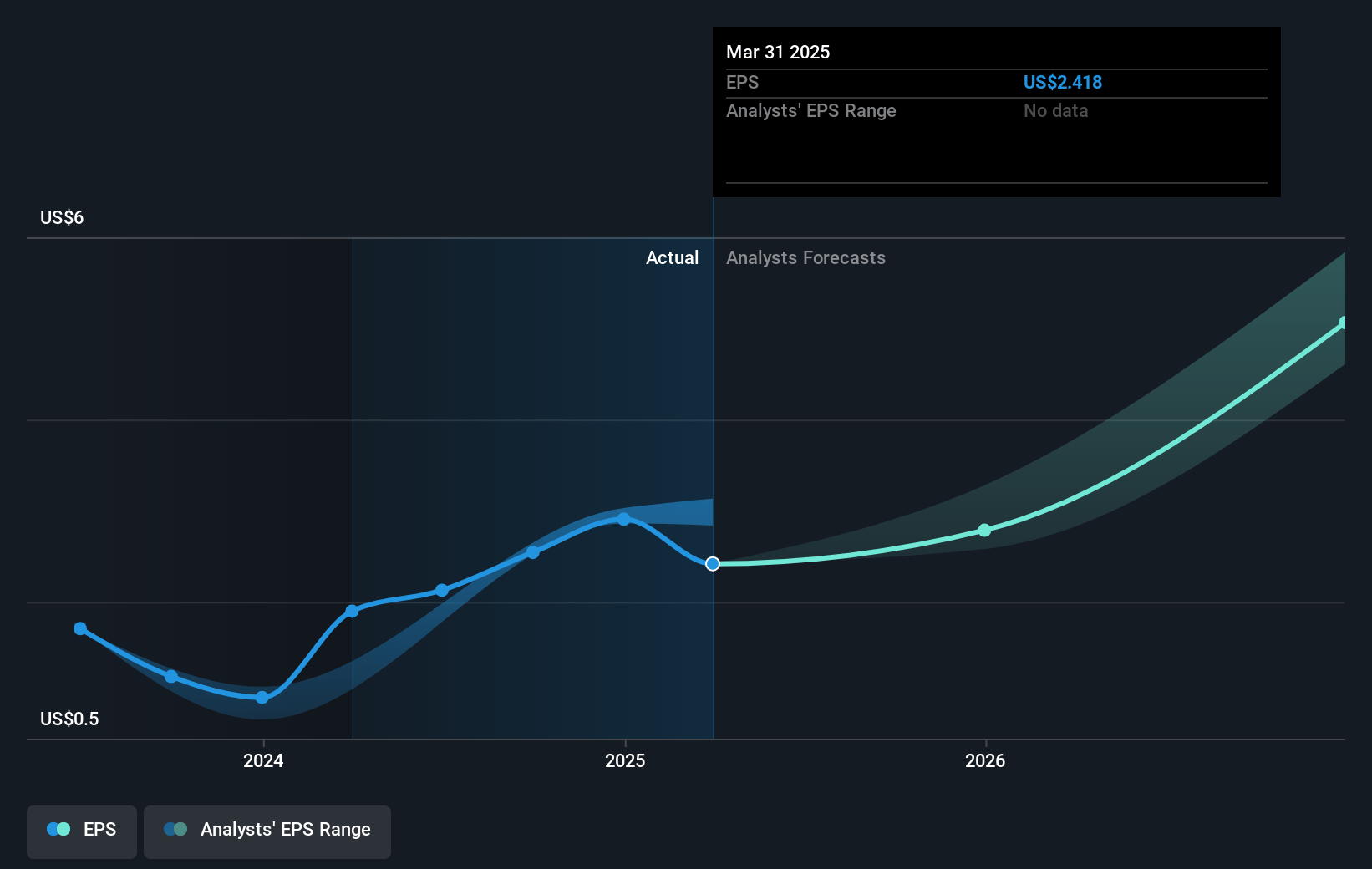

- The bullish analysts expect earnings to reach $91.7 million (and earnings per share of $10.39) by about July 2028, up from $21.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 3.9x on those 2028 earnings, down from 11.4x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.36%, as per the Simply Wall St company report.

First Internet Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces persistent credit risks in its small business lending and franchise finance portfolios, highlighted by elevated net charge-offs and provisioning for loan losses, which could pressure future net income and dampen earnings growth if delinquencies or economic uncertainty persist.

- First Internet Bancorp's reliance on commercial real estate and niche loan categories increases asset quality volatility, and with unfunded construction commitments at high levels, a real estate downturn or concentration risk could result in higher loan loss provisions and negatively affect profitability.

- The significant growth in deposits and fee revenue from embedded fintech partnerships exposes the company to competition from big tech, neobanks, and non-traditional providers; this long-term secular trend threatens both revenue growth and customer retention, potentially weakening fee-based income over time.

- Limited brand recognition compared to larger, more diversified institutions constrains the company's ability to attract low-cost deposits, which can drive funding costs higher and result in compressed net interest margins, challenging sustained long-term earnings expansion.

- Tightening regulatory scrutiny and the complexity of managing fintech partnerships may increase compliance costs and operational burdens, while ongoing cybersecurity threats require heavy investment in risk management, both of which can erode net margins and threaten the company's ability to scale profitably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for First Internet Bancorp is $35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of First Internet Bancorp's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $185.3 million, earnings will come to $91.7 million, and it would be trading on a PE ratio of 3.9x, assuming you use a discount rate of 8.4%.

- Given the current share price of $27.66, the bullish analyst price target of $35.0 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.